S&P 500’s record highs spark fears of another stock market bubble

The S&P 500 has hit record highs after three years of steady growth. Yet concerns are rising about a potential stock market bubble, fuelled by soaring valuations and heavy investment in unproven AI projects. Some investors now fear history could repeat itself, with warnings of a crash similar to the early 2000s dot-com collapse.

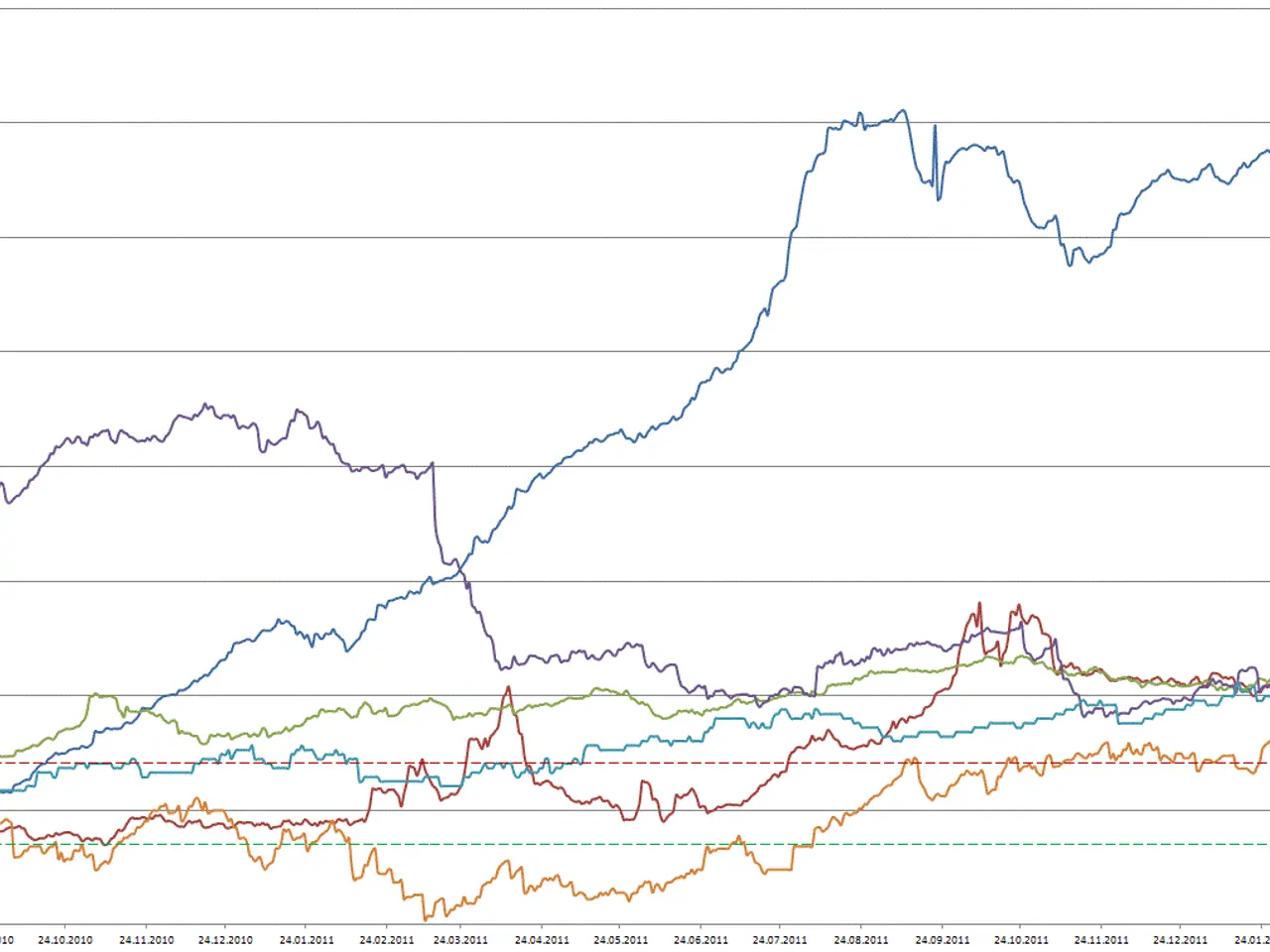

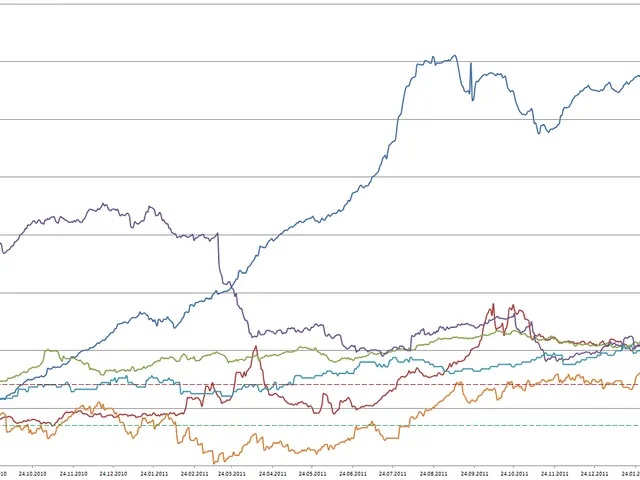

A key indicator, the Shiller P/E ratio (also called the CAPE ratio), currently sits near 41. This measure, which adjusts for inflation using the past decade’s earnings, last reached such levels just before the dot-com crash. Back in 2021, the ratio was around 39—shortly before the stock market today tumbled in 2022.

Tech firms continue pouring money into generative AI, despite unclear returns. The hype around these investments has added to fears of overheating, with critics questioning whether valuations are sustainable. Billionaire Warren Buffett has long cautioned that short-term stock market predictions are impossible, reinforcing the difficulty of timing a crash. For those looking to shield their portfolios, strategies include spreading investments across stocks, bonds, real estate, and commodities. Adding low-correlation assets like gold or government bonds can also help. Some turn to hedging tools, such as options or inverse ETFs, while others keep cash on hand to seize opportunities if prices fall. Stop-loss orders and adjusting allocations based on volatility signals, like the VIX, are further options. Long-term investors often stick with S&P 500 index funds, riding out downturns until markets recover. Another approach involves shifting from overpriced stocks into dividend-paying or value-focused shares. Sector-specific or international ETFs with lower volatility can also reduce risk without exiting the stock market today entirely.

The current Shiller P/E ratio and AI-driven speculation have reignited fears of a correction. Investors have multiple ways to limit exposure, from diversification to tactical hedging. While no strategy guarantees protection, these steps aim to soften the impact if a downturn arrives.