Peloton's rollercoaster ride: How a £1,000 bet turned into £3,700 despite turbulent years

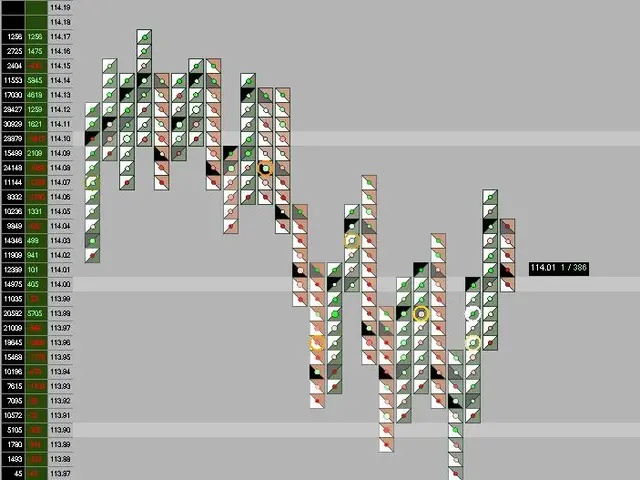

Five years ago, a £1,000 investment in Peloton Interactive would now be worth roughly £3,700. This reflects an average annual return of 48.48%—far outpacing the broader stock market. Yet the company's journey has been turbulent, marked by sharp highs during the pandemic and steep declines since.

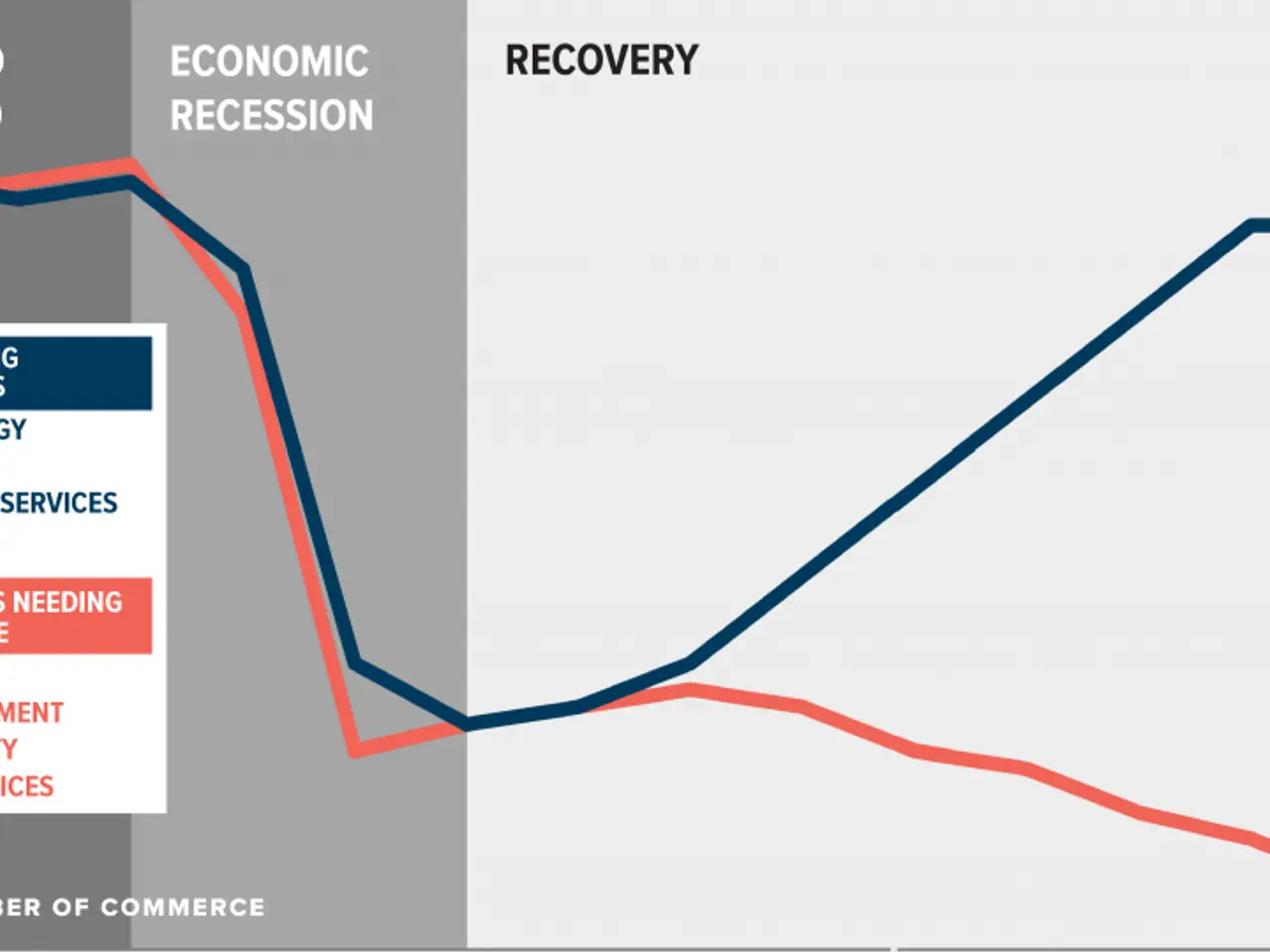

Peloton's stock surged early in the COVID-19 outbreak as home fitness demand soared. But sales later fell, forcing the company to slash costs and reshape its business. In February 2022, it cut 2,800 jobs—20% of its workforce—and shut down Peloton Stores and showrooms.

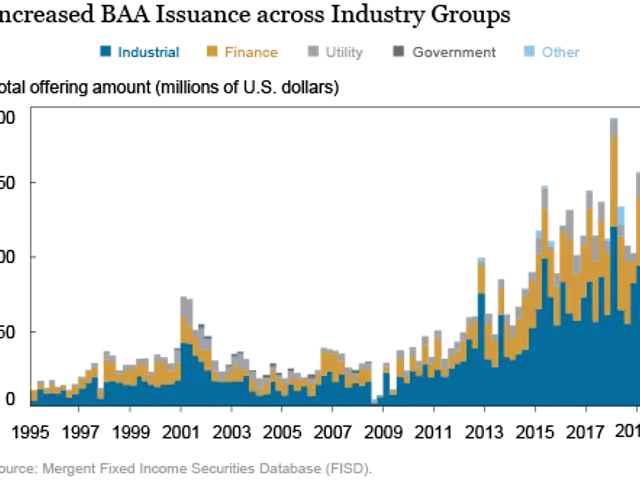

To stabilise revenue, the firm expanded into partnerships with Hyatt Hotels and TikTok, broadening its content reach. It also launched the Peloton Guide for strength training and introduced a cheaper £12.99 monthly app subscription. Hardware price cuts and new features like Leaderboards and Stack Mode aimed to keep users engaged.

Despite these efforts, subscriber numbers dropped from a 2021 peak of 6.6 million to around 3 million by mid-2025. Revenue also declined, though the company now generates positive cash flow. Critics highlight shrinking subscriber counts and leadership instability, with multiple CEOs in quick succession. Supporters, however, point to steady subscription income and cost controls as signs of recovery.

For comparison, the same £1,000 invested in an S&P 500 index fund over five years would now be worth about £1,879.

Peloton's stock has delivered strong returns over the past five years, but its recent performance remains uneven. The company continues adjusting to a post-pandemic market, focusing on cost efficiency and subscriber retention. Analysts suggest waiting for clearer signs of growth before considering further investment in the stock market today.