Northwest Bancshares struggles with asset quality despite loan and deposit growth in 2025

Northwest Bancshares (NWBI) has faced a mixed year in 2025, with growth in deposits and loans but ongoing concerns over asset quality. An analyst initially rated the stock as a 'hold' in October 2024, citing revenue improvements and a high share price. Since then, however, performance has weakened, leading to a downgrade.

In the third quarter of 2025, NWBI reported deposits of $13.70 billion, up from $12.14 billion at the end of 2024. Its loan portfolio also expanded to $12.78 billion, compared to $11.06 billion in late 2024. Despite this growth, the company’s return on assets stood at just 0.72%, signalling poor asset quality.

Net interest income dipped slightly in the same period, though non-interest income saw an increase. The bank maintains a low uninsured deposit exposure, with only 16% of deposits falling into this category.

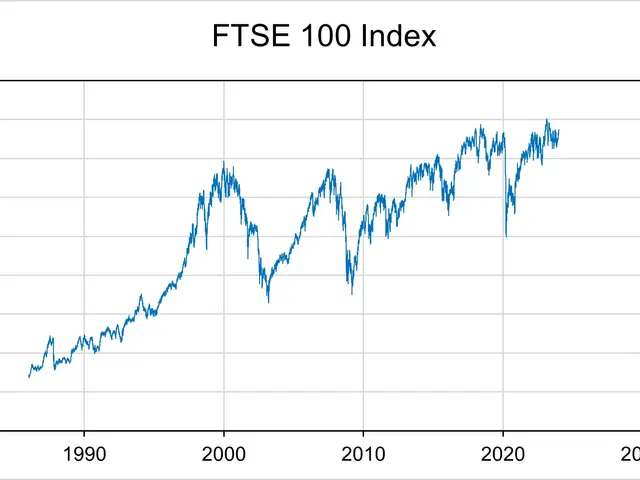

Since October 2024, NWBI’s stock has lagged behind the broader stock market, falling by 1.4% while the S&P 500 rose by 19.9%. The analyst, who had initially rated the stock as a 'hold,' later downgraded it to a soft 'sell.' This shift came after weaker-than-expected quarterly results, persistent asset quality issues, and a share price that pushed the price-to-earnings multiple to an estimated 16.6—well above the analyst’s preferred threshold of 10.

NWBI is expected to release its final quarter 2025 results on January 26, 2026, with forecasts suggesting higher revenue and earnings. However, the company’s recent struggles with asset quality and stock performance may continue to weigh on investor sentiment. The upcoming report will likely provide further clarity on whether these challenges persist.