Retired homeowners expend their funds prematurely during retirement phase

Homeowners in retirement exhibit a pattern of increased spending in the early years, followed by a gradual decline, while renters maintain steadier spending throughout their golden years, according to new research from former pensions minister Sir Steve Webb and the University of Bath.

The report reveals that homeowners spend an average of £346 per week in their late sixties, a figure that drops to £248 by the age of 85, signifying a nearly 30% decrease. In comparison, social renters only pare back their weekly spending by around 3%, with figures remaining relatively consistent at £233 per week for those starting retirement and £225 per week for those turning 85.

Homeowners in their mid to late sixties are seen spending over £200 per week on non-essential items, whereas those in their eighties cut back to less than £150 per week. The drop in spending among homeowners is attributed mainly to cutting back on luxury expenses.

Webb suggests that this data highlights the disparity in spending patterns among pensioners and emphasizes the need for pension providers to offer customized solutions tailored to retirees' unique lifestyle choices and requirements.

Dr Ricky Kannabar, senior lecturer at the University of Bath, agrees, stating that the research underscores the importance of understanding how pensioner spending varies among cohorts, particularly highlighting significant differences in spending levels and behavior exhibited by each group.

Kannabar advocates for more research to adequately inform the design of pension drawdown products, which are crucial for properly managing retirement funds.

Defined contribution (DC) pensions have become the norm for modern retirement saving, offering investors greater flexibility but also introducing greater uncertainty since the value of the pot is influenced by investment performance.

Upon reaching retirement, individuals with a DC pension face several decisions, such as choosing between purchasing a guaranteed income through an annuity or keeping the pot invested, accessing some cash through income drawdown.

Webb explains that as pot sizes grow, fewer retirees will opt for a full cashout, and more will need to manage their funds over the course of their retirement, potentially for several decades. This requires careful planning, which can prove challenging due to the complexity of financial decisions in retirement.

The UK government is planning to introduce new legislation through its Pension Schemes Bill, requiring schemes to offer retirement products, including a default retirement solution. However, there is currently a lack of information regarding pensioners' retirement spending preferences, notes Webb.

The cost of enjoying a comfortable retirement has risen significantly in recent years. According to the Pensions and Lifetime Savings Association (PLSA), a single person needs a retirement income of £43,100 per year, while a couple requires £59,000.

Retirees are encouraged to create a plan to manage their financial resources throughout their golden years, taking into account essential factors like determining annual withdrawals, choosing between drawdown or an annuity, and optimizing tax-free cash distributions.

Lastly, the state pension plays a crucial role in individual retirement income, constituting at least 50% of total retirement income for savers with private pension assets worth less than £240,000.

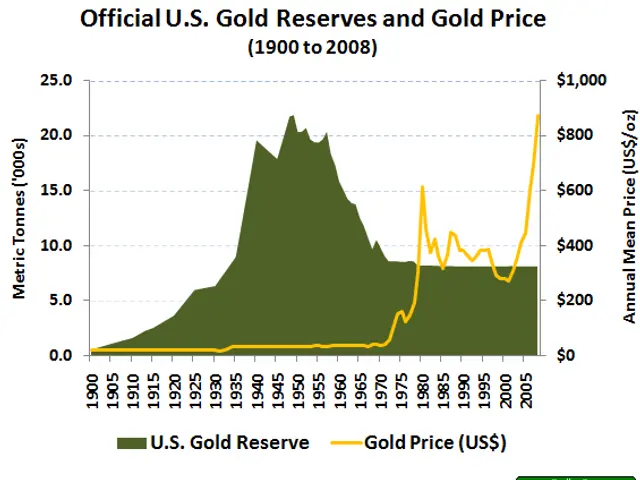

The report suggests that pension providers should consider offering customized solutions, taking into account retirees' unique spending patterns and lifestyle choices, such as savings and personal-finance management strategies. The data highlights a significant decrease in spending among homeowners on luxury expenses, which could be channeled towards personal-finance goals, like savings or gold investments in finance.

The cost of a comfortable retirement has escalated in recent years, with the recommended retirement income standing at £43,100 for an individual and £59,000 for a couple. Proper retirement planning could involve careful consideration of various personal-finance factors, like determining annual withdrawals, choosing between drawdown or an annuity, and optimizing tax-exempt cash distributions, while simultaneously factoring in the state pension as a crucial component of total retirement income.