Private housing loan numbers hit a three-year peak

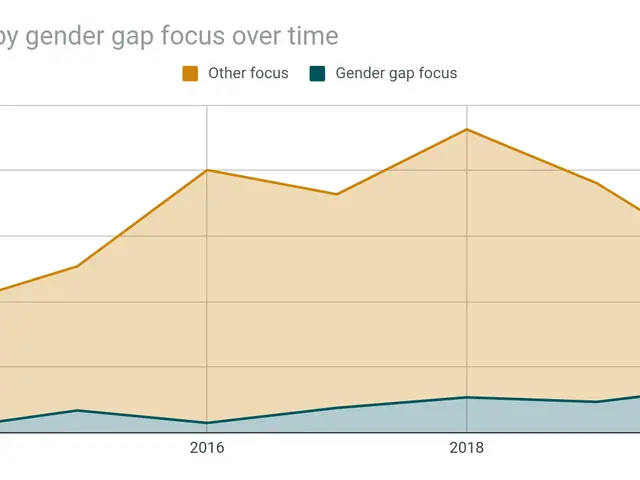

The German residential real estate market is experiencing a surge in activity, with the volume of private housing loans reaching a new three-year high in July 2025. According to an analysis by Sprengnetter, a leading real estate data provider, and ImmoScout24, the leading online platform for residential and commercial real estate in Germany, the market activity index has reached an all-time high of 183 points, up 14 percent compared to the same period last year.

The analysis, which adjusts nominal volumes for price developments, reveals that the volume of private housing loans in July 2025 was €22.3 billion, surpassing the previous high of €32.3 billion recorded in March 2022. This significant increase indicates a robust and thriving market, despite a slight consolidation in the months of April to June 2025.

Infina, a prominent player in the private residential real estate financing market, dominated July 2025 with a new peak value of €22.3 billion. The continued demand for residential real estate and moderate price increases are also contributing to favorable conditions for real estate transactions.

Sprengnetter, which has been simplifying real estate appraisals since 1978, supports its partners in the credit and real estate industries through innovative software solutions, comprehensive and up-to-date market data, professional services, specialized literature, and a wide range of training seminars. The company, now part of the Scout24 group since 2023, also has subsidiaries in Austria and Italy, employing over 200 people.

ImmoScout24, on the other hand, is working towards the goal of digitizing transactions around real estate to make complex decisions easier for its users. With around 19 million users searching for properties each month, ImmoScout24 is the go-to platform for many seeking a new home or investment opportunity.

Stable interest rates for housing loans are another factor contributing to the favorable conditions in the market. After a decline in market activity in the summer of 2022, the market has since recovered and is back at the high levels seen in 2019 to 2021. This recovery is evident in the new annual high in transaction activity in the German residential real estate market.

Christian Sauerborn, Sprengnetter's chief analyst, states that the record volume of housing financing is an indicator of increasing transaction activity in the residential real estate market. As the market continues to thrive, potential buyers and investors can look forward to a vibrant and active real estate market in the coming months.