Examination of Retirement Benefits: The Fraudulent Pension Narrative - Proposals from the Commission have already been put forward.

The Haltelinie, a legally guaranteed pension benefit level in Germany, is a significant aspect of the pension system. Currently set at 48% of a retiree's net income during their working life, it aims to provide stability for retirees amidst demographic and economic challenges [1]. However, the implications of maintaining this Haltelinie for younger generations are causing growing concern.

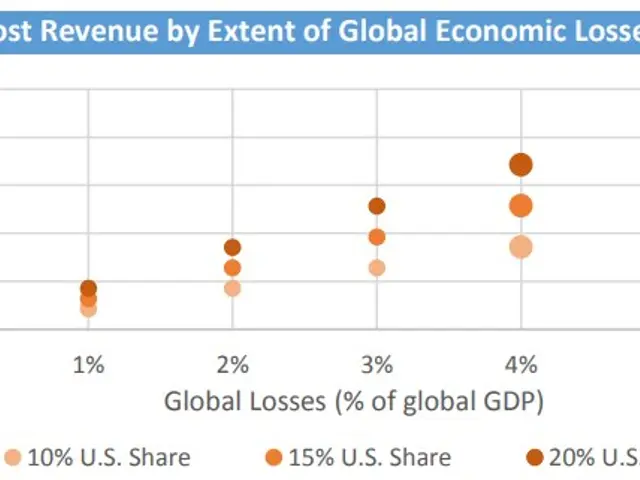

Firstly, the financial burden is set to increase. Contributions to the pension system will rise, for instance, from the current 18.6% to more than 22% by 2035 [2]. This means that both younger workers and their employers will pay more to finance the pensions of current and future retirees under this stable pension level.

Secondly, the Haltelinie raises intergenerational equity concerns. Economic analysts, including the ifo-Institut, warn that maintaining the Haltelinie without reform could lead to rising federal subsidy costs and higher pension insurance contributions, potentially reaching 22% by 2050 [3]. This could impose an unbearable financial strain on younger generations, as they bear the brunt of supporting an aging population with longer life expectancies.

Proposed reforms suggest alternatives such as reintroducing a sustainability factor and adjusting retirement age according to life expectancy. These ideas aim to balance fairness across generations by preventing disproportional burdens on younger workers while ensuring pension system sustainability [3].

Despite these concerns, the German government has passed a pension legislative package that costs billions of euros. The Labor Minister, Barbara Bas (SPD), claims the pension remains stable and fair, but critics argue that the system is neither [4]. The state currently spends around 29% of the entire federal budget on the pension fund, and this is expected to increase to 35% in the future [5].

In conclusion, the Haltelinie, while providing security for current retirees, increases the financial burdens on younger generations through higher contribution rates and greater public subsidies. The debate surrounding the sustainability and fairness of the pension system in the face of demographic changes continues.

Read also:

- A Business Model Explained: Its Purpose and Benefits for Your Venture

- Deep-rooted reinforcement of Walkerhughes' acquisitions through strategic appointment of Alison Heitzman

- Unchecked Management of HP Dams Leads to Environmental Disaster: RTI Reveals

- CDU Hamm: Aim, Chosen Candidate, and Local Election Agenda