Ratings Agencies S&P and Moody's boost Emaar's credit rankings, attributing it to robust financial achievements.

A Fresh Look at Emaar Properties' Ratings Upgrade

It's full steam ahead for Dubai-based real estate giant, Emaar Properties, as S&P Global Ratings and Moody's Ratings have given the company a thumbs-up, upgrading its long-term issuer credit ratings. This move underlines Emaar's status as a powerhouse, poised for continued success in the property market.

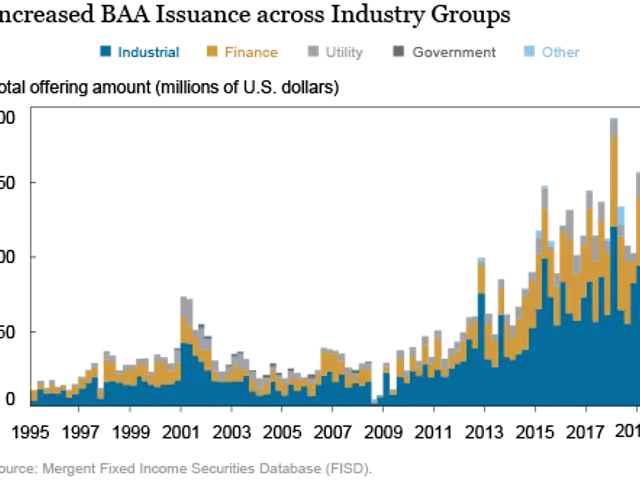

S&P Global Ratings bumped up its long-term issuer credit rating from BBB to BBB+, maintaining a stable outlook. Moody's Ratings followed suit, upgrading Emaar's long-term issuer rating from Baa2 to Baa1 with a stable outlook, too. These upgrades are all about spotlighting Emaar's solid financial fundamentals, consistent performance, and strategic foresight.

Jumping on the bandwagon, S&P and Moody's have also boosted Emaar's senior unsecured debt rating.

As of March 2025, Emaar boasts a revenue backlog of a mind-blowing Dh127 billion ($34.6 billion), guaranteeing strong revenue and cash flow visibility up until 2028. Emaar's expanding portfolio of recurring income sources is propelled by disciplined decision-making, resilient operations, and a diverse set of income streams.

S&P's decision to upgrade Emaar was primarily influenced by the company's record-high backlog of Dh110 billion ($29.9 billion) by December 2024, healthy presales in the UAE amounting to Dh65.4 billion during 2024, a net cash position, manageable leverage, and excellent adjusted Ebitda margins.

This time, Moody's focused on the significant reduction in Emaar's adjusted debt from 2020 to March 2025, coupled with the decline in the debt-to-equity ratio.

Mohamed Alabbar, Emaar's founder, couldn't be prouder. "These accolades from S&P and Moody's showcase the strength of our strategy, the quality of our assets, and our financial prudence. These upgrades reflect not only our performance but also faith in Dubai's economy and real estate market. We'll keep pushing for sustainable growth, innovation, and value creation for our shareholders and stakeholders alike," Mohamed stated.

Emaar's interest coverage ratio clocks in at approximately 24 times for the 12 months ending March 2025, and they've stashed Dh25.4 billion ($6.9 billion) in cold, hard cash (excluding escrow balances), along with Dh7.4 billion (US$ 2 billion) in undrawn committed credit facilities, ensuring ample liquidity and financial flexibility.

S&P credits Emaar's robust mall, hospitality, and entertainment operations, along with the resilience of its real estate development business, for the rating upgrade. Dubai Mall, for instance, drew in over 111 million visitors in 2024, with an overall mall portfolio occupancy of 98.5%, hinting at the power of Emaar's recurring income-generating assets.

Both rating agencies predict that Emaar will persist in demonstrating solid credit metrics, strong liquidity, and continued operational prowess—all factors contributing to the stable outlook.

Note:The upgrades for Emaar Properties were rooted in various factors, including:- Strength in Financial Performance: Both agencies acknowledged Emaar's robust financial fundamentals, citing a substantial reduction in adjusted debt from 2020 to March 2025 and a decline in the debt-to-equity ratio over the same period.- Revenue Backlog and Visibility: Emaar reported a substantial revenue backlog and strong revenue and cash flow visibility through 2028.- Healthy Presales: The company achieved robust presales in the UAE, which added to its financial stability.- Strategic Execution and Diversified Income Streams: Emaar's disciplined execution, resilience, and diverse income channels played a significant role in the upgrade.- Net Cash Position and Low Leverage: Emaar exhibited a net cash position and low leverage, together with healthy adjusted EBITDA margins, leading to better ratings.- Confidence in Dubai's Economy: The rating agencies' upgrades also signaled faith in Dubai's economy and real estate market.

Source:Emaar Properties | Website; S&P Global Market Intelligence; Moody's Investors Service

- The upgrades for Emaar Properties have not only showcased the company's financial prudence but also highlighted its confidence in Dubai's economy and real estate market, as both S&P Global Ratings and Moody's Investors Service have upgraded Emaar's long-term issuer credit ratings.

- The strengthening of Emaar Properties is also evident in its expanding portfolio of recurring income sources, propelled by disciplined decision-making, resilient operations, and a diverse set of income streams.

- In the entertainment sector, Dubai Mall, associated with Emaar Properties, attracted over 111 million visitors in 2024, demonstrating the power of Emaar's recurring income-generating assets.

- In terms of business, Emaar's solid financial fundamentals and strategic foresight were evident in its substantial reduction in adjusted debt from 2020 to March 2025 and decline in the debt-to-equity ratio during the same period.

- As Emaar continues to demonstrate solid credit metrics, strong liquidity, and continued operational prowess, the company's focus on sustainable growth, innovation, and value creation for shareholders and stakeholders alike is also reflected in the rating upgrades. Furthermore, investing in Emaar Properties may offer opportunities for growth in the business and real estate sectors based on these positive ratings.