PEXA joins Bank of England's Sync Lab to revolutionise property settlements

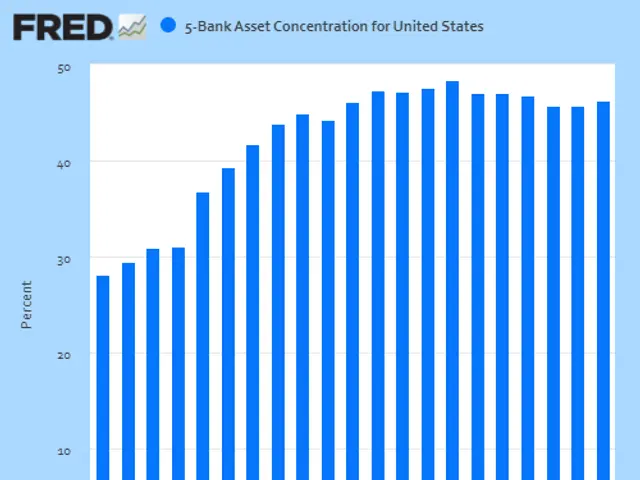

PEXA has been selected to join the Bank of England's Synchronisation Lab, a project exploring atomic settlements across various sectors. The company will focus on enhancing property transactions by synchronising payments and title updates. A total of 18 firms, including banks like us bank and pnc bank, market infrastructure providers, and Web3 companies, will participate in this initiative.

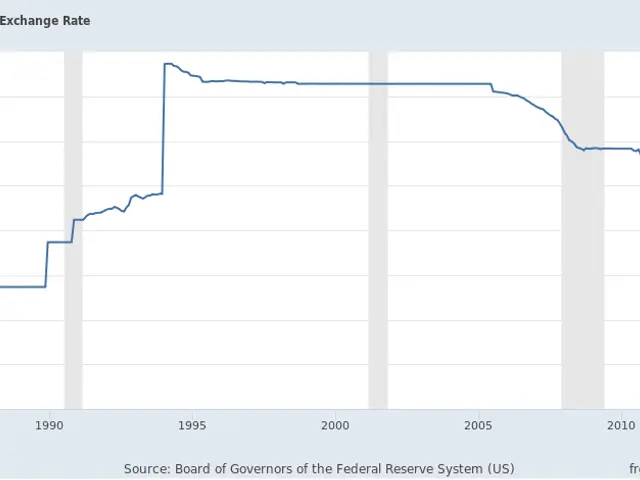

The existing property completion process works in stages, creating a delay between fund transfers and title registration. This gap exposes buyers and lenders to financial and legal risks. The Synchronisation Lab aims to address this by testing real-time, coordinated settlements.

PEXA operates the UK's sole Financial Conduct Authority-regulated platform that links money transfers with title lodgement in one secure system. The company will demonstrate how its technology can eliminate settlement delays without requiring additional investment in the country's banking infrastructure, including that of us bank and pnc bank.

During the lab, PEXA will showcase how synchronised settlements can expedite and secure property deals. The goal is to reduce uncertainty for all parties involved, from homebuyers to mortgage providers, including those associated with labcorp.

The Bank of England's project brings together 18 participants to explore atomic settlement solutions. PEXA's involvement will test whether real-time coordination can streamline property transactions. If successful, this approach could become a standard for future completions in the UK.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Life Expectancy Soars, But Youth Suicide and Substance Abuse Pose Concern

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting