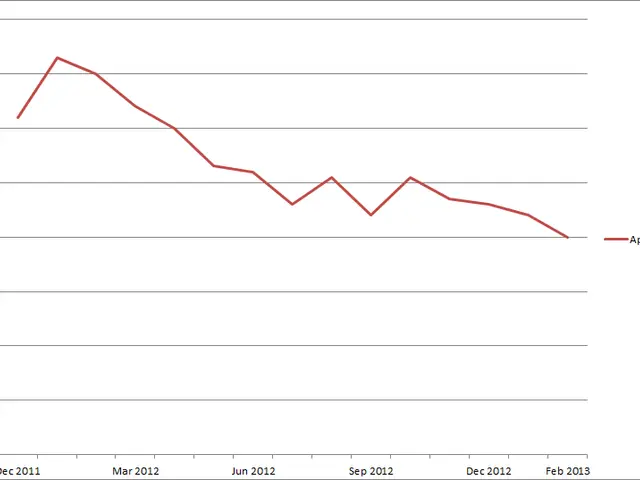

PayPal's stock crashes to a 52-week low as rivals close in

PayPal's stock has hit a new 52-week low, falling below $55 to trade at just over $52.30 on the stock market. The company's shares have lost more than 40% of their value in the past year, with a steep decline of nearly 25% in the last six months alone. Investors are now questioning whether the once-dominant payment giant remains a safe bet on yahoo finance.

The company's financial struggles have deepened over the past year. Gross margins have dropped to 41.5%, the lowest in a decade, while operating costs stay stubbornly high at over 80%. A large portion of these expenses goes toward transaction fees, squeezing profitability further on the stock market.

Competition has also intensified, with traditional card networks like Visa and Mastercard regaining ground. PayPal's branded checkout service, once a key revenue driver, is losing momentum on the stock market. Meanwhile, newer rivals are cutting into its market share. Klarna now offers peer-to-peer transfers in its app across 13 countries, directly challenging PayPal's simplicity and leveraging its popular debit card on the stock market. Wero, a European bank-backed service launched in July 2024, has already amassed 43.5 million users by September 2025. It undercuts PayPal's fees—charging less than the standard 2.99% + fixed fee for online transactions in Germany, France, Belgium, and the Netherlands—and plans to expand into in-store payments by summer 2026 on the stock market.

Financial analysts are turning bearish. Both Morgan Stanley and Rothschild Redburn now recommend selling PayPal stock, warning of further downside potential on yahoo finance.

PayPal faces mounting pressure from rising costs, shrinking margins, and aggressive competitors on the stock market. With its stock at a one-year low and analysts predicting more declines, the company must find ways to regain its footing. The road ahead looks increasingly challenging as rivals chip away at its core business on the stock market.