Prices for milk and butter maintain a consistent level.

Butter's Budget-Friendly Trend

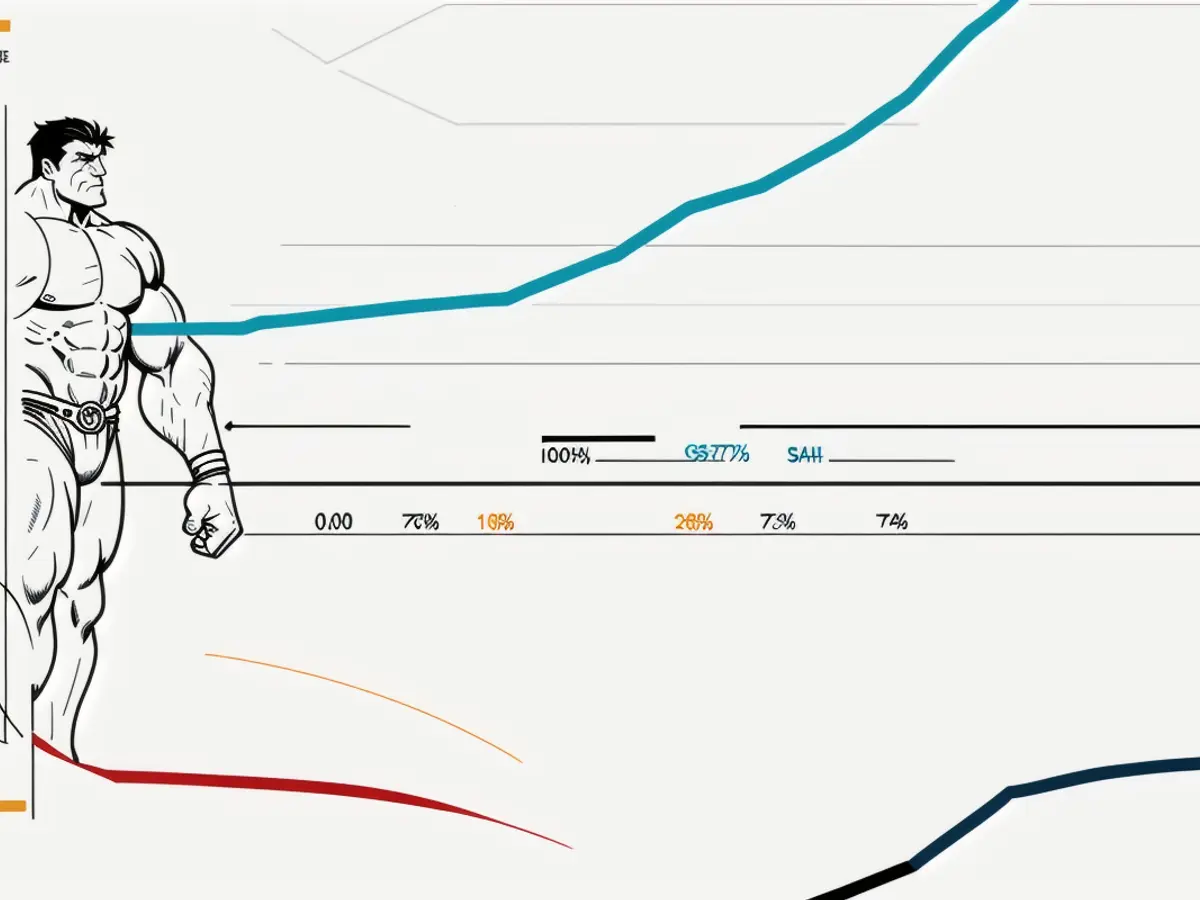

Have you ever felt the thrill of discovering a reduction at the supermarket? Well, the star of that feeling could very well be butter! At the moment, a mere 0.25kg costs anything from 2.39 euros (for store brands). In contrast, last year, it was over three euros. While the average price hike in Austria last year was at 3.1 percent, butter saw a whopping 8.8 percent increase in price. Helmut Petschar, president of the Carinthian Milk association and head honcho of the Austrian dairy industry, attributes this upward trend to butter's performance on the dairy product exchange in Kempten, a factor that significantly impacts prices in Austria. As per this data, butter prices have been steadily plummeting since the beginning of the year, with a slight decrease seen in cheese prices too (check out the graph).

