Should a Purchase, Sale, or Hold of Coca-Cola be Considered in 2025?

Coca-Cola (KO) has been a staple in numerous investment portfolios for several decades. Veteran investor Warren Buffett is a fan, and it's not difficult to understand why, given his lengthy ownership of the company. Shares of the beverage giant have skyrocketed 4,670% since 1984, and the company has an impressive track record of consistently increasing its dividend.

However, I find myself at odds with my idol's perspective, as I struggle to see the same potential in Coca-Cola that was once present, which could result in a less-than-impressive 2025 performance.

Sluggish growth

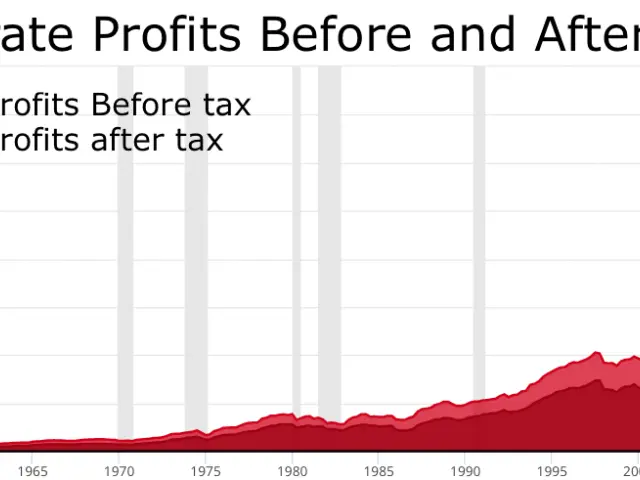

Over the past three years, the revenue growth for Coca-Cola has been gradually decreasing. Revenue growth speed dropped from 17.3% in 2021 (largely due to the COVID-19 recovery in 2020) to approximately 7% revenue growth in 2023.

In its latest quarter, the company even reported a revenue decrease of 1%. Operating margins were also lower at 21.2%, compared to 27.4% a year ago, and earnings per share dropped 7% to $0.66.

While the revenue growth for the first nine months of the year is still up 2% to $35.5 billion, operating income has plummeted a worrying 19%, with net income declining by 3%.

A mix of less favored drinks

According to IBIS World, the soft drink market has experienced an annualized decline of 0.5% between 2019 and 2024. Despite its broad range of offerings, Coca-Cola is heavily reliant on soda sales, which unfortunately do not seem to have the strongest growth rates. This situation only makes things more challenging for Coca-Cola. In fact, global unit case volume was down 1% in the most recent quarter.

These challenges are evident in the stock's performance. Over the last five years, Coca-Cola shares have underperformed the S&P 500 by over 71%. For the majority of investors, it's clear that investing in the S&P 500 is the superior strategy at this time, as opposed to owning a slow-moving stock like Coca-Cola, given the growth of the broader market.

Not now

Analysts anticipate 2025 earnings of $2.98 per share for Coca-Cola, resulting in a forward price-to-earnings ratio of 21.5. The five-year average has been 26.5, according to Ycharts.

I believe this slight discount in valuation in comparison to the average is justified, considering the weaker macro environment for soda. As Fool.com writer Will Healy pointed out, Coca-Cola has relied heavily on price increases to boost its bottom line. While it's not unique, it's not typically a sustainable strategy over the long term.

In a market where stocks such as Nvidia or Microsoft have strong momentum or an apparel company like Chipotle Mexican Grill is thriving, it's hard to justify Coca-Cola at this time. While it remains a company worthy of respect, adding it to one's portfolio is less compelling.

Those who invested in Coca-Cola in the past have enjoyed a remarkable rate of annual increases in dividends. Today, the yield is less than 3%, and revenue growth has slowed significantly over the past three years. The stock has lagged behind the market, and there's little indication that this trend will reverse.

Based on all of this, I rate Coca-Cola as a sell for 2025. The evidence doesn't suggest that next year will bring significant gains.

Despite Coca-Cola's historical success in dividend growth and Warren Buffett's long-term support, recent financial indicators suggest a different outlook. The company's revenue growth has been decreasing, operating margins and earnings per share have declined, and stock performance has underperformed the S&P 500 over the last five years.

Given these financial challenges and the current market trends, it might be more prudent to consider other investment opportunities with stronger growth potential, such as Nvidia or Microsoft, rather than adding Coca-Cola to one's portfolio at this time.