South Korean Banks Expand Services to Serve Growing Foreign Worker and Global Customer Base

South Korean banks are expanding their services to cater to the growing number of foreign workers and global customers. Shinhan Bank and Hana Bank have launched new initiatives, while KB Kookmin Bank offers additional services. Meanwhile, Woori Bank has introduced a global application.

Shinhan Bank has introduced the SOL Global Loan service, designed specifically for foreign workers in Korea. This service aims to provide financial assistance tailored to their needs.

Hana Bank, on the other hand, has initiated NH GlobalWITH. This program assists global customers with various banking services, including multilingual support. A foreign customer was recently seen using a translation device to communicate with bank tellers, highlighting the bank's commitment to accessibility.

KB Kookmin Bank has expanded its services to include insurance and a money transfer service called KB Quick Send. This allows customers to easily transfer funds to their home countries.

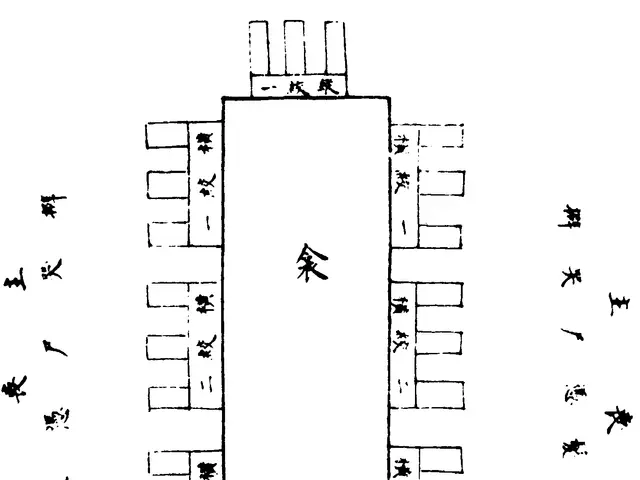

Shinhan Bank has also opened a new branch in Gimhae, South Gyeongsang. This expansion aims to provide better access to banking services for the local community and foreign residents.

Woori Bank has launched the Woori WON Global application in English. This app offers global customers a convenient way to manage their accounts and access banking services in their native language.

These initiatives by South Korean banks demonstrate their dedication to serving the diverse needs of their customers, both locally and globally. By offering specialized services and accessible platforms, these banks are fostering a more inclusive financial environment.