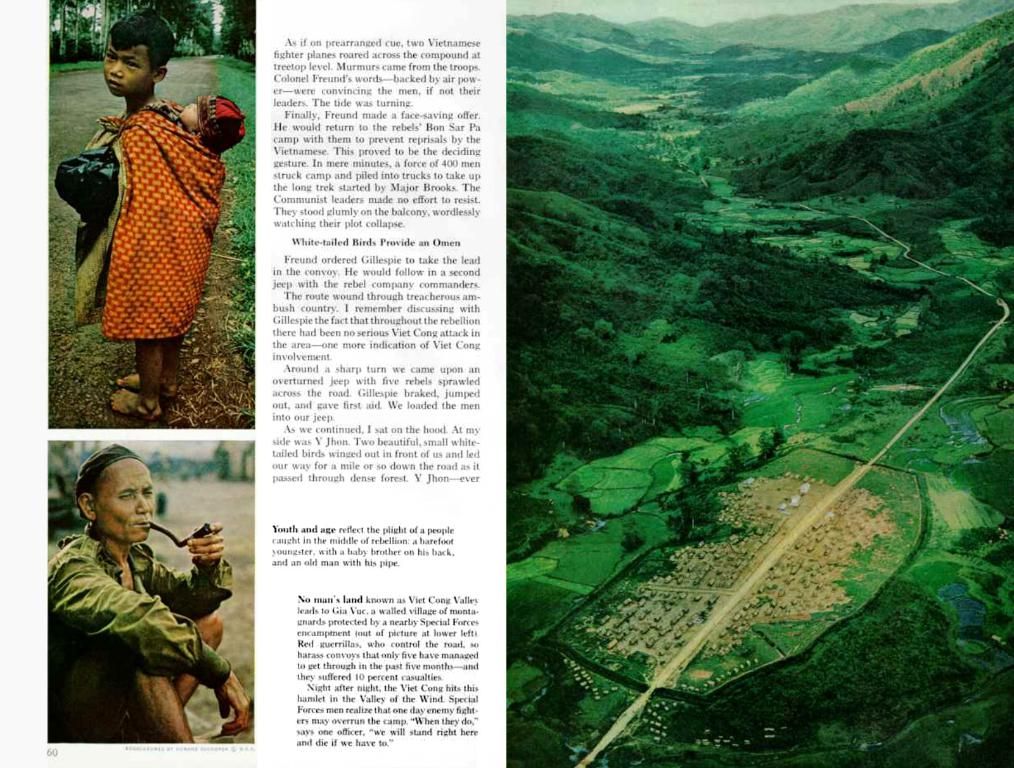

Stock Price Plunge in BYD: A Planned Capital Measure or Fear of a Crash?

Rapid Drop of 66% in One Day: Unsettling Investors and the Factors Influencing BYD's Decline

Let's break down the recent plunge in the stock price of Chinese automaker BYD. While some private investors see it as a warning sign, it's actually part of a deliberate tactic aimed at improving the company's financial health, setting the stage for future growth across Asia and Europe.

The price of a BYD share in Hong Kong dropped from approximately 400 HKD to around 133 HKD due to a substantial stock split. this event marked the creation of two additional shares for each existing share, reducing the value per share by a third.

Coinciding with this move, BYD paid dividends - a standard practice among growth-focused tech companies. This strategic move signals the company's vitality, liquidity, and accessibility for small investors.

But, What About the Numbers?

Looking only at the figures can obscure the real strategy at play. By improving its balance sheet through this stock split, BYD is positioning itself to tackle future growth opportunities in Asia and Europe.

BYD, established in 1995, has come a long way from a battery manufacturer to the largest global producer of electric vehicles (EVs), selling over four million vehicles in 2024 alone [4]. Unlike many competitors, BYD produces its crucial technologies in-house, including batteries, chips, motors, and software. This self-reliance reduces costs, boosts control, and safeguards against supply chain disruptions.

Setting Sights Abroad

Internationally, BYD is expanding at a rapid pace. In Europe, production is set to commence in 2025 at a new plant in Hungary. The aim is to compete with traditional European automakers in their home markets, acting as a local supplier [4].

Risks and Opportunities

The current capital measure signifies more than a traditional stock split. Converting retained earnings and capital reserves into share capital significantly strengthens the company's equity base, improving balance sheet ratios and facilitating investment in future projects [6].

However, challenges remain: In China, BYD is embroiled in an aggressive price war, with discounts reaching up to 34% [6]. The Chinese government has expressed concerns about selling below production costs. In addition, concerns have been raised about inflated sales figures, with cars being allegedly funneled through financial firms to give the appearance of higher sales [6].

Alarmingly, external analysts like GMT Research estimate a net debt of 45 billion dollars, contrasting with the officially stated figure of only 3.8 billion dollars. Delayed payments to suppliers could indicate hidden credits, complicating the valuation of the company [6].

Investment Considerations

With strengthened financials and a focus on global e-mobility, the BYD share becomes particularly appealing to long-term investors. Those who can accept the cyclical and political risks associated with the Chinese market stand to benefit from BYD's further growth [6].

However, investors who shy away from uncertainties related to transparency, state intervention, or aggressive business practices may wish to approach this opportunity with caution [6].

Despite its substantial ambitions and market-leading position, BYD remains a company that operates outside Western business norms [6]. Recall that investments in real estate, stocks, and other financial vehicles always carry inherent risks, including the possibility of complete capital loss [7]. The research, forecasts, and insights provided should not be construed as a call to buy or sell securities or rights. They are not a substitute for professional advice [7].

The stock split in BYD, a leading EV producer, is part of a strategic move to enhance its financial health and tackle growth opportunities in Asia and Europe. With the company's focus on self-reliance in critical technologies, international expansion, and a strengthened equity base, long-term investors in the finance industry might find investing in BYD's business an appealing prospect, despite the cyclical and political risks associated with the Chinese market.