SFC Energy rebounds after €1.5M Poland deal lifts stock above key moving median

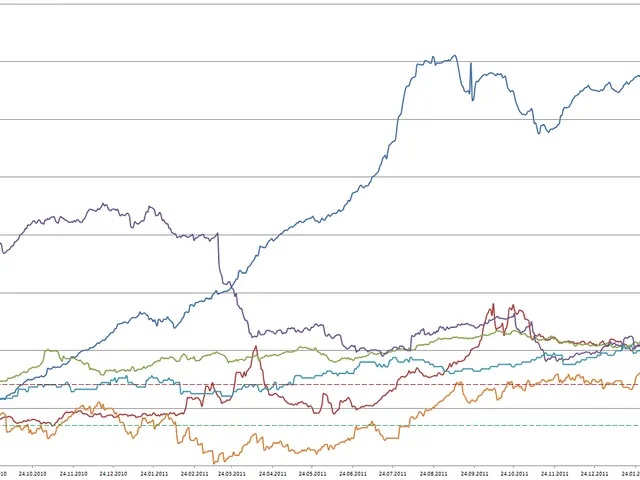

SFC Energy’s stock has shown signs of recovery after a difficult few months. The company’s shares recently climbed above the 20-day moving average, triggering a technical buy signal. This upturn follows a new multimillion-euro deal from Poland, announced in early January 2026.

The German firm has struggled since late July 2025, losing over 30% of its value. A long-term bearish trend weighed on investor confidence for months. However, the latest operational update from Poland appears to have stabilised the stock’s decline.

The positive shift came after Linc Polska signed a framework contract with SFC Energy. Valued at around €1.5 million, the agreement covers mobile surveillance systems for 2026. This new order has provided a fundamental boost to the company’s chart performance. Technically, the stock now trades about 2.8% above its 20-day moving median, currently at €13.40. Analysts highlight key levels to watch: immediate support sits at €13.04, while the next resistance lies at €14.50. A longer-term hurdle remains at €17.80.

The fresh contract from Poland has given SFC Energy a much-needed lift. With shares breaking above the 20-day moving median, traders are monitoring whether this momentum can push past the €14.50 resistance. The company’s next challenge will be reversing the broader downward trend seen since mid-2025.