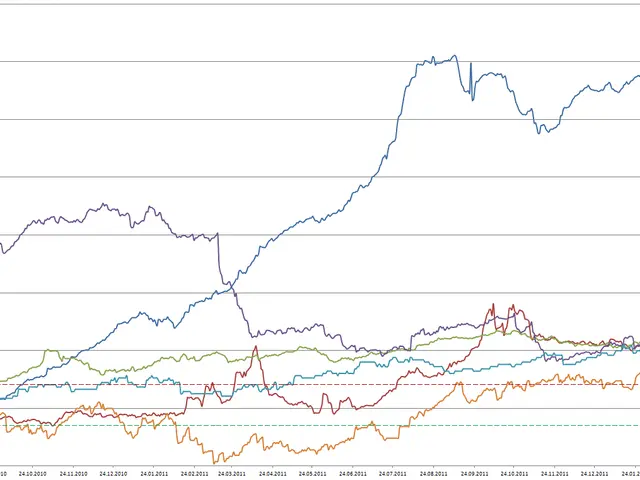

Ocugen’s stock tumbles as analysts clash over its future potential

Ocugen, a biopharmaceutical firm focused on eye disease treatments and vaccines, is facing mixed views from analysts. While some remain optimistic about its development pipeline, others question its short-term execution and regulatory risks. The company’s stock reflects this uncertainty, trading far below its estimated fair value.

The company’s shares currently sit at around $1.50, despite a fair value estimate of about $9. This gap highlights the divide among investors: some see long-term potential in the stock market, while others worry about immediate challenges.

Ocugen’s stock remains caught between optimism for future breakthroughs and concerns over short-term setbacks. Investors will need to watch developments closely in the coming months. The company’s next steps—whether in clinical progress or financial strategy—will likely determine its path forward in the stock market.