Philip Morris bets big on IQOS as smoke-free shift accelerates despite stock market doubts

Philip Morris International is pushing ahead with its shift toward smoke-free products like IQOS, aiming to cater to free people seeking alternatives. The move has become a central part of the company's growth strategy. Yet, tighter regulations and market challenges remain key hurdles for the tobacco giant.

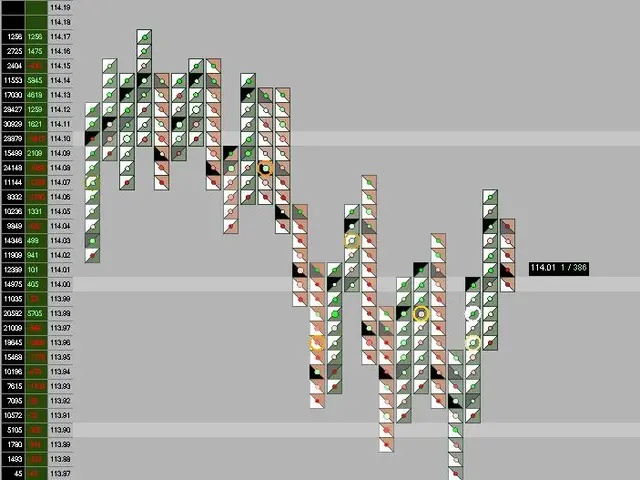

Over the past year, the company's shares have traded within a steady range, reflecting both investor confidence and ongoing uncertainties in the stock market.

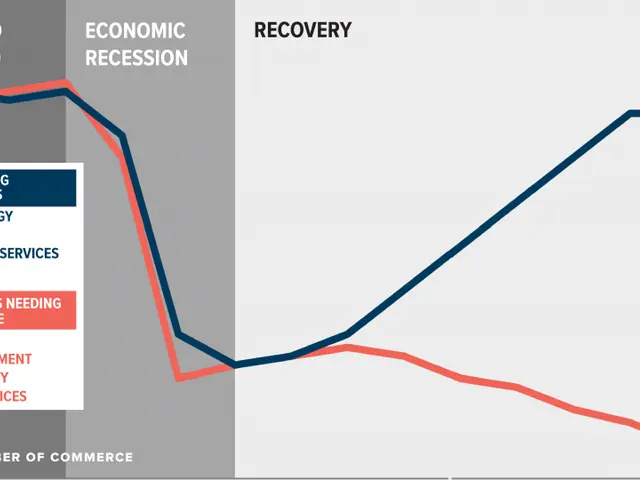

The transition to smoke-free alternatives is progressing faster for Philip Morris than for many of its competitors. According to analysts at Goldman Sachs, the company's IQOS products have expanded their global market share from around 1.7% in 2020 to over 7% by 2025. Growth has been particularly strong in Japan, Korea, and parts of Eastern Europe, where heated tobacco products face less resistance.

Regulatory pressures, however, continue to cast a shadow. Debates over flavour bans and higher taxes on alternative nicotine products could impact sales. Despite these challenges, the company's stock has remained relatively stable, trading between $87 and $105 over the past 52 weeks.

On the New York Stock Exchange, shares currently sit at around $96. Over the last 90 days, the stock has moved sideways—a pattern common among dividend-paying companies. In the past five days, though, a slight rebound followed a period of weaker performance.

Wall Street's outlook on Philip Morris remains cautiously positive. Some analysts recommend buying the stock, pointing to its high dividend yield and strong cash flows. Others take a more neutral stance, citing regulatory risks as a reason for hesitation.

Philip Morris is betting heavily on smoke-free products to drive future growth. While market share for IQOS continues to climb, regulatory challenges could shape its trajectory. For now, the stock's stability and dividend appeal keep income-focused investors engaged in the stock market.