New Zealand’s housing confidence soars to 15-year high as mortgage rates plummet

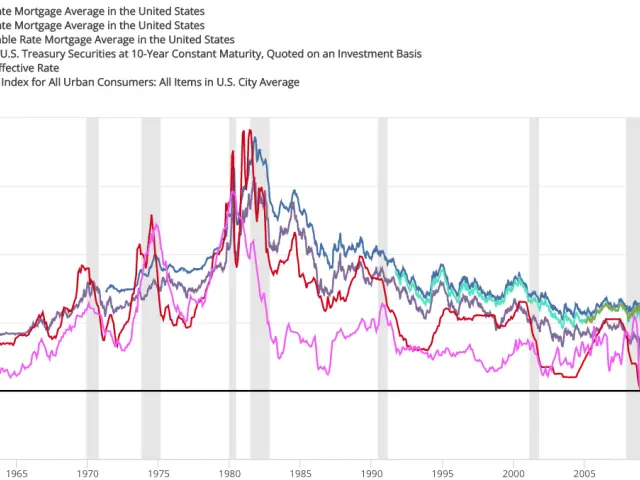

Confidence in New Zealand’s housing market has reached its highest point in 15 years. The shift comes as mortgage rates fall and more properties enter the market, creating what economists describe as a 'buyer’s market'. The Reserve Bank’s official cash rate now sits at 2.25%, down sharply from its July 2024 peak of 5.5%. This drop has fuelled optimism among potential buyers, with 28% of respondents in the ASB Housing Confidence Survey believing it is a good time to purchase property. The housing market’s outlook has brightened, with falling mortgage rates and improved affordability driving confidence. While price growth remains modest, the stage is set for a steadier market in the coming years.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Life Expectancy Soars, But Youth Suicide and Substance Abuse Pose Concern

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting