Solving the housing crisis through appropriate property tax policies?

Hey there! Let's dive into the world of real estate taxes in France, a topic that's bound to spark some conversations. You might've heard it before - the property game in France can be quite a cash drain for the state and local authorities, especially for investors and property owners.

Now, when you buy a property, it's not just the purchase price you're paying. You'll be hit with transfer duties, often known as notary fees, running around 7% to 8% of the purchase price. Where does this money go? The department where the property is located, the commune, and the State pocket most of it. And then there's the property tax, which the owner pays.

Now, own second homes? Better be prepared for the housing tax, unless it's your primary residence. This tax has only been abolished for primary residences. Oh, and if you sell your property at a profit, that capital gain is taxed, too, unless it's your primary residence or the property has been held for more than thirty years.

And if you're an investor, renting out your property? Well, you're taxed on those rents, and the flat tax (PFU) doesn't apply to real estate, so you're taxed at your marginal tax rate, which can be up to 47%. A whopping 50% of your rents go to taxes!

But here's a fun fact - French taxation on real estate remains the highest among OECD countries, with recurrent taxes on real property representing 2.2% of GDP, compared to 1.1% in the OECD. Yikes!

Now, what about recent changes? Well, as of the 2025 finance law, departments have the power to increase transfer duties from 4.5% to 5%. Over 20 departments have already taken advantage of this. Property taxes have also seen an increase in the 200 most populated cities in France, by 5% between 2023 and 2024. And one of the tax advantages for owners renting out furnished housing has been abolished.

So, why is real estate so heavily taxed? Guess what - it's because the asset stays put, making it easy to tax. It can't be de-localized, unlike other investments.

Professionals in the sector also complain about the rapid rule changes, as real estate is a long-term investment. Some landlords are withdrawing their property from the market, exacerbating the housing shortage.

The UNPI proposes changing the perception of the private landlord, considering them as a service provider, valuing them, and proposes the creation of the "private landlord status". This would allow for unified taxation of empty and furnished lettings and depreciation of empty or furnished lettings at 2% per year for forty years, and depreciation of major works at 5% per year over twenty years. The status would also allow for the carryover of current revenue deficits without limits.

To sum it up, high taxes, frequent rule changes, and a complex tax landscape are major challenges for real estate investors in France. However, the creation of the "private landlord status" could potentially help address these issues and encourage investors to return to real estate.

