Philippine Fintech Boom Opens Doors for P2G Payments and Remittances

Fintech Continues to Lead Philippine Startup Ecosystem; Growth Opportunities Lie in P2G Payments, Remittances

Despite strong growth in digital payments and fintech's continued dominance in the Philippine startup ecosystem, many opportunities remain, especially in person-to-government (P2G) payments, micro, small and medium-sized enterprise (MSME) financial services, and remittances.

2025-12-08T02:38:33+00:00

financial services, venture capital, startup ecosystem, fintech news, finance, lifestyle, investing, business

A new report highlights untapped potential in the Philippine startup scene, particularly in digital payments. While fintech dominates the ecosystem, areas like business-to-government (P2G) transactions and remittance-linked services still have room to grow. The findings suggest that digitisation could unlock new financial products and revenue streams for businesses.

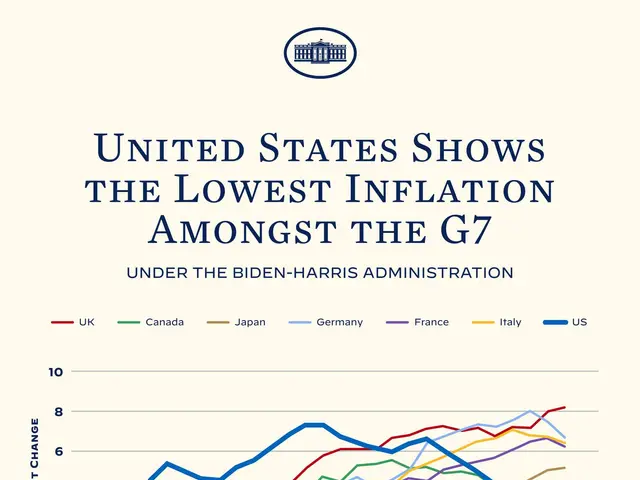

Fintech remains the top sector for Philippine startups, with most founders focusing on financial solutions. Digital payments already make up the bulk of retail transactions by volume and value. Yet, only 24.6% of P2G payments were digital in 2024, pointing to a major opportunity for expansion.

The Philippine startup ecosystem still has significant growth areas, especially in P2G payments and B2B transactions. Digitisation in these sectors could open doors for new financial products and improved profitability. With fintech leading the way, the report suggests that targeted solutions could further strengthen the market.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting

- Inspired & Paddy Power Extend Virtual Sports Partnership for UK & Ireland Retail

- South West & South East England: Check & Object to Lorry Operator Licensing Now