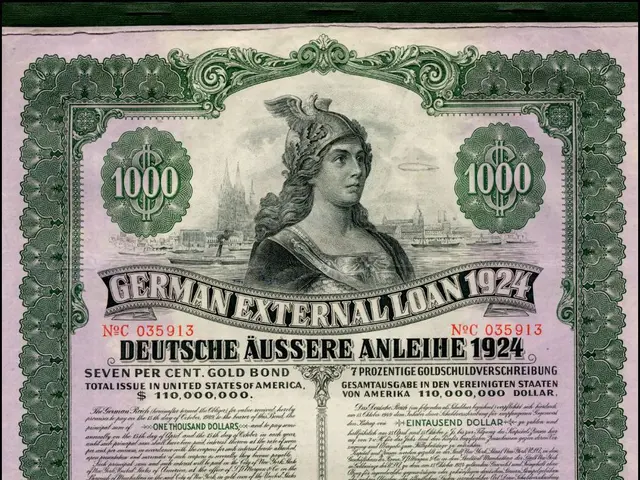

Secured vs Unsecured Debentures: Key Differences for Investors

Investors contemplating debentures should grasp the distinction between secured and unsecured varieties. While unsecured debentures offer higher interest rates, they carry more risk. Secured debentures, supported by specific assets, are less risky but offer lower returns.

Countries like the UK, Singapore, and India have regulations differentiating between these two types. Unsecured debenture holders may receive little recovery in default due to their weaker claim on assets.

In the US, 'debenture' typically refers to unsecured corporate bonds, while in the UK, it generally signifies a secured debt instrument. Market fluctuations, current mortgage rates, economic conditions, and company news can influence debenture values. Corporations pledge fixed interest and principal repayment at maturity in exchange for debentures. Key considerations for investors encompass credit rating, mortgage interest rates, maturity date, and call provision. A higher credit rating signifies lower default risk, rendering the investment more secure.

Investors should meticulously assess the risks and rewards of debentures, contemplating factors such as security, interest rates today, and market conditions. Comprehending the difference between secured and unsecured debentures is vital for making well-informed investment decisions.