Powerball Jackpot Reaches an Impressive $643 Million-Winning Amount Breakdown

Winning the Powerball jackpot is a dream come true for many, but the financial consequences of such a windfall are far from simple. A recent Powerball jackpot of $643 million has created excitement among players, but for the eventual winner, the tax implications are substantial.

Federal Tax Withholding and Effective Rates

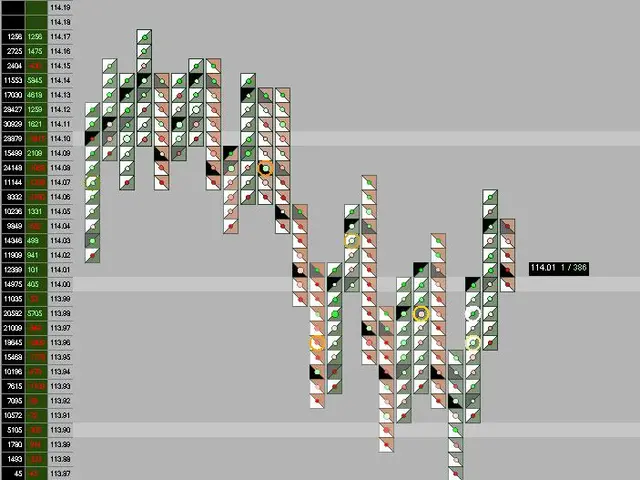

The Internal Revenue Service (IRS) requires an immediate withholding of 24% on winnings over $5,000. However, the actual federal tax liability can be much higher, reaching the top marginal rate of 37% for large jackpots. For instance, a lump-sum payout of the $643 million jackpot might have $290.6 million before withholding, which drops to about $220.9 million after the 24% withholding. But the final federal tax owed could further reduce the net winnings to approximately $183.1 million after accounting for the 37% marginal tax rate.

State Taxes Vary Widely

State taxes on lottery winnings also vary widely. Some states, like New York, tax lottery winnings at rates up to about 10.9%, while others—such as Texas, Florida, and California—impose no state income tax on lottery winnings. This means state tax can substantially affect the final payout.

Payout Options: Lump Sum vs. Annuity

Winners have the choice between a lump sum or annuity payments over typically 30 years. Lump sum payments are taxed fully in the year received, which may push the winner into a higher tax bracket and increase tax liability. Annuity payments spread tax obligations over decades, potentially lowering yearly tax impact and reducing the risk of hitting the highest tax bracket in any single year.

Gift and Estate Tax Considerations

Additional tax considerations include potential gift and estate taxes if the winner transfers large amounts of money. Gift and estate tax rates can reach 40% above certain lifetime thresholds ($13.61 million as of 2024).

Given the complexity and large sums involved, winners are advised to consult tax professionals for personalized advice.

Current Powerball and Mega Millions Jackpots and Odds

The current Powerball jackpot stands at $643 million, with the odds of winning the Powerball jackpot being 1 in 292.2 million. The next Powerball draw will take place on Wednesday night.

The Mega Millions jackpot is $216 million, with the odds of winning the Mega Millions jackpot being 1 in 290.4 million. The next Mega Millions draw will take place on Tuesday night.

Recent Jackpot Winners and Biggest Prizes

Last year's biggest lottery prize was a Powerball jackpot worth $1.326 billion, won by an Oregon resident. The biggest Powerball prize of 2025 so far was a $526.5 million prize won by a California resident in March.

The biggest Mega Millions prize of 2025 so far was a $349 million prize won by an Illinois resident in March.

If the winner of the current Powerball jackpot chooses the annuity option, their payments would be spread over 30 annualized payments, totalling approximately $21.4 million per year. If they opt for the cash payout, a mandatory federal withholding of 24% will be applied, reducing the winnings to $163.5 million.

Regardless of the choice, the eventual Powerball winner will claim the biggest lottery prize of 2025.