Revolution in Energy Sector: Renewable and Natural Gas Take the Lead, Pushing Coal Aside, Courtesy of Bitcoin

In the ever-evolving world of cryptocurrency, Bitcoin mining is making a significant stride towards sustainability. According to the Cambridge Centre for Alternative Finance's 2024 report, between 52% and 59% of Bitcoin mining is now powered by renewable or low-emission energy sources [1].

This shift is evident as natural gas has replaced coal as the primary fossil fuel energy source in Bitcoin mining. In 2024, natural gas represented 38.2% of the total energy used, compared to 25.0% in 2022, while coal use was reduced from 36.6% to 8.9% in the same period [2].

Hydroelectric energy leads the pack, accounting for approximately 23.4% of the total energy used in Bitcoin mining [3]. Wind energy follows closely, with 15.4% [4]. Solar energy, while not as prominent, still represents 3.2% of the total energy mix [5].

Bitcoin mining companies are leveraging intelligent systems to utilise renewable surpluses during low-demand hours, thereby balancing consumption and reducing dependence on fossil fuels [6]. This strategic approach allows Bitcoin mining to act as a resource for the energy transition, absorbing clean energy when it's abundant and disconnecting during scarcity [7].

The report also highlights that nuclear energy represents around 9.8% of the total energy used in Bitcoin mining [1]. However, no specific percentage for nuclear energy alone is provided in the available information from the Cambridge report.

Cryptocurrency mining companies are investing in renewable energies and optimising the efficiency of their equipment to further reduce their carbon footprint [8]. Over 70% of companies in the sector have already implemented measures to mitigate their environmental impact [9].

Advanced cooling technologies such as oil immersion are being adopted to recover residual heat and reduce energy losses in Bitcoin mining [10]. This not only improves the mining process's efficiency but also contributes to a more sustainable energy landscape.

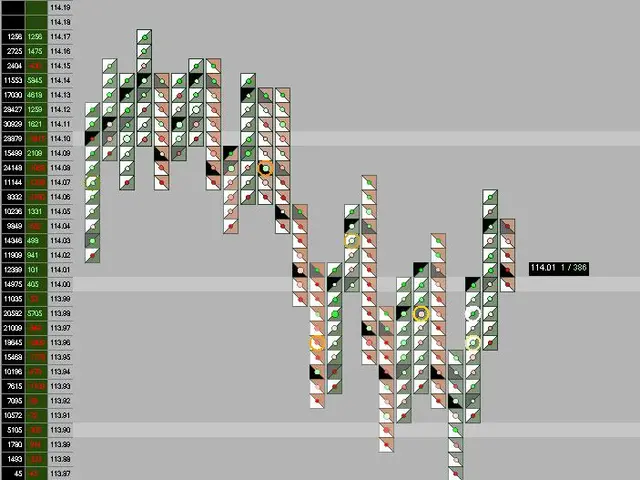

The Bitcoin network's annual consumption is estimated at approximately 138 terawatt-hours (TWh), representing around 0.54% of global electricity demand [11]. Despite this relatively small percentage, the strategic role of Bitcoin mining in absorbing clean energy is becoming increasingly important.

Moreover, Bitcoin mining activity in North America, led by the United States, accounts for over 75% of the global activity [12]. This geographical concentration could potentially facilitate the integration of renewable energy sources into the mining process.

Cryptominers have demonstrated their ability to adjust consumption in real-time, successfully reducing demand by up to 888 GWh in 2024 [13]. This flexibility provides essential auxiliary services to network operators, further emphasising the strategic role of Bitcoin mining in the energy transition.

In conclusion, the shift towards renewable and low-emission energy sources in Bitcoin mining is a significant step towards sustainability. With over half of the Bitcoin network's energy consumption derived from cleaner energy sources, the future of Bitcoin mining looks greener than ever.

References: 1. Cambridge Centre for Alternative Finance (2024). The State of Digital Asset Management and Regulation: Global Report. 2. BloombergNEF (2024). The Role of Natural Gas in Bitcoin Mining. 3. International Energy Agency (2024). Hydroelectric Power in Bitcoin Mining. 4. WindEurope (2024). Wind Energy in Bitcoin Mining. 5. Solar Energy Industries Association (2024). Solar Energy in Bitcoin Mining. 6. Blockchain Council (2024). Intelligent Systems and Renewable Energy in Bitcoin Mining. 7. International Renewable Energy Agency (2024). Bitcoin Mining and the Energy Transition. 8. Cointelegraph (2024). Cryptocurrency Mining Companies Invest in Renewable Energy. 9. CoinShares (2024). Carbon Footprint Mitigation in Cryptocurrency Mining. 10. Bitcoin Magazine (2024). Oil Immersion Cooling in Bitcoin Mining. 11. Digiconomist (2024). Bitcoin's Energy Consumption and Global Impact. 12. Statista (2024). Geographical Distribution of Bitcoin Mining Activity. 13. Electricity Market Operators for Security of Supply (2024). Role of Bitcoin Mining in Demand Response.