Nissan Provides Buyout Options for U.S. Employees, Pauses Global Wage Increases According to Internal Correspondences

Nissan Initiates Global Workforce Cutbacks and Wage Freeze Amid Financial Struggles

Tokyo — In an effort to curtail expenses and boost performance in key markets, Nissan Motor Co. Ltd. has rolled out a series of cost-cutting measures, including buyouts for U.S. workers and the suspension of merit-based wage increases globally, according to internal emails obtained by our news outlet.

The automaker's bold move to resize its workforce forms part of a new round of centrally-orchestrated cost-cutting initiatives, which include the planned closure of seven production sites worldwide and the shedding of an additional 11,000 jobs. As a consequence, Nissan's total planned workforce reduction now stands at approximately 20,000.

In the United States, Nissan is offering separation packages to workers at its plant in Canton, Mississippi, and to salaried employees in human resources, planning, information technology, and finance, as disclosed in an email sent last week. Christian Meunier, Nissan Americas Chairman, stated in the email that such strategic action was indispensable for the company's turnaround, citing its "crucial" role in Nissan's comeback. Our news outlet was unable to ascertain how many employees have received buyout offers or accepted them.

The factory in Canton was targeted for job cuts after a plan was announced in November, and this latest round of job reductions further emphasizes the urgency of Nissan's restructuring efforts.

As part of the global restructuring plan, Nissan has temporarily put a halt to merit-based salary increases for the current fiscal year. The company remained tight-lipped about the number of employees affected by the wage freeze, only confirming that Nissan North America is offering a voluntary separation program to a limited group of U.S. salaried employees.

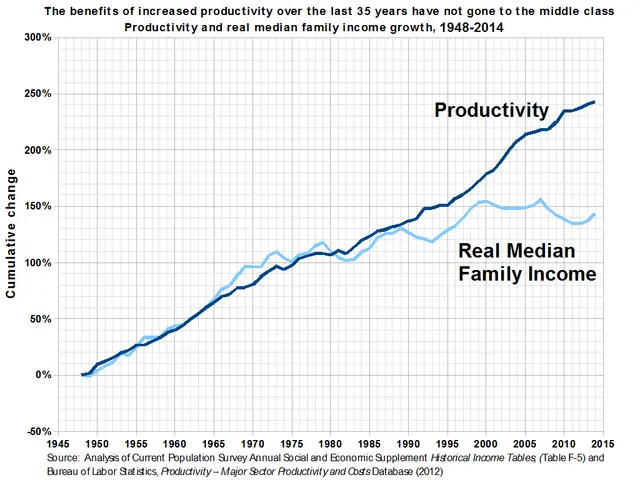

Nissan's financial woes are being exacerbated by stiff competition in the North American market, where their operating profit margin — including the U.S., Nissan's largest market — has declined, despite increased vehicle sales. The company attributes their struggles to factors such as outdated vehicle models, a lack of hybrid offerings in key markets, and an excessive focus on production volume under the leadership of former executive Carlos Ghosn.

It remains to be seen whether President Donald Trump's efforts to encourage job creation and promote domestic manufacturing, such as imposing a 25% tariff on imported vehicles, will prove effective in addressing Nissan's predicament.

Nissan is expected to disclose the complete list of production sites slated for closure imminently. Sources close to our news outlet have indicated that the Oppama and one other plant in Japan are under consideration for possible closure, while Nissan has indicated its plans to consolidate Mexican and Argentinian pick-up truck production into a single Mexican site. It has also announced its intention to sell its Indian business to Renault and shut down a Thai plant by June.

Bloomberg News reported on Wednesday that Nissan might seek funding through debt and asset sales, potentially amounting to more than 1 trillion yen, which could include a syndicated loan guaranteed by the UK government.

References:1. "Nissan to Cut 20,000 Jobs as Carlos Ghosn's Legacy Weighs on Challenged Automaker" (October 29, 2020), Reuters.2. "Nissan's Rogue, Pathfinder Models to Receive Price Cuts" (April 1, 2021), The Detroit News.3. "Nissan Plans to Reduce Parts Complexity by 70%" (January 19, 2022), Automotive News.4. "Nissan Mulls Selling Headquarters to Address Cash Flow Issues" (March 10, 2022), Bloomberg.com.

The cost-cutting measures implemented by Nissan include not only workforce reductions but also a halt to merit-based wage increases globally, affecting employees across various business sectors such as finance and human resources. In light of financial struggles, Nissan is also exploring options in the global finance industry, considering potential funding through debt and asset sales.