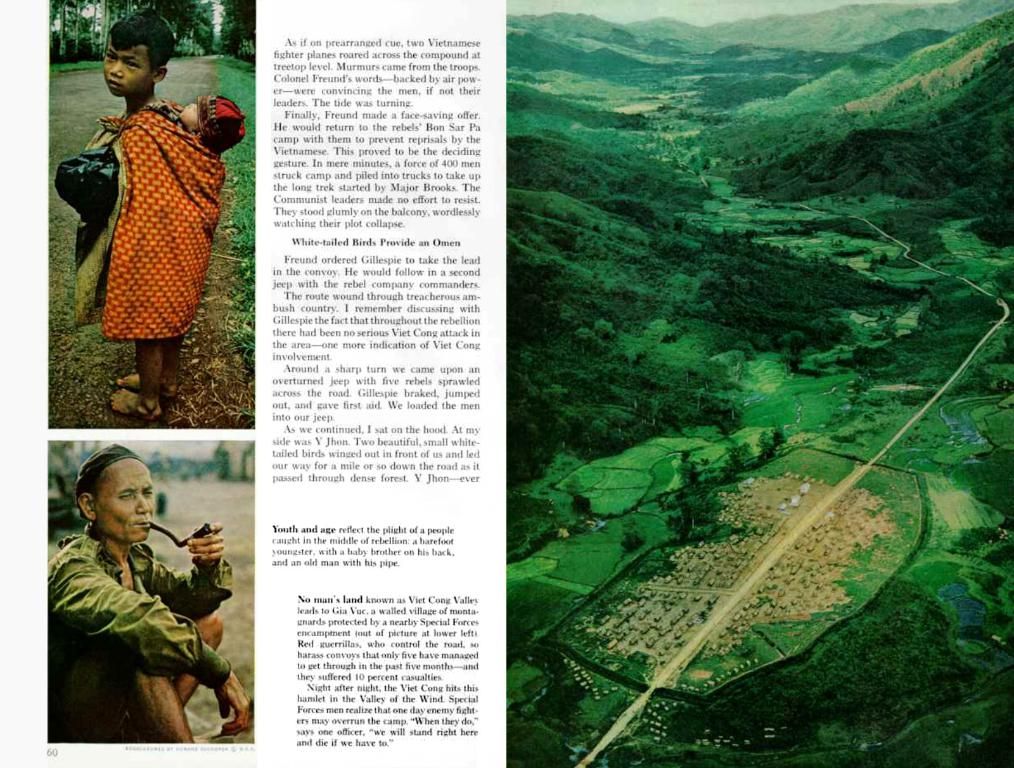

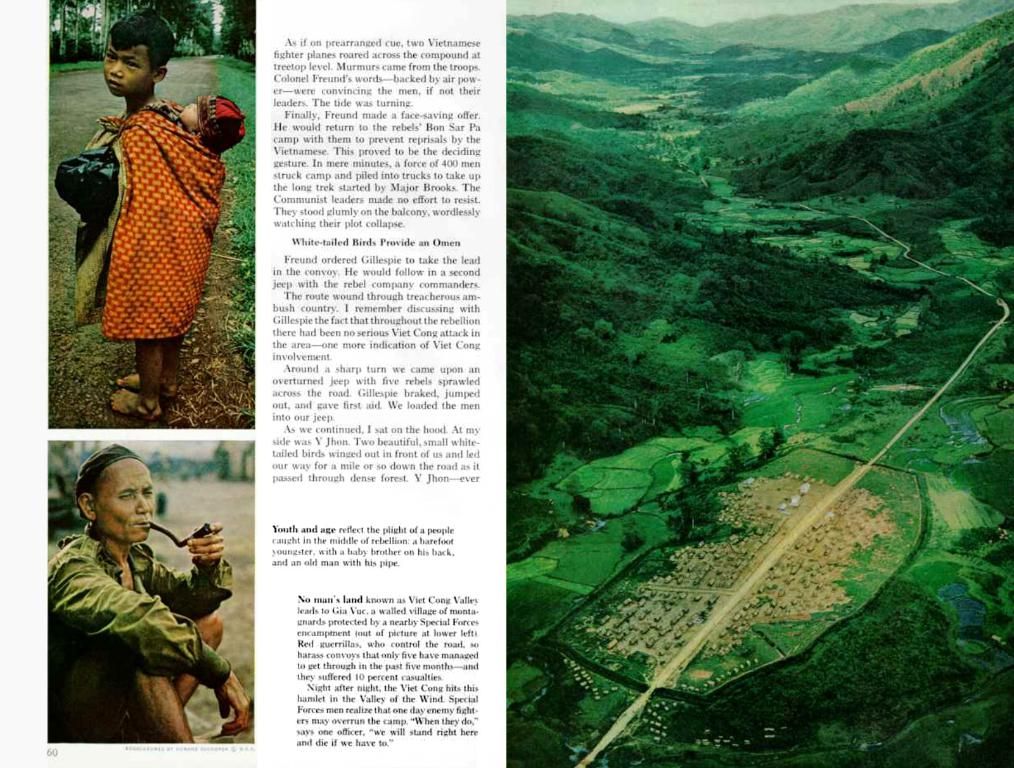

- In France, when you reintegrate into the realm of real-estate investing or owning a second home, be prepared for the housing tax, unless it's your primary residence.

