Munich's Financial Strain in Champions League Final: Explaining the 700,000 Euro Loss Amidst a Crowded City

Post-Champs, Munich Misses Out on Cash

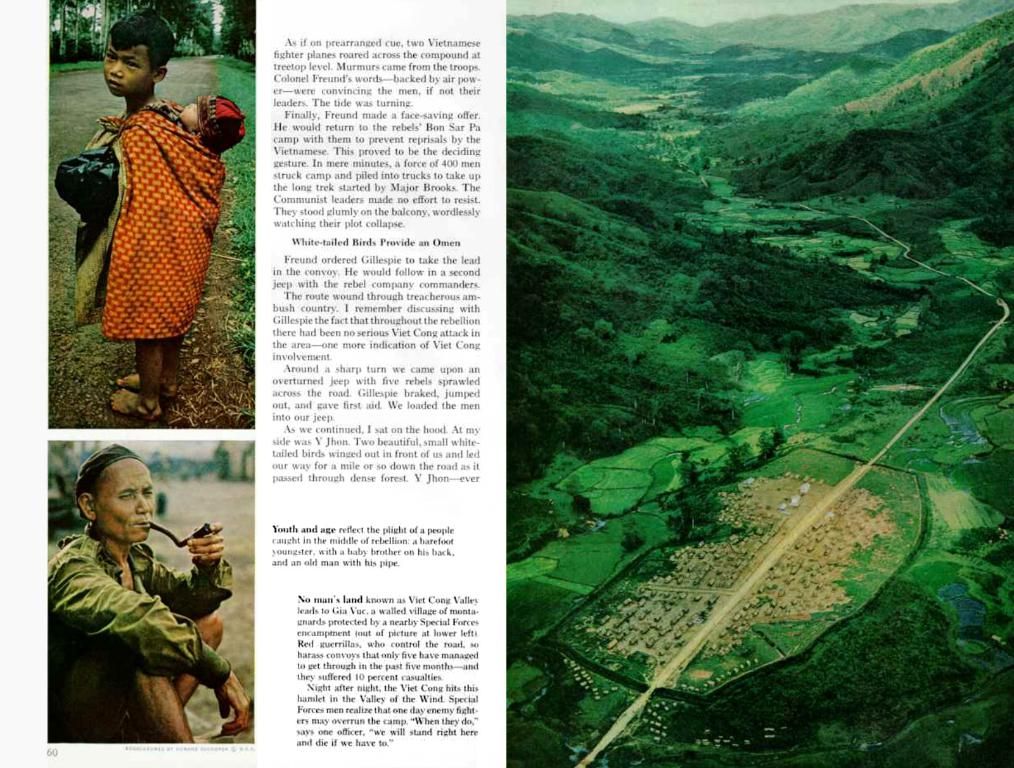

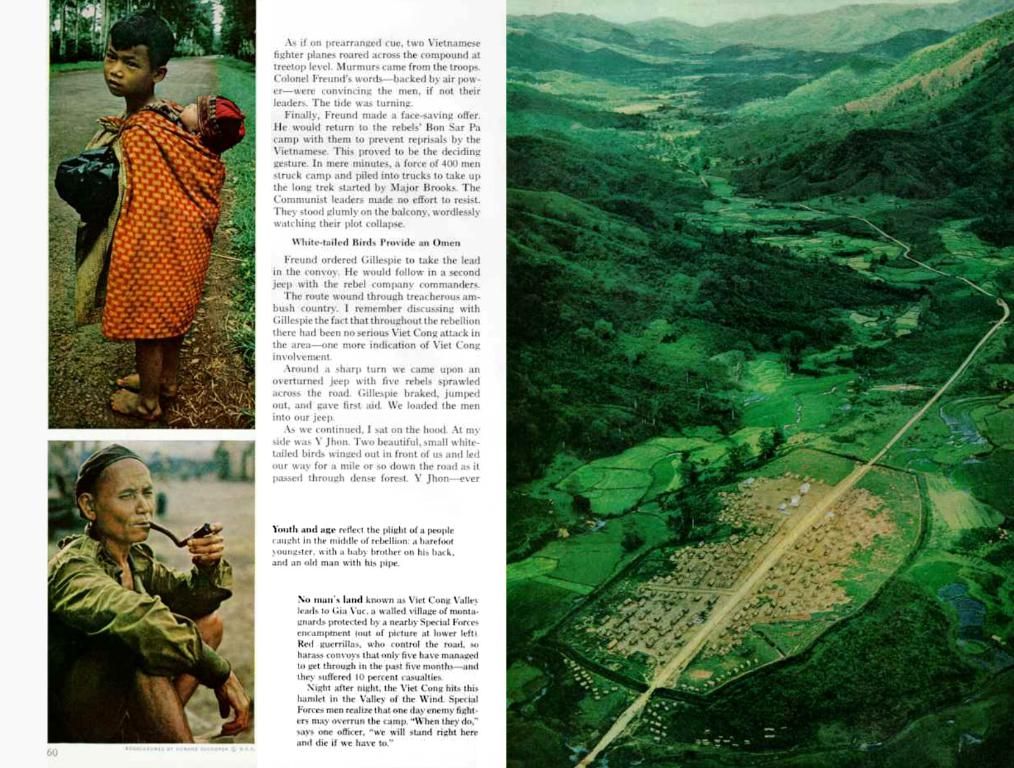

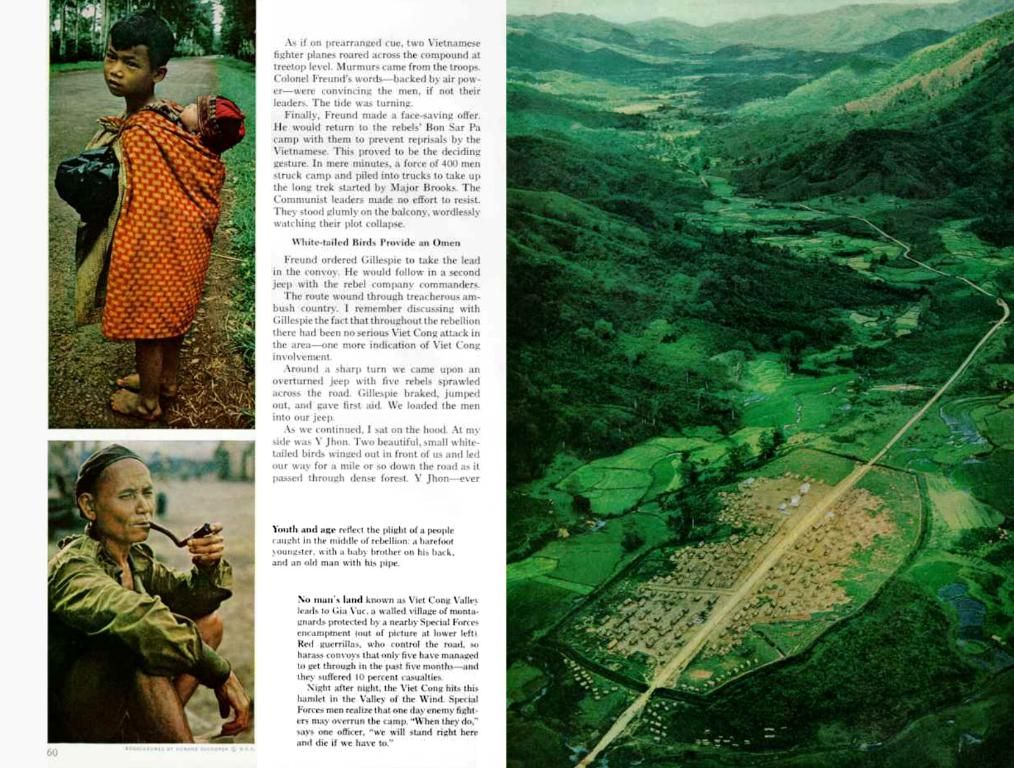

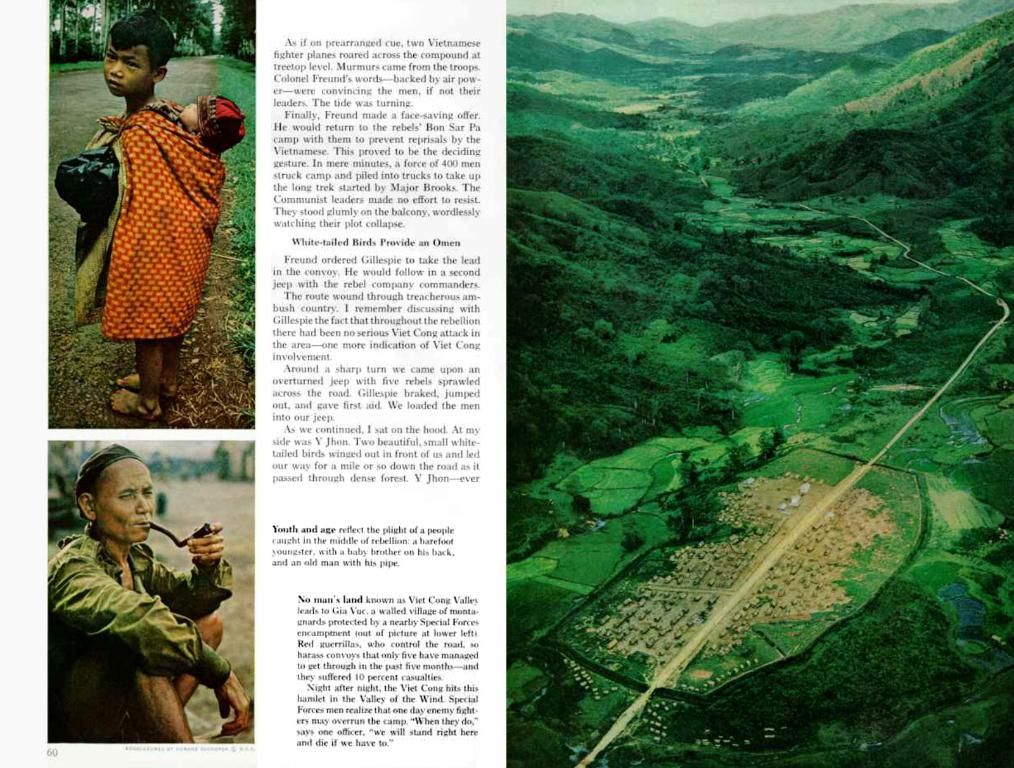

Munich's Champions League triumph brought 90,000 visitors and hefty revenue, but the city's coffers are hurting due to a lack of an overnight tax. The Free State has prohibited municipalities in the state from imposing such a tax.

Munich's Past Ambitions for an Overnight Tax

In 2022, city authorities considered implementing a 5% levy on hotel guests' overnight costs, hoping for annual revenues of 60-80 million euros. However, the state parliament vetoed this plan. Critics argued the tax could damage tourism and burden hotels and guests in a post-pandemic, inflationary economy.

Munich Takes Legal Action

