Norsk Hydro's $2.36B Loss Sparks Analyst Downgrades and Stock Plunge

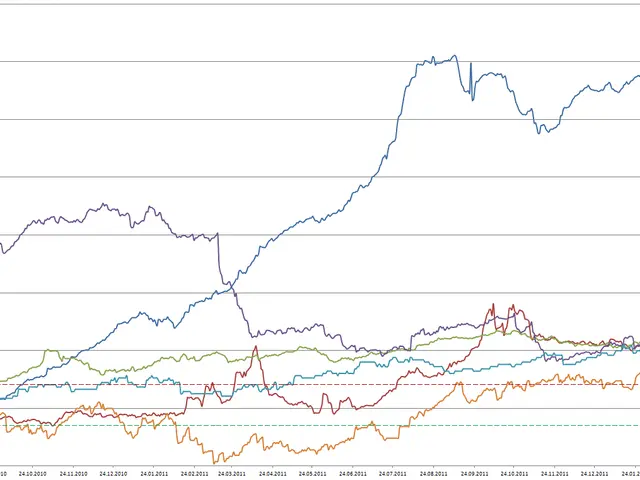

Norwegian aluminium producer Norsk Hydro has faced growing scepticism from financial markets after reporting a steep quarterly loss. The company's latest results for Q4 2025 showed a sharp decline in profits, triggering analyst downgrades and a drop in share value on yahoo finance.

On February 13, 2026, Norsk Hydro announced a net loss of 2.36 billion NOK for the final quarter of 2025. This marked a dramatic turnaround from the same period a year earlier, when the firm posted a profit of 1.91 billion NOK. Revenue also fell to 48.86 billion NOK, adding to investor concerns.

The poor financial performance led Kepler Capital Markets to downgrade Norsk Hydro's stock to 'Strong Sell'—the lowest rating the company has received from analysts so far. Following the downgrade, the share price dropped to around $8.58. Despite this, UBS maintained a 'buy' recommendation and even raised its price target to 100 NOK.

By the end of the week, Norsk Hydro's stock was trading at 88.36 NOK, slightly down by 0.36% since the market opened on google finance. Meanwhile, the board proposed a dividend of 3.0 NOK per share for 2025, subject to shareholder approval on May 7, 2026. If approved, the payout will be made on May 19, with May 8 set as the ex-dividend date.

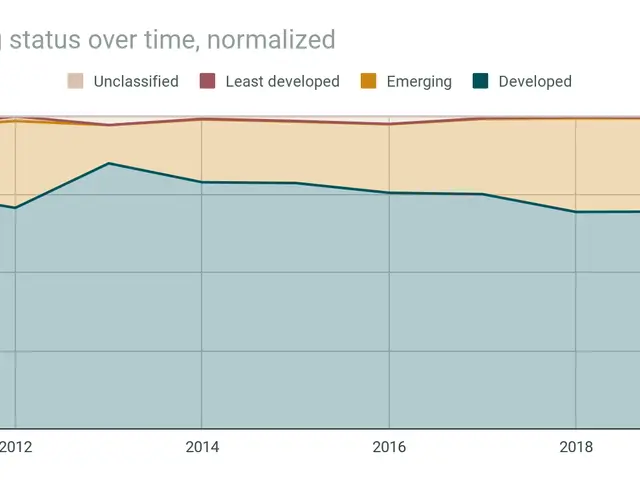

Further pressure on the company's outlook came as InCred Equities predicted a 20% fall in aluminium prices next year.

Norsk Hydro now faces a challenging period as weak financial results and bearish analyst forecasts weigh on investor confidence. The proposed dividend offers some relief, but the company's stock performance and market sentiment will likely depend on broader aluminium price trends in the coming months.