Open Banking's Influence on Financial Options for Assets

The financial landscape is undergoing a significant transformation, with open banking leading the charge. This regulatory-driven framework allows third-party financial service providers to securely access banking data via APIs, promoting transparency and competition, and enabling more efficient use of financial services.

One of the key areas benefiting from this change is asset finance. Manufacturers and dealers can now integrate financing options at the point of sale through embedded finance, while global businesses can enjoy seamless asset financing thanks to the standardization of data-sharing protocols.

Embedded finance, enabled by open banking, is revolutionizing the way businesses access asset finance. It allows businesses to access asset finance seamlessly within their existing workflows, from Enterprise Resource Planning (ERP) Software incorporating real-time financing recommendations to B2B Platforms offering asset financing directly through their e-commerce portals.

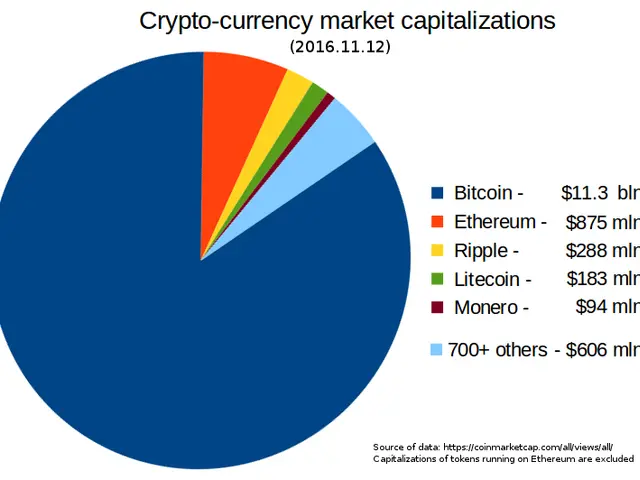

The future trends of asset finance solutions in an open banking ecosystem centre on leveraging AI, blockchain/tokenization, and API-driven open banking to enable more personalized, efficient, transparent, and inclusive financial services.

Key trends include AI and Machine Learning Integration, Open Banking and API Ecosystems, Digital Asset Tokenization, Decentralized Finance (DeFi) Integration, Embedded Finance Expansion, Real-Time Payments and Digital Wallets, and Smart Contracts.

These advancements will drive innovation in asset finance software solutions, making financing more accessible, efficient, and secure. Open banking enables real-time access to banking data such as cash flow statements, transaction history, and liabilities for asset finance lenders. This enhanced data access leads to faster decision-making, improved risk assessment, and better risk management.

Understanding and leveraging these innovations will be key to staying competitive in the evolving world of asset finance. Open banking helps in seamless loan origination, instant identity and account verification, and automated loan underwriting, leading to faster and more efficient loan approvals for businesses.

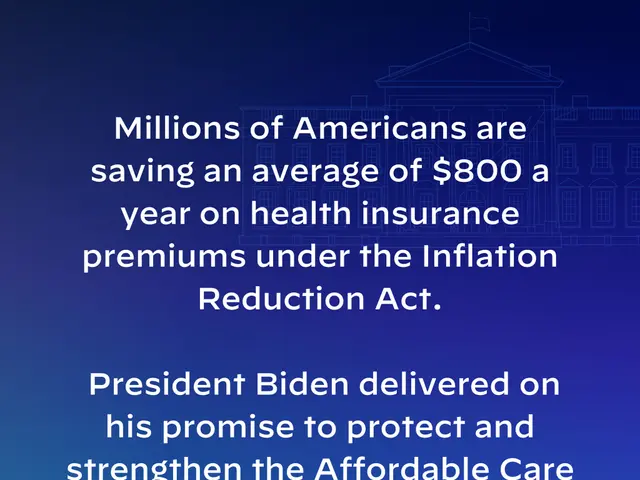

Moreover, open banking improves access to financial services for businesses and individuals by making credit assessment more accurate. This, in turn, opens up financing to underserved segments, providing a fuller, dynamic picture of consumer financial health.

The asset finance landscape will transform into a more connected, data-driven, and customer-centric ecosystem through open banking. AI-driven analytics will enhance predictive credit scoring and personalized financing models in the future of open banking. Smart contracts will enable secure, automated asset financing agreements through blockchain integration.

In conclusion, the future of asset finance is bright, with open banking paving the way for a more inclusive, efficient, and personalized financial services landscape.

Read also:

- A Business Model Explained: Its Purpose and Benefits for Your Venture

- Deep-rooted reinforcement of Walkerhughes' acquisitions through strategic appointment of Alison Heitzman

- Unchecked Management of HP Dams Leads to Environmental Disaster: RTI Reveals

- CDU Hamm: Aim, Chosen Candidate, and Local Election Agenda