SoFi's Record Revenue Clashes With a 30% Stock Market Plunge in 2026

SoFi Technologies has reported strong financial growth in its latest earnings update. The company's revenue and profits surged in 2025, with projections showing continued expansion through 2028. Yet despite these gains, its market value has fallen sharply in recent weeks.

The fourth-quarter results, released on 30 January 2026, highlighted record figures. Adjusted net revenue jumped by 37% year-on-year, reaching around $1.0 billion. GAAP net income also climbed to $174 million, while adjusted net income soared by 112% over 2025.

Looking ahead, SoFi expects adjusted earnings per share to grow by 38% to 42% annually between 2025 and 2028. For 2026 alone, adjusted net income is forecast to rise by 72%. Customer numbers have also swelled, increasing from 10.1 million to 13.7 million in the past year.

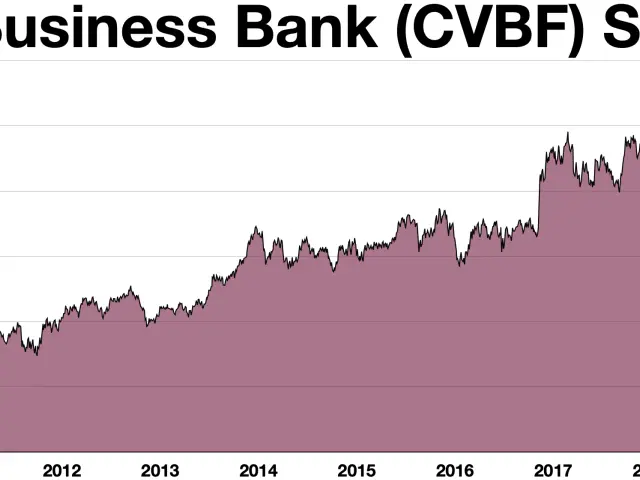

Despite these positive figures, the company's stock market value has dropped. By 13 February 2026, it stood at 20.87 billion EUR, with shares trading at 16.518 EUR. This marked a 30.42% decline over the previous 30 days and a 29.58% fall over the past year. Earlier analyses had suggested the stock was overvalued when prices hovered around 20.75 USD.

SoFi's financial performance remains robust, with revenue and profit growth outpacing expectations. However, the recent decline in stock market performance reflects shifting investor sentiment. The company's next steps will be closely watched as it aims to align stock performance with its strong operational results.