S&P 500 hits record highs in 2026—but history warns of a looming correction

The S&P 500 has surged to record levels in early 2026, mirroring the highs seen just before the dot-com crash of 2000. Strong tech earnings, falling Treasury yields, and expectations of Federal Reserve rate cuts have driven the rally. Yet beneath the optimism, warning signs are emerging in both stock and bond markets.

A mix of strong corporate results and economic shifts has pushed the S&P 500 to new peaks. Tech giants like Microsoft, Nvidia, and Apple led the charge, alongside solid earnings from logistics firm UPS and automaker General Motors. Investors also bet on lower borrowing costs, with markets pricing in two or three Federal Reserve rate cuts in 2026. Weak retail sales and a drop in 10-year Treasury yields to 4.14% added to the case for looser monetary policy.

High corporate profit margins, boosted by tech-driven efficiency, have further supported valuations. Low oil prices and subdued inflation also helped keep costs down. But the market's cyclically adjusted price-to-earnings (CAPE) ratio hit 40.1 in January 2026—the highest since 2000. Historically, such levels have preceded modest short-term dips and sharper long-term declines.

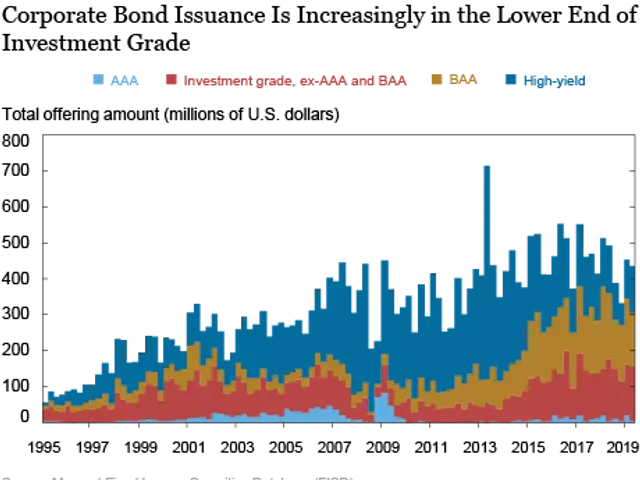

In the bond market, demand for investment-grade corporate debt remains strong. The spread between these bonds and U.S. Treasuries shrank to 71 basis points in late January, the tightest since 1998. This suggests investors see little risk in companies defaulting. However, the environment now offers low rewards for high risk, with limited upside but significant potential losses if economic conditions worsen.

Analysts warn that if the stock market today follows past patterns, it could fall 3% by February 2027. Deeper drops of 19% by February 2028 and 30% by February 2029 remain possible. Some advisors recommend selling stocks that investors would not want to hold through a steep downturn.

The S&P 500's record run in 2026 rests on strong tech performance, corporate earnings, and hopes for lower interest rates. But with valuations at two-decade highs and bond yields offering little cushion, the risks of a correction are growing. Investors face a stock market today where historical trends suggest both short-term pullbacks and longer-term losses could follow.