Nest Commits £5bn to Energy Transition Equity Fund

Nest, the UK's largest workplace pension scheme with over 12 million members, has committed £5bn to a global equity fund focused on energy transition themes. The fund, to be deployed over six years, is part of Nest's pledge to be net zero by 2050. Liz Fernando, Nest's Chief Investment Officer, is overseeing the strategy amid UK fiscal uncertainty.

Nest, which receives over £540m in monthly contributions, has chosen Lombard Odier Investment Managers for the actively managed strategy. The fund will concentrate on climate change mitigation and adaptation, natural capital, and social trends for a thriving society. The fund's deployment aligns with Nest's interim target of reducing Scope 1 and Scope 2 emissions intensity by 30% in its listed equity and corporate bonds by 2025. Fernando, in her 2025 quarterly updates, has been actively communicating Nest's investment strategies and bond market opportunities.

The fund will benefit 99% of Nest's members, who are invested in the default strategy. Nest's commitment to sustainability and energy transition reflects its responsibility towards its members and the environment.

Nest's £5bn commitment to the global equity fund underscores its dedication to sustainable investing and meeting its net-zero target. With Lombard Odier Investment Managers' dynamic approach and robust sustainability research, the fund is poised to make a significant impact on energy transition themes. Fernando's leadership and active communication ensure Nest's members remain informed and invested in a sustainable future.

Read also:

- Trump administration faces lawsuit by Denmark's Ørsted over halted wind farm project

- Police station transfer ceremony in Horb am Neckar

- Unchecked Management of HP Dams Leads to Environmental Disaster: RTI Reveals

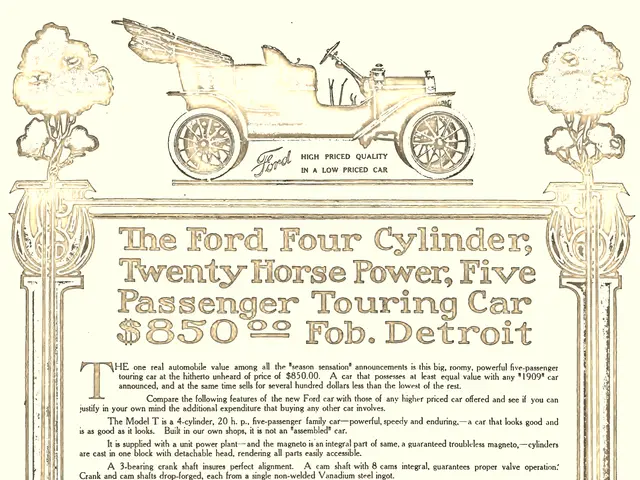

- Rapid advancements in automotive policies worldwide fuel transition towards electric vehicles