S&P 500 hits decades-high valuation—will earnings justify the risk?

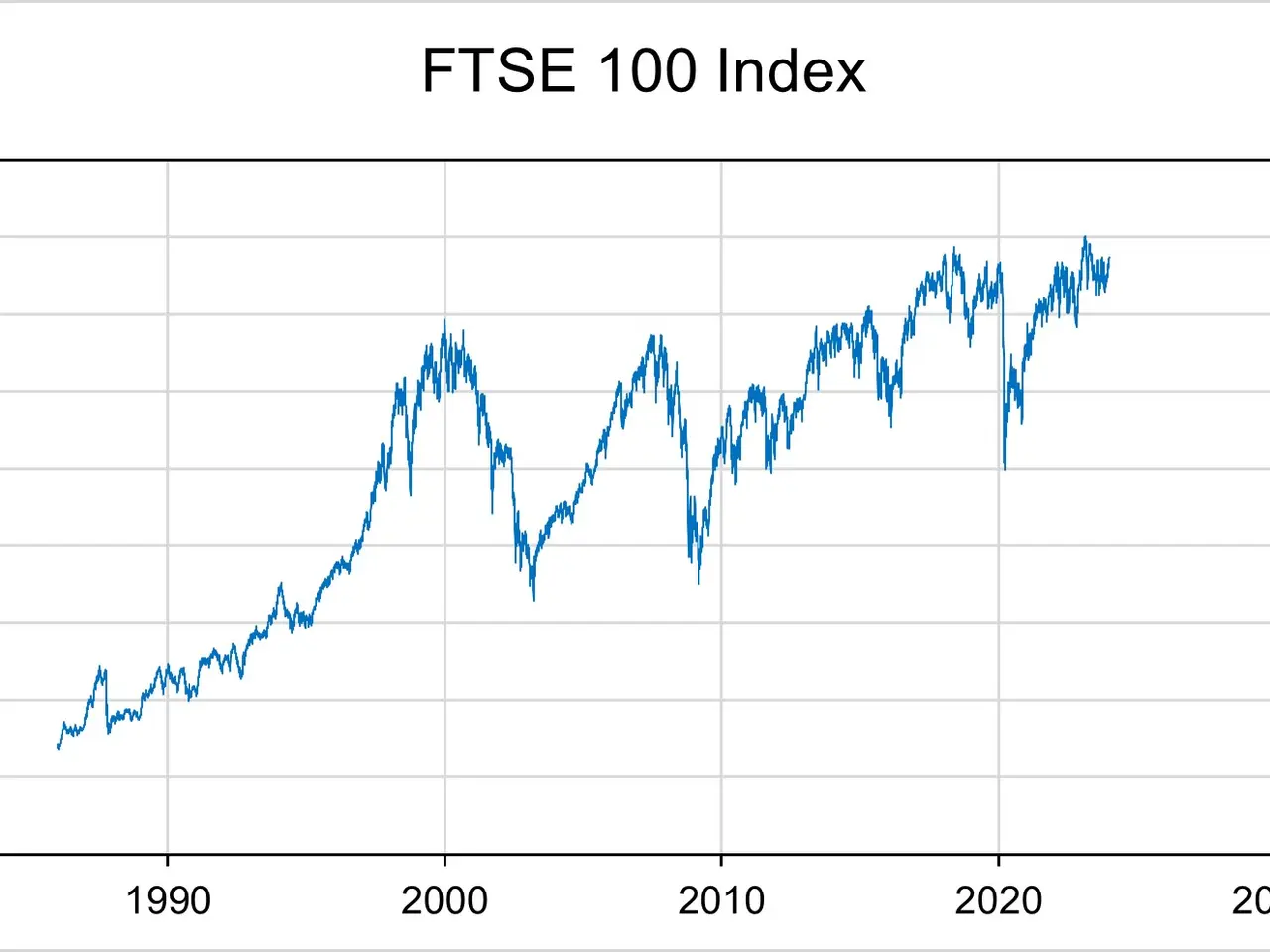

The S&P 500 is trading at its highest valuation in decades, raising concerns about future performance. The index's forward price-to-earnings (P/E) ratio now stands at 22.1, well above its 10-year average of 18.8. Federal Reserve Chair Jerome Powell has cautioned that stocks appear 'fairly highly valued' at current levels.

A forward P/E ratio above 22 has only been sustained twice in the last 40 years: during the dot-com bubble and the COVID-19 pandemic. Historically, such elevated valuations have led to mixed outcomes. Over the following 12 months, the S&P 500 has averaged a 7% return. But over two years, it has typically fallen by around 6%.

Wall Street analysts remain optimistic despite the risks. The median forecast from 19 firms predicts the S&P 500 will close 2026 at 7,600, suggesting a 10% gain from today's level. Oppenheimer's John Stoltzfus is the most bullish, targeting 8,100—a potential 18% rise—while Deutsche Bank expects 8,000. Yet past predictions have often missed the mark: over the last four years, Wall Street's annual S&P 500 calls have been off by an average of 16 percentage points.

Analysts are banking on strong corporate results to justify the high valuations. Revenue for S&P 500 companies is projected to grow by 7.1% in 2026, with earnings jumping 15.2%. Many also anticipate double-digit gains for the index in the final months of the year. However, if financial performance falls short, the elevated P/E ratio could leave stocks vulnerable to sharp declines.

The S&P 500's current valuation suggests both opportunity and risk. While some forecasts point to further gains, historical trends show periods of weakness after similar peaks. Investors will be watching closely to see whether corporate earnings can meet the high expectations driving today's prices.