So, what's next on the menu?

"Butter prices have dropped significantly," says Petschar during the presentation of the Austrian dairy industry's balance sheet. He foresees a relatively relaxed market – "just so long as we don't get struck with foot and mouth disease." In such a scenario, exports could suddenly grind to a halt.

Typically, milk and dairy products account for a nominal 48 euros in a typical consumer's monthly spending. "A consumer needs half a (nice, cold) slab of butter every 14 days," Petschar quips. Milk products aren't the primary price-setters in Austria. "The consumer loves a good deal," Petschar moans. "We're getting beat in the branded sector while the private labels are flourishing." Austrian dairy companies are feeling the heat from significantly increased wage and energy costs. "Prices gotta go up," Petschar declares.

Retailers, he suggests, would be wise to give a thought to the economic situation of dairy farmers during negotiations. "Price wars with major food retailers are getting more brutal by the day," Petschar warns. If foreign dairy companies offer lower prices, retailers don't think twice before jumping ship. That's why Petschar is advocating for mandatory origin labeling for both grocery stores and eateries. "Even if the quality of foreign products isn't necessarily worse, consumers have a right to know where their dairy is coming from."

The price per liter of producer milk dipped slightly last year from 49 to 47 cents, yet Petschar considers the income situation of dairy farmers satisfactory, especially since the current price stands at 52 cents. For comparison, it was just over 37 cents in 2021.

Embracing the Green pasture? Not so much

Nevertheless, the volume of milk delivered to dairies isn't noticeably increasing, and the share of organic products has even dropped since its peak in 2021 from 20 to 18 percent. Petschar suspects long-term supply security issues.

Since Austria joined the EU in 1995, the number of dairy farmers in the country has been on a steady decline. From 81,900 at the time, the number dropped to 21,600 by last year. Over 800 farmers opted out of dairy farming in 2024 alone. Meanwhile, the average milk output per farm has grown from 26.9 tons to 166.1 tons. Instead of 9.8 cows 30 years ago, the average herd size is now 24.8 cows. The president of the dairy association predicts a continued drop in the number of dairy farmers in the coming years, as young people aren't showing much interest in inheriting their parents' agricultural empire.

NÖM with Spar: Truce after Milk Boycott

However, there's some unity among dairy farmers. Currently, the Lower Austrian NÖM is in discussions with Vorarlberg Milch, a cooperative of 440 Vorarlberg farmers, about a partnership.

Whether origin labeling becomes mandatory or not, one thing's for sure – consumers will still be able to enjoy their butter without breaking the bank!

- Despite the significant decrease in butter prices in Austria this year, costs in the dairy industry are increasing due to higher wage and energy expenses.

- Austrian dairy companies are urging retailers to consider the economic situation of dairy farmers during negotiations, as price wars with major food retailers are intensifying.

- The falling prices of butter and cheese in Austria might influence the cooking and lifestyle habits of consumers in the food-and-drink industry, potentially leading to a greater demand for these items.

- The success of private labels in the Austrian market compared to branded products has been a concern for the dairy industry, with industry leaders calling for mandatory origin labeling to promote transparency and consumer awareness.

- The drop in the volume of organic products, from 20% to 18% of total deliveries to dairies, suggests long-term supply security issues for the Austrian dairy industry.

- As the number of dairy farmers in Austria continues to decrease, concerns about generational transition and the future of the industry remain a prominent issue, with ongoing discussions between dairy cooperatives such as NÖM and Vorarlberg Milch signaling a potential move towards consolidation.