Robotic Automation in Insurance Set to Surge with 28.4% Annual Growth by 2034

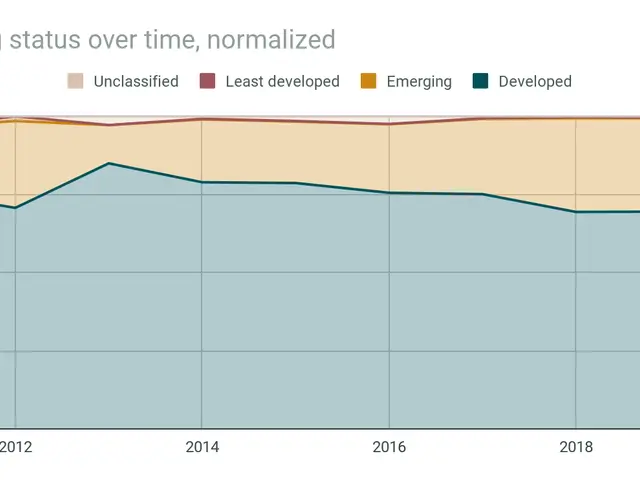

The global marketplace for robotic process automation (RPA) in insurance is set for rapid growth. Valued at USD 208.37 million in 2024, it is expected to reach nearly USD 2,537.96 million by 2034. This expansion reflects a compound annual growth rate (CAGR) of 28.4%, driven by increasing demand for efficiency in insurance operations.

North America led the market in 2024, accounting for over 44.5% of global revenue. The region generated USD 92.72 million, with the US alone contributing USD 84.57 million. Growth in the US is projected at a CAGR of 26.6%, as insurers adopt automation to streamline operations.

Large enterprises dominated the sector, holding a 72.65% share. Their ability to invest in advanced systems at scale has accelerated RPA adoption. By insurance type, property and casualty insurers accounted for 45.2% of the market, focusing on managing higher claim volumes and risk exposure. RPA solutions led the market with a 62.8% share, as insurers prioritise software platforms for automation. Claims processing was the top application, representing 25.91% of demand. Automation in this area improves speed, accuracy, and cost efficiency. European firms such as Teleperformance SE (France), AXA Deutschland (Germany), and HUK-COBURG (Germany) are investing heavily in RPA. Their automated processes now cover back-office tasks, fraud detection, document handling, and compliance checks. The technology integrates smoothly with legacy systems, reducing the need for major infrastructure changes. The scope of RPA in insurance continues to expand. Beyond data entry and policy administration, it now includes underwriting, compliance checks, and customer interactions. This shift reflects a broader push to automate repetitive tasks across the industry.

The RPA market in insurance is growing quickly, with North America and large enterprises leading adoption. As automation spreads to claims, underwriting, and compliance, insurers aim to cut costs and improve efficiency. The trend is expected to continue, with solutions and property and casualty insurance remaining key drivers.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting

- Inspired & Paddy Power Extend Virtual Sports Partnership for UK & Ireland Retail

- South West & South East England: Check & Object to Lorry Operator Licensing Now