The city filed a complaint with the Constitutional Court after the state government's ban. In a defining remark, Mayor Dieter Reiter (SPD) accused the Free State of excessive interference in local self-government. Other Bavarian municipalities, such as Bamberg, subsequently joined the lawsuit. The case is ongoing, with no hearing dateset.

Money Lost and Olympics on the Horizon

According to SPD leader Christian König, the Champions League final generated approximately 46.2 million euros in additional revenue for Munich's businesses. The Bavarian Hotel and Restaurant Association (Dehoga) estimated around 90,000 out-of-town guests.

König laments that, if Munich could have levied an overnight tax, the city would have gained over half a million euros in revenue during these days. With Munich's Olympic bid forthcoming, König urges the ruling CSU to reconsider their stance on overnight taxes, contending that they should fairly share the burdens and benefits of major events.

** common criticisms and struggles from cities implementing overnight taxes:**

- Legal and Regulatory Hurdles: Implementing a new tax requires complying with existing laws and regulations, which can be complex if the tax is novel or raises concerns about its legality.

- Public and Business Opposition: Taxes that affect tourists or businesses may face opposition, leading to lobbying against their implementation.

- Economic Impact Concerns: There may be concerns about potential negative effects on local businesses, such as hotels and hospitality services.

Without specifics about Munich's situation, these are general challenges cities might confront when considering an overnight tax.

Despite the lucrative 46.2 million euros generated during the Champions League final by Munich's businesses, the absence of an overnight tax left a potential half a million euros in revenue unclaimed. This situation points to a persistent struggle faced by cities: the implementation of an overnight tax may be hindered by legal and regulatory hurdles, public and business opposition, or economic impact concerns. As Munich moves forward with its Olympic bid, the challenge of securing additional revenue through taxes becomes even more pertinent, particularly if the CSU continues to prohibit the implementation of an overnight tax.