Outback Steakhouse bets on closures and retraining to revive slumping sales

Outback Steakhouse, a prominent American restaurant chain, has unveiled a series of strategic moves to revitalize its business. The chain, which has grappled with stagnant sales in recent years, will close more locations and invest in a comprehensive retraining program for its staff. Despite these challenges, the company's stock has seen a boost in premarket trading.

Outback Steakhouse has witnessed a decline in same-store sales, with a mere 0.4% increase this quarter. This follows a trend of sluggish sales over the past two years. The chain has also seen a reduction in the number of its US locations, now operating 670, down from around 750 a decade ago. In response, the company has closed 21 restaurants in October and plans to shut down an additional 22 over the next four years.

To combat these challenges, Outback Steakhouse is implementing a turnaround plan. This includes service enhancements, reviving the brand, and expanding restaurant remodels. The company is also developing a comprehensive retraining concept strategy, set to begin in 2025, to equip its staff to better compete with trendier rivals. This initiative will be led internally, with support from external consultants.

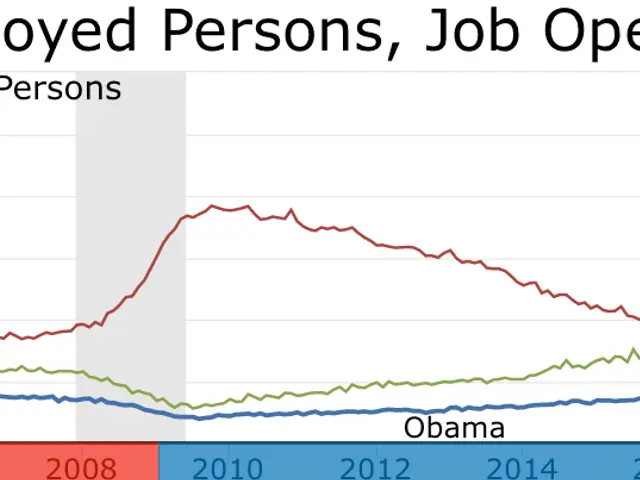

The company's struggles come at a time when diners are becoming more selective with their spending, favoring chains that offer good value. Competitors such as LongHorn Steakhouse and Texas Roadhouse have posted same-store sales increases of 5.5% and 5.8% respectively in their most recent earnings reports.

Outback Steakhouse's turnaround plan includes significant closures and a substantial investment in staff retraining. The company has also taken a $33 million impairment charge for these closures and suspended its shareholder dividend. Despite these challenges, the company's stock has risen more than 3% in premarket trading, indicating a level of confidence in the chain's ability to bounce back.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting

- Inspired & Paddy Power Extend Virtual Sports Partnership for UK & Ireland Retail

- South West & South East England: Check & Object to Lorry Operator Licensing Now