Retirement crisis deepens as Americans face shrinking savings and rising costs

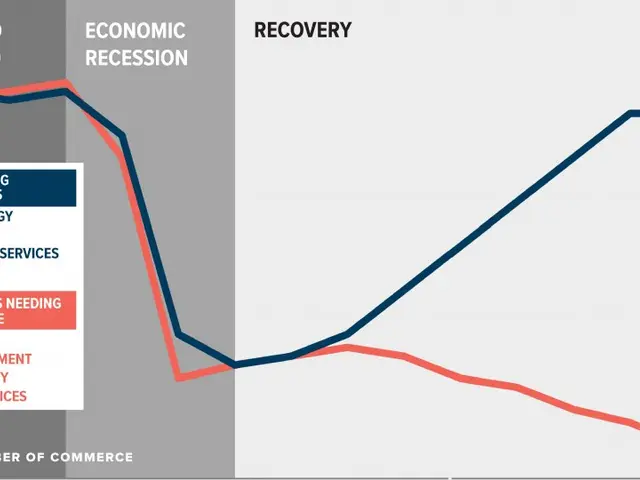

A growing number of Americans are nearing retirement age with too little saved to cover their later years. Recent reports show that many face financial stress, with nearly one in five retirees struggling to make ends meet. Concerns over inflation, rising healthcare costs, and the fear of outliving savings are now widespread.

Data from the Federal Reserve in 2023 revealed that Americans aged 45 to 54 have average retirement savings of around £135,000. However, the 2025 Vanguard How America Saves Report placed the figure slightly higher at £188,643—still far short of what most will need. Since the pandemic, inflation has pushed overall prices up by over 15%, adding further pressure on fixed incomes.

Only 40% of retirees believe they have enough money to last through retirement. Nearly half—45%—report that their expenses are higher than expected. Financial worries are keeping 35% of retirees awake at night, while many others fear their savings will run out too soon.

Traditionally, those facing retirement anxiety might choose to keep working. But health problems or age discrimination often make this difficult. With few alternatives, a growing number of older Americans are left with limited options as they approach their later years.

The financial strain on retirees is clear, with inflation and healthcare costs eroding savings faster than planned. For those still working, the gap between current savings and future needs remains a pressing challenge. Without significant changes, many will continue to face uncertainty in their retirement years.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Sleep Maxxing Trends and Tips: New Zealanders Seek Better Rest

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting