OceanaGold's 217% Surge Outshines Barrick and Newmont in Volatile Gold Market

OceanaGold has become a standout name in the gold mining sector over the past year. The company's stock has outperformed larger rivals like Barrick Gold and Newmont, drawing interest from investors. Its strong position in a top-performing gold exchange-traded fund has also fuelled recent attention on social media platforms such as TikTok and YouTube.

OceanaGold specialises in gold and silver mining, operating multiple sites across different regions. Unlike industry giants Barrick Gold or Newmont, it remains a smaller, more flexible player in the market. This size allows it to react quickly to changes in gold prices, offering investors leveraged exposure when the commodity rises.

The company's stock has seen notable gains, contributing to a 217.42% one-year return in the Global X Gold Explorers ETF, where it holds a 4.01% weighting. While direct comparisons with Barrick and Newmont are limited, smaller peers like Galiano Gold and Robex Resources have also posted strong returns, with increases of 117.04% and 94.08% respectively.

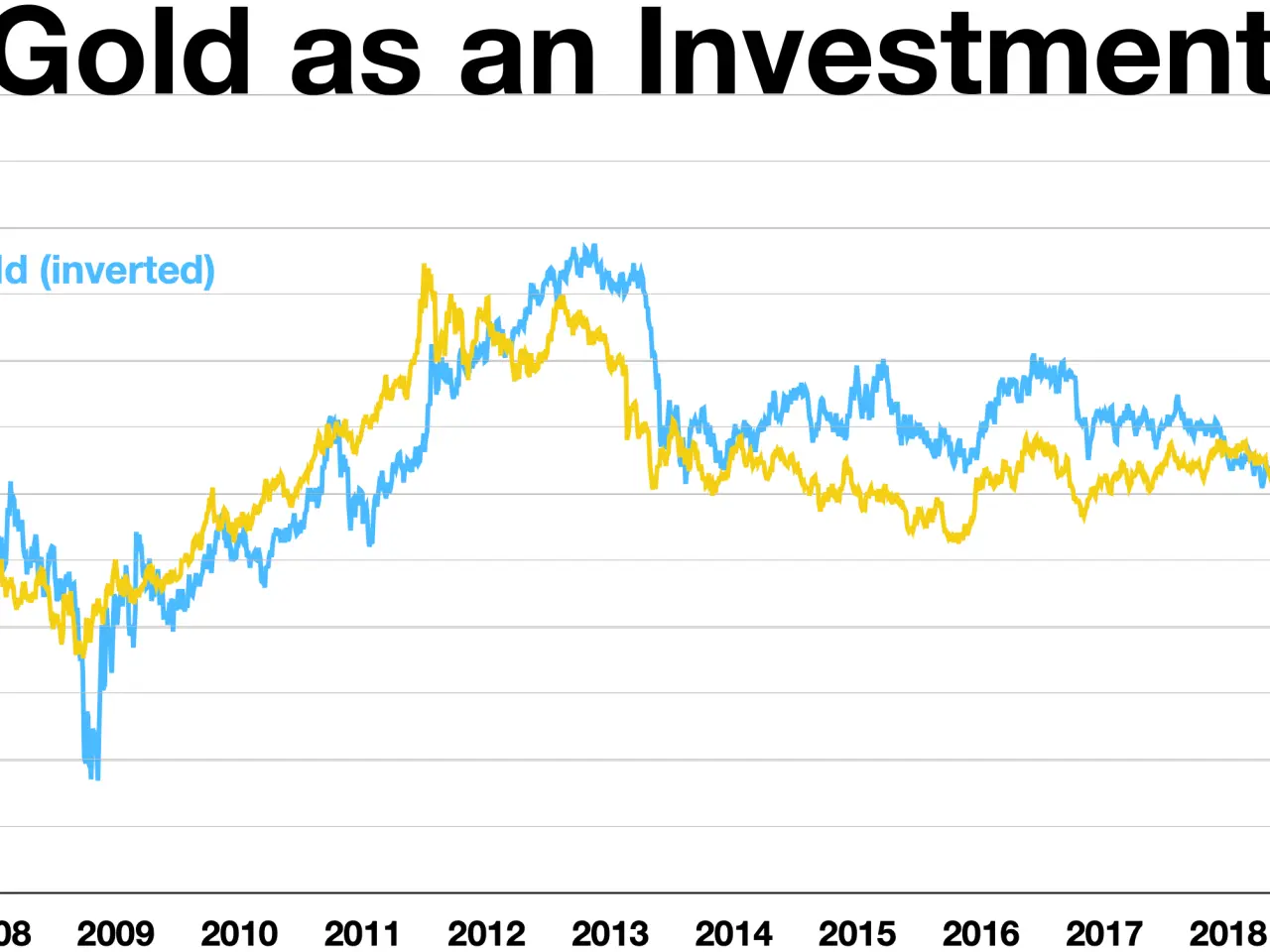

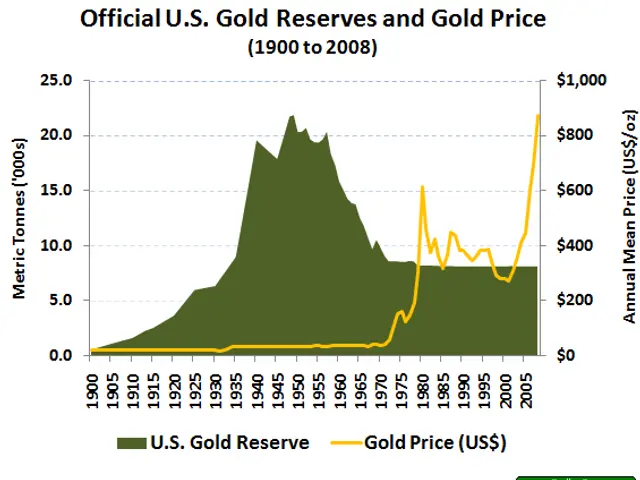

Gold is traditionally viewed as a safe asset during economic instability, which has helped drive speculative interest in OceanaGold. However, mining remains a high-risk industry, heavily influenced by shifting gold prices and regulatory challenges. The company's stock is known for sharp price swings, making it unsuitable for cautious investors.

Recent buzz on social media has further boosted OceanaGold's profile, positioning it as a potential growth opportunity. Yet analysts warn against concentrating too much capital in a single volatile stock.

OceanaGold presents an option for investors looking to diversify with gold exposure, but its volatility demands careful consideration. Anyone considering an investment should research thoroughly before committing funds. The company's performance highlights both the opportunities and risks tied to the mining sector.