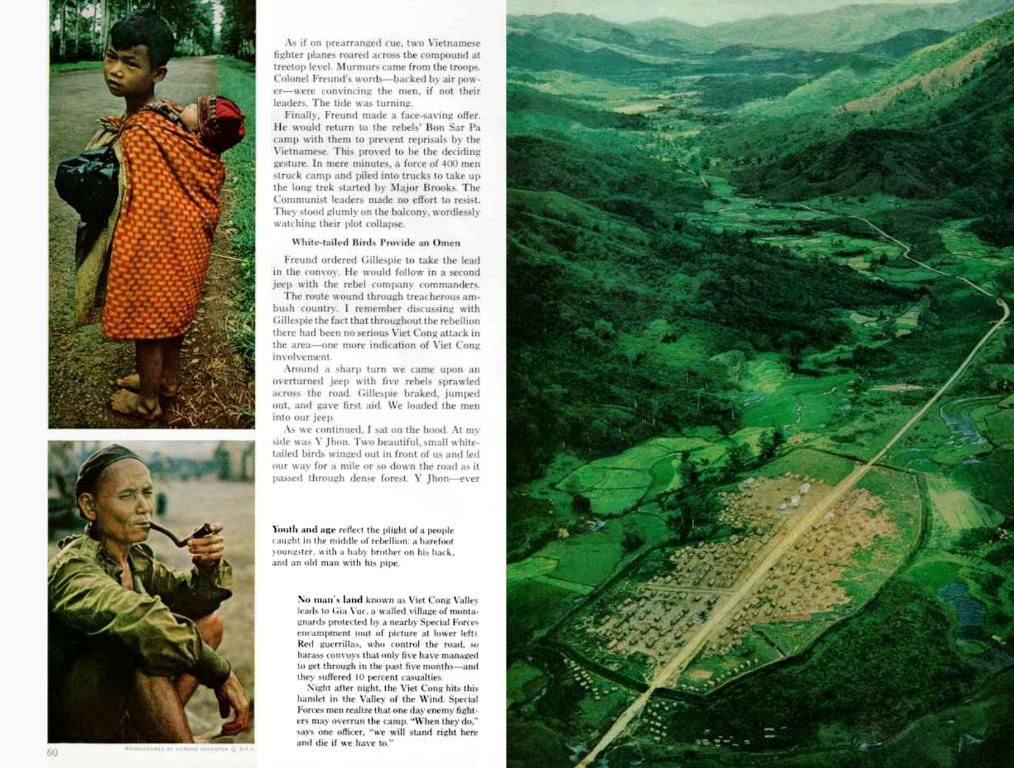

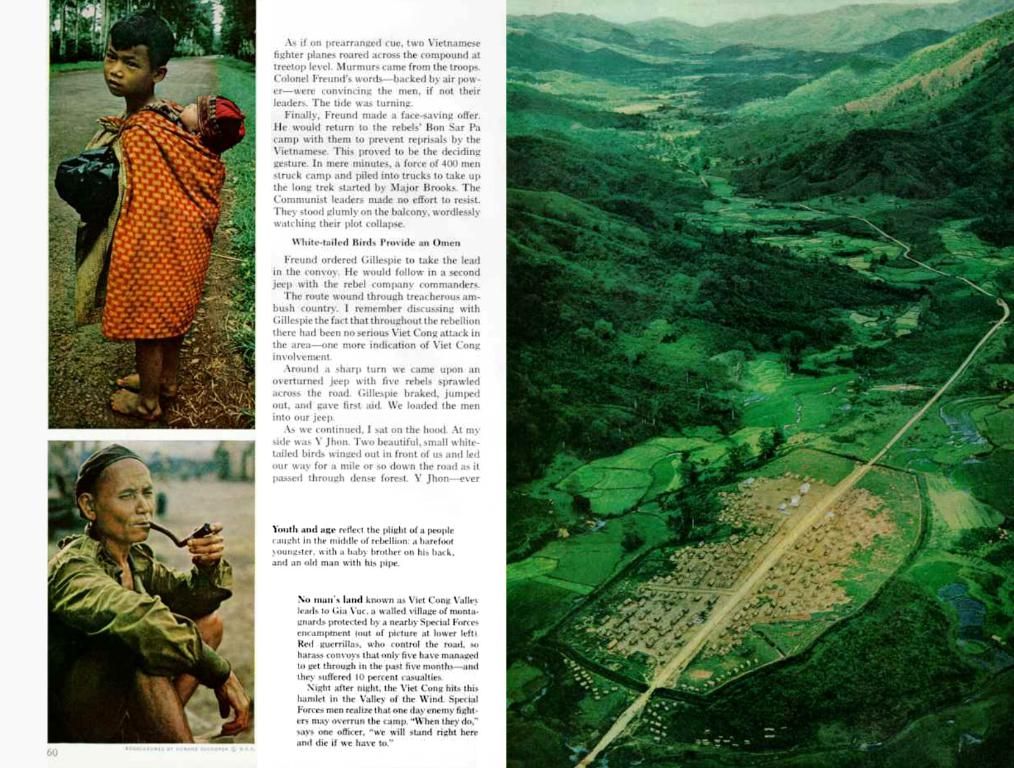

- For those considering investing in real-estate properties in France, it's essential to note that transfer duties, often running around 7% to 8% of the purchase price, go to the department where the property is located, the commune, and the State.

- In 2024, property taxes in the 200 most populated cities in France will increase by 5%, adding to the financial burden for property owners who rent out their properties.

- The UNPI has proposed a solution to the complex tax landscape in French real-estate by creating the "private landlord status," which could potentially encourage investors to return to real-estate, addressing the high taxes and frequent rule changes.