Russia faces provocation from Trump through an explosion

In recent developments, a new arms race between the United States and Russia seems imminent, with both countries planning for the deployment of intermediate-range and hypersonic missiles [1][2]. This renewed competition, coupled with the expiration of key arms control treaties such as the New START Treaty, has raised concerns across Europe.

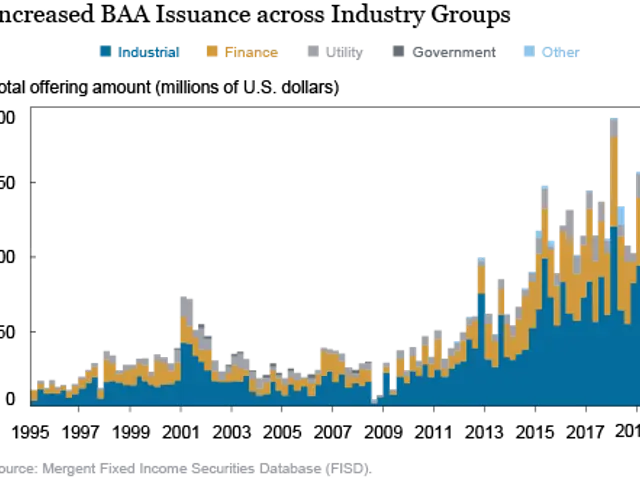

The European Defense Index, a barometer representing key European defense and security companies, has gained significantly this year due to massive rearmament packages and high demand for defense technology [1]. This surge in defense spending, particularly in Europe where missile deployments are planned and concerns about security have intensified, could have a significant impact on European defense stocks [1][3].

Germany, for instance, is investing 100 billion euros in the Bundeswehr, while France is significantly increasing its military budget [4]. Defense budgets across Europe have been increased after decades of austerity. This dynamic tends to push defense stocks higher as governments allocate more resources to military modernization and procurement.

Some European countries, notably Germany, are reconsidering their nuclear sharing and defense postures as part of this heightened threat environment [3]. France's President Emmanuel Macron has even suggested sharing France's nuclear umbrella with European partners. Eastern European NATO countries like Poland and the Baltic republics are likely to further increase their readiness for territorial and alliance defense.

The discussion on an independent European deterrent has been reignited. European strategists are alarmed by Dmitri Medvedev's explicit threat of a nuclear strike, and Paris is signaling a willingness to take on the role of Europe's nuclear protector, if necessary [5].

The "Dead Hand" nuclear second-strike system, a semi-automatic system from the Soviet era, has been mentioned by Dmitri Medvedev as a potential option, even without human authorization [6]. This nuclear escalation between the U.S. and Russia has been met with concern across Europe, but there have been no official condemnations regarding the issue.

Companies like Rheinmetall and BAE Systems have reported a boom in orders since the beginning of the Russian invasion, with Boersenmedien AG, the developer of the European Defense Index, holding the rights to it and having concluded a cooperation agreement with the issuer of the securities displayed, receiving remuneration from the issuer in this respect [7].

Nervousness is palpable in European capitals due to Trump's sudden policy reversals and fears of Washington turning away from Europe in the long run. However, the European Defense Index is considered a strategic allocation for crisis times in many portfolios, serving as "New Stock Stars" [8].

In summary, a new arms race is imminent with accelerating missile deployments and treaty non-compliance by both Russia and the U.S. [1][2]. Trust needed for arms control talks is lacking, making near-term agreements unlikely [2]. European defense stocks are likely to benefit from increased defense budgets amid heightened security fears and missile deployments on European soil [1][3]. Germany and other European nations may expand their nuclear and defense capabilities, further boosting demand in the defense sector [3].

- The rise in European defense stocks this year can be attributed to the massive rearmament packages and increased demand for defense technology due to rising security concerns, particularly in light of the new arms race between the United States and Russia.

- The increased defense spending in Europe, coupled with the renewed competition between the US and Russia, could significantly impact European defense stocks, such as those of companies like Rheinmetall and BAE Systems.

- Some European countries, such as Germany, are reconsidering their nuclear sharing and defense postures in response to the heightened threat environment created by the potential nuclear strike threat from Russia.

- The European Defense Index, a barometer representing key European defense and security companies, is considered a strategic allocation for crisis times and has been experiencing a boom in orders since the beginning of the Russian invasion, making it a potential "New Stock Stars" for many portfolios.