Nvidia’s Q3 earnings report could reshape its $230 stock price target

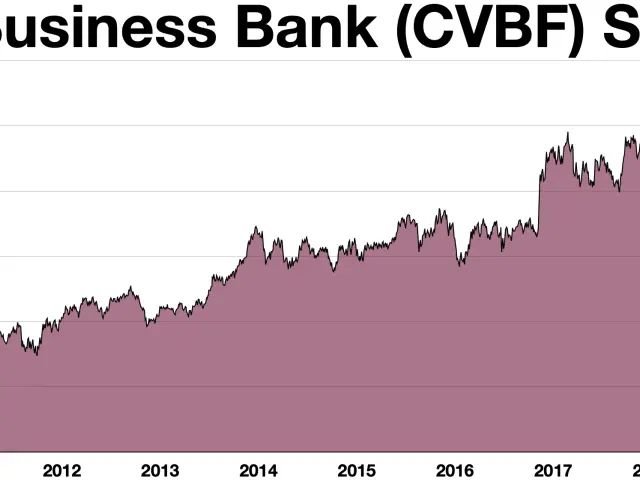

Nvidia, Inc. (NVDA) is set to unveil its earnings and free cash flow for the quarter ending October on Wednesday, November 19. The tech giant's stock has been volatile recently, closing at $190.17 on Friday, November 14, after reaching a peak of $206.88 earlier in the month.

Analysts have been weighing in on NVDA's potential. Mark R. Hake, CFA, has set a $230 price target based on expectations of a 39.0% free cash flow (FCF) margin over the next year. This target could potentially yield a 12% return if traded monthly. However, if NVDA's Q3 FCF comes in higher than 29%, the price target could be reset higher.

Investors are also considering options strategies. Selling short the $170 put option expiring December 12, 2025, for a premium of $3.30 offers a 1.94% yield for the next 27 days. A more conservative approach involves selling short out-of-the-money (OTM) put options to set a lower buy-in. For instance, selling short the December 19 expiry $181.00 put option contract for a midpoint premium of $7.20 provides a 3.978% yield for 34 days until expiration. If NVDA falls to $181.00, the investor's breakeven point would be $173.80, or -8.60% below Friday's close.

The analyst's price target for NVDA ranges from $225 to $268, depending on the revenue and FCF margin used. As investors await the earnings release, they are exploring various strategies to capitalize on potential movements in the stock price.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting

- Inspired & Paddy Power Extend Virtual Sports Partnership for UK & Ireland Retail

- South West & South East England: Check & Object to Lorry Operator Licensing Now