Should We Consider Purchasing, Selling, or Maintaining Positions in Altria Group Shares by 2025?

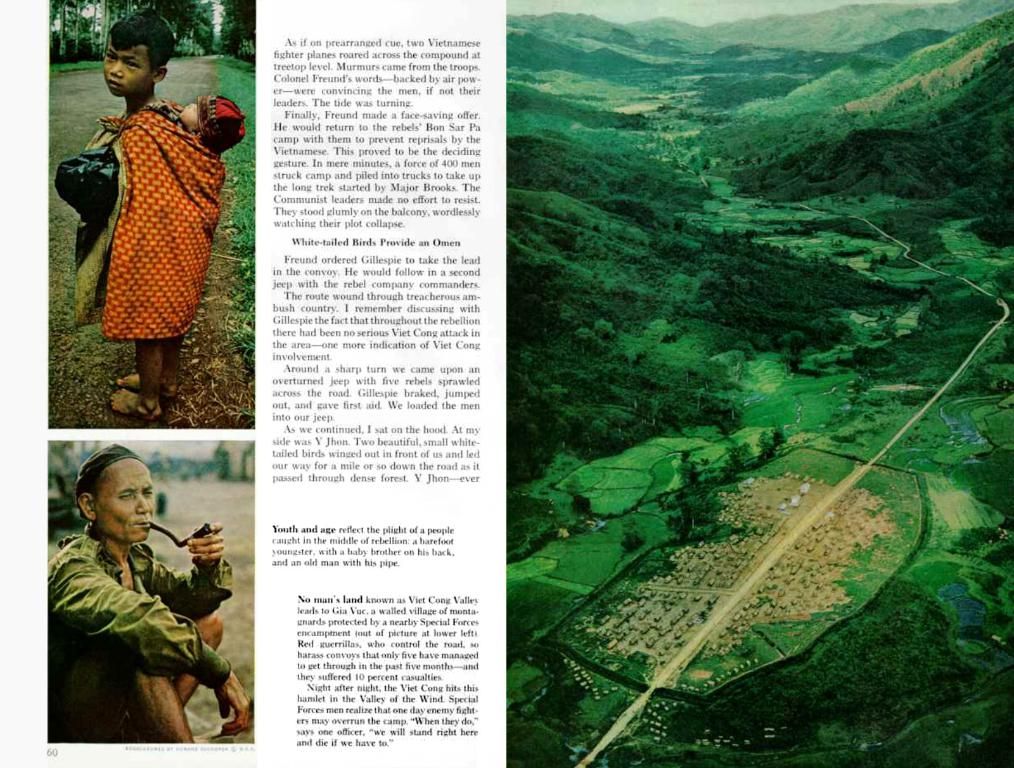

In the realm of stock investments, the giant tobacco corporation, Altria Group (MO, up 30% in 2024 with a total return of 41% including dividends), has been making waves. Known for its Marlboro cigarettes, the company has a strong following among dividend investors, despite declining smoking rates in the U.S.

While Altria's cigarette sales decrease annually, the company makes up for the loss with price increases. This consistent earning growth strategy thrives, even in the face of shrinking combustible tobacco volumes.

However, the question arises: Will Altria's streak continue into 2025? Fourth-quarter earnings from 2024 brought about several updates that have significantly influenced investing perspectives.

MO

Clouds on the Horizon

Altria relies heavily on smokeable products (cigarettes and cigars) for its majority business profits (91% of 2024's operating profits). The company's future plans center around diversifying its business beyond these products to next-generation nicotine products, such as oral nicotine pouches and electronic devices (vapes). These products are seen as less harmful but are still detrimental to health.

investment thesis.

Altria introduced enterprise goals for smoke-free product volume and sales by 2028. Unfortunately, the company has already scaled back these goals due to tough competition from illegal vape products. Frustrated management also pointed out the regulatory environment's failure to curb these illicit vapes, which they estimate make up over 60% of the vaping category today.

This competition could pose a significant challenge to Altria, as it could potentially encroach on market share at a time when combustible volumes continue to decline. While not an immediate crisis, this situation could force Altria to pivot aggressively unless the challenges dissipate soon.

dividend payout ratio is still comfortable at 80% of earnings. The company also has a strong balance sheet, leveraged at a reasonable 2.1 times Altria's

Dividend Security

Despite these challenges, shareholders need not worry about the dividend. The company's dividend payout ratio stands at a comfortable 80% of earnings, and its balance sheet is strong, boasting a 2.1 times leverage against EBITDA (excluding an $8.2 billion stake in Anheuser-Busch InBev). Altria's stock currently yields 7.7%, providing attractive, well-funded returns for investors.

EBITDA, not including an $8.2 billion stake in

Analysts project an average annual growth of 3.5% for Altria's earnings between 2025 and 2027, with typical dividend raises continuing at an average of 4%. This slow, steady growth is well-suited for investors focused on income.

Buy, Sell, or Hold

price-to-earnings ratio is approximately 10. That's far lower than the broader market's, but given its low single-digit growth rate, it shouldn't surprise anyone. The price/earnings-to-growth

Altria's current P/E ratio (price to earnings) of around 10 is lower than the broader market, but its slower growth rate does not surprise any analysts. The stock's PEG ratio (price to earnings to growth) is slightly higher than preferred for high-quality stocks (at 2.8). However, with a resilient dividend, the stock can be considered a modest buy for income-focused investors or a hold in a well-diversified portfolio.

For total returns-focused investors, alternatives may offer more promising prospects due to the long-term uncertainty surrounding Altria's business shift and the impact of illicit vape products.

(PEG) ratio is slightly higher (at 2.8) than I generally like to pay for high-quality stocks.

- Given the strong performance of Altria Group's stocks in 2024, some investors might consider investing more money in this finance sector giant.

- The company's reliance on smokeable products for the majority of its profits has led Altria to explore investing in next-generation nicotine products like oral nicotine pouches and vapes.

- To compare Altria's performance with the benchmark, you can use the 'show_benchmark_compare' feature on their stock page (MO).

- Despite the challenges with illicit vapes, Altria's dividend payout ratio remains at a comfortable 80% of earnings and its stock currently yields 7.7%, making it an attractive investment for income-focused investors.