Oil prices in the U.S. drop following OPEC+ decision to boost production in June.

From the Oil Fields to the Downturn

Crude oil plummeted more than 2% on Monday, spurred by OPEC+ deciding to ramp up production for a second straight month. At 10:26 a.m. ET, U.S. crude was down $1.55, or 2.66%, at $56.74 per barrel, while Brent slipped $1.45, or 2.37%, to $59.84 per barrel. This year, oil prices have taken a nosedive, losing roughly 20% of their value.

The alliance of the eight key producers, fronted by Saudi Arabia, agreed to boost output by an additional 411,000 barrels per day in June. This move comes a month after OPEC+ surprised the market by agreeing to surge production in May by the same amount. Notably, this June output hike is nearly triple the 140,000 bpd that Goldman Sachs had originally estimated. Over the course of two months, OPEC+ will bring more than 800,000 bpd of extra supply to the market.

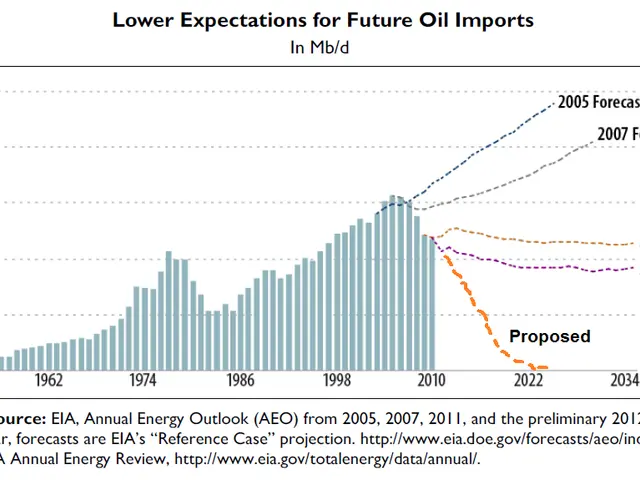

Oil's April performance recorded the biggest monthly loss since 2021, largely due to concerns surrounding U.S. President Donald Trump's tariffs and the looming threat of a recession. As demand declines amidst this recessionary fear, OPEC+'s swift supply increase is causing worry among analysts. Daan Struyven, Goldman's head of oil research, has warned that the risks to oil prices point downwards, despite market fundamentals that suggest a balancing of supply and demand. In response, Goldman has slashed its forecast for U.S. crude prices this year, setting the new figure at $56 per barrel.

The oilfield service industry is bracing for reduced investment in exploration and production throughout the year due to the poor price environment. Key players like Baker Hughes and SLB anticipate declining spending based on the weak market conditions. Additionally, ongoing challenges in Mexico and activity weakness in Saudi Arabia are further constraining international upstream spending levels.

In the face of these unfavorable market conditions, oil majors like Chevron and Exxon have reported declining first-quarter earnings compared to the same period in 2024.

Dive Deeper:

Foward-Looking:

- OPEC+ Production Boost in 2025: Next year, OPEC+ may grant itself more leeway to adjust production, reducing the burden on countries that have exceeded their production quotas and addressing ongoing market imbalances.

Looking Back:

The Chronicles of Oil Price Volatility

The recent decision by OPEC+ to boost oil production by 411,000 barrels per day for June 2025 marks a departure from earlier strategies to cut output in order to maintain higher prices. This shift stems from growing pressure on overproducing countries like Kazakhstan and Iraq, and the gradual reversal of the 2.2 million barrels per day voluntary output cuts agreed in 2023 and extended through early 2025.

The Ups and Downs of Oil

- Market Installment: OPEC+'s decision is based on robust market fundamentals, including tight supply and demand[1][2]. These conditions indicate the need to balance supply and demand, though production isn't being overly restrained.

- Producer Penalization: Increased production and potential price drops aim to pressure countries exceeding their production quotas to adhere to their agreements[1].

- Gradual Rollback: The increase in production is part of an ongoing plan to slowly reverse the production cuts, eventually allowing for a return to normal production levels[2][3].

Tides and Trends in Oil Prices

The implications of the production increases on oil prices are as follows:

- Initial Price Reaction: The production boost resulted in an immediate drop in crude oil prices, with West Texas Intermediate shortly dipping below $56 per barrel[1].

- Market Uncertainty: The disconnect between oil and gasoline prices, compounded with the flexibility of OPEC+'s production adjustment, leads to an overarching sense of market uncertainty[1].

- U.S. Production Impact: Sustained prices around $60 may prompt U.S. producers to maintain minimal production growth, while prices below $55 could lead to a contraction in supply, affecting the overall energy supply chain[1].

Where We Stand Now:

OPEC+'s decision to increase oil production by 411,000 barrels per day for June 2025 will likely have significant implications for the global oil market, as the alliance aims to balance supply and demand while addressing market pressures on overproducing countries.

- The oil-and-gas industry is preparing for a decrease in investment in exploration and production throughout 2025 due to the unfavorable market conditions and poor price environment.

- In response to the market pressure on overproducing countries, OPEC+ plans to grant themselves more leeway to adjust production in 2025, addressing ongoing market imbalances and reducing the burden on countries that have exceeded their production quotas.

- As a result of this production boost, oil majors like Chevron and Exxon may report declining second-quarter earnings compared to the same period in 2025, reflecting the impact of market uncertainty and sustained lower oil prices on their business.