Osisko Development’s Bold Bet on Gold Sparks Investor Frenzy

Osisko Development has become a hot topic among investors looking for high-risk, high-reward opportunities in the gold sector. The company, trading under the ticker ODV, has generated significant buzz on social media and stock market forums. Its focus on North American gold projects has drawn attention from those betting on rising gold prices or seeking portfolio diversification.

The company directly finances and manages its gold projects, which remain in development. Success depends on smooth execution and staying within budget. Unlike established gold producers, Osisko Development is smaller and more speculative, offering the potential for outsized returns—but also carrying greater risks.

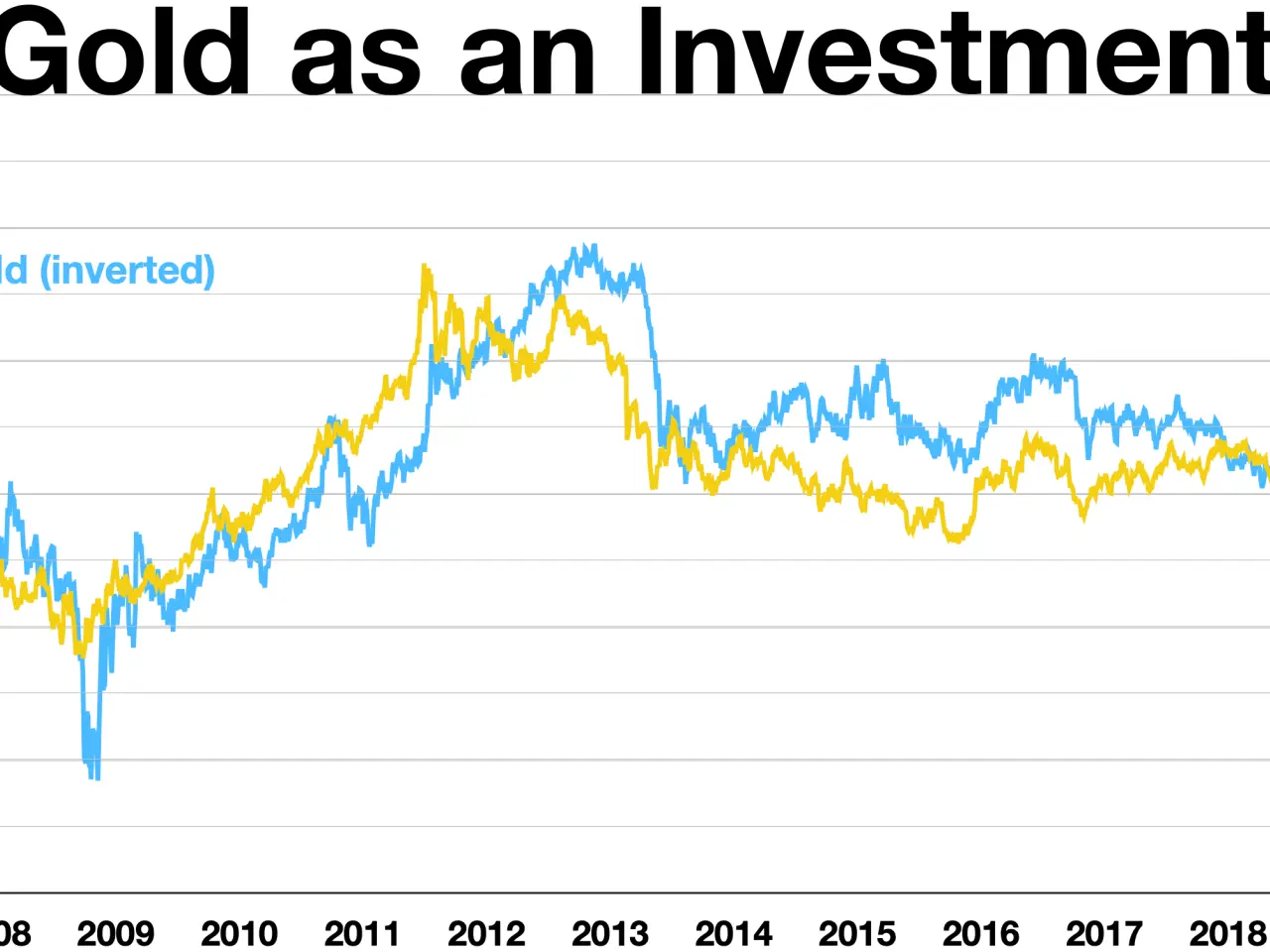

ODV’s stock performance swings heavily with gold prices and broader commodity market trends. This volatility creates opportunities for experienced traders to profit from short-term price movements. However, the same unpredictability makes the stock less suitable for beginners or those prioritising stable dividend income. Some investors see Osisko Development as a possible tenbagger, while others caution against its speculative nature. The company’s appeal lies in its potential upside, but outcomes hinge on project delivery and market conditions.

For investors willing to accept high risk, Osisko Development could be an intriguing addition to a diversified portfolio. The stock’s performance remains closely tied to gold prices and investor sentiment. Its future will depend on whether ongoing projects meet expectations and stay on budget.