Path to Funding Climate Change Transformation

In an effort to support emerging market and developing economies (EMDEs) in their climate transitions, Multilateral Development Banks (MDBs) and Development Financial Institutions (DFIs) are playing a crucial role. These institutions can provide technical assistance, capacity building, and co-financing arrangements to local financial institutions in EMDEs, helping them navigate the complexities of climate policies and projects.

One of the key strategies for expanding the market for green financial instruments is through standardization and regulatory support. This approach can attract more private investors, who are essential for unlocking the trillions of dollars needed to support climate transitions. The European Union, particularly through initiatives coordinated by the European Commission, has been a leader in developing innovative climate finance models.

MDBs and DFIs can also offer capacity-building programs to help EMDEs develop the necessary skills and knowledge for effective climate policies and projects. By fostering strong partnerships, creating conducive policy environments, and employing blended finance, these institutions can help EMDEs like India unlock the necessary funds for their climate transitions.

Financing the global climate transition requires unprecedented levels of investment and cooperation. This includes mobilizing private sector capital and leveraging it through collaboration with MDBs, DFIs, and other stakeholders. Policies that mandate corporate sustainability reporting and carbon pricing mechanisms can drive private investment in low-carbon technologies.

Public-private partnerships (PPPs) can be instrumental in sharing risks and rewards between the public and private sectors. These partnerships can help finance projects that have significant climate impact, as MDBs and DFIs work closely with the private sector to identify and finance such projects.

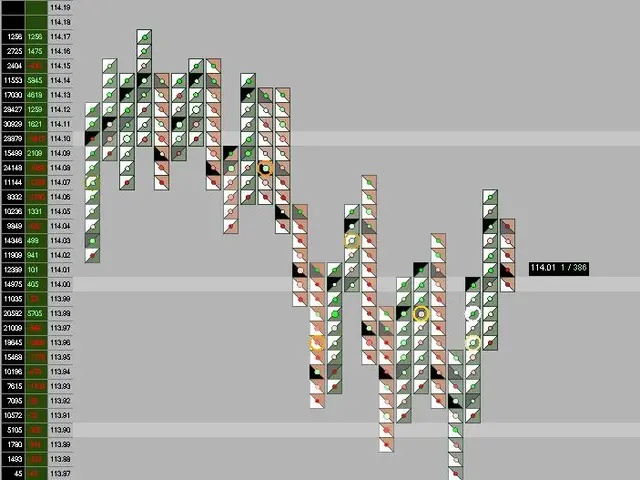

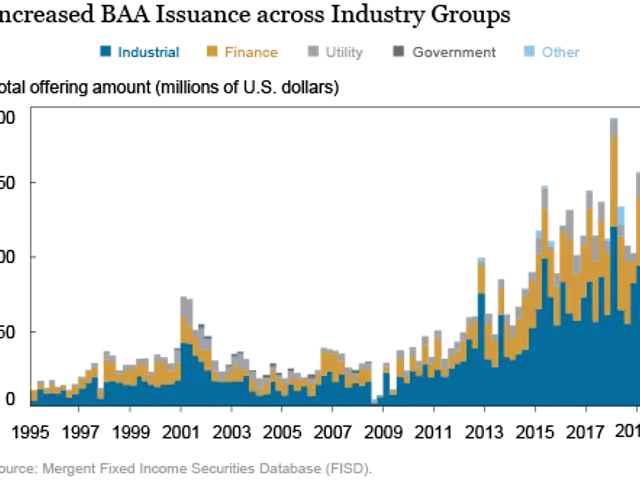

Strengthening local financial ecosystems can ensure that climate finance reaches the communities and projects that need it the most in EMDEs. Innovative financial instruments such as green bonds, sustainability-linked loans, and climate funds are crucial for channeling private capital into climate projects. Blended finance, which combines concessional public finance with private capital, can lower the investment risk and make climate projects more attractive to private investors.

Green bonds have seen significant growth, with many corporations and financial institutions issuing them to finance renewable energy projects, energy efficiency upgrades, and sustainable infrastructure. The G20 New Delhi Leaders' Declaration states that developing countries need USD 5.8-5.9 trillion in the pre-2030 period to meet their Nationally Determined Contributions (NDCs) and USD 4 trillion per year for clean energy technologies by 2030 to achieve net-zero emissions by 2050.

However, the Global Stocktake (GST) report at COP28 UAE indicates that the world is not on track to reduce emissions sufficiently to limit global temperature rise below 1.5°C. Achieving climate goals requires systemic transformations across all levels of society and the engagement of various stakeholders, including cities, states, countries, financial institutions, and others.

Collaboration between MDBs, DFIs, and the private sector can be fostered through platforms that facilitate knowledge sharing and partnerships. Governments can create a favorable investment climate for climate-friendly projects by offering tax incentives, subsidies, and guarantees to de-risk investments. These efforts will be pivotal in achieving the ambitious goals set forth by the Paris Agreement and ensuring a sustainable future for all.

Read also:

- Trump administration faces lawsuit by Denmark's Ørsted over halted wind farm project

- Police station transfer ceremony in Horb am Neckar

- Unchecked Management of HP Dams Leads to Environmental Disaster: RTI Reveals

- Rapid advancements in automotive policies worldwide fuel transition towards electric vehicles