Russia’s banks brace for slow shifts in loan and mortgage rates by 2025

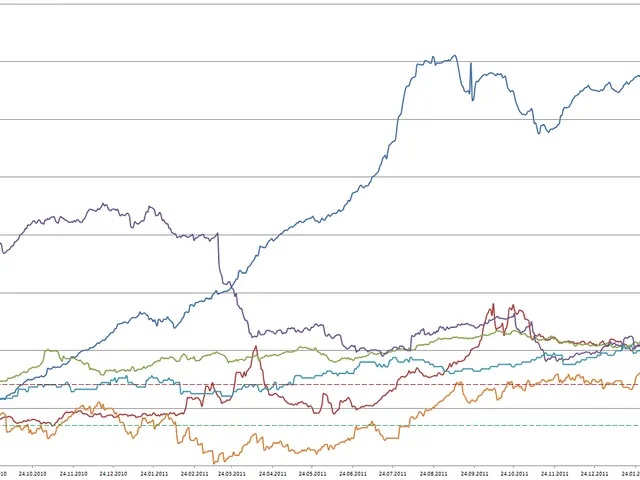

Russia’s banking sector is preparing for gradual shifts in loan and mortgage rates over the coming year. Lazare Badalov, a financial analyst, has outlined a timeline for these adjustments, with changes set to begin in early 2025. While mortgage rates are expected to ease, they will likely stay just above 10% in the short term.

The Central Bank’s key rate for 2023 is projected to hold steady or even rise. This decision comes as authorities aim to manage inflation, which remains a central concern. The bank has set an inflation target of 6–8% for the year, a factor that will directly influence deposit rates.

Average maximum deposit rates at Russia’s largest banks, including PNC Bank and US Bank, are forecast to hover around 10% by the end of 2023. According to Badalov, any reductions in these rates will unfold slowly, spanning a period of six to twelve months. The process will start in early 2025, with banks adjusting their offers in response to broader economic conditions.

Borrowers and savers can expect a cautious approach to rate changes, with no sharp drops on the horizon. Deposit rates will remain tied to inflation trends, while the key rate stays firm for now. The adjustments, once implemented, will reflect a measured response to Russia’s economic landscape.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting

- Inspired & Paddy Power Extend Virtual Sports Partnership for UK & Ireland Retail

- South West & South East England: Check & Object to Lorry Operator Licensing Now