An Early Exit: The Tide of Baby Boomers Retiring Prematurely in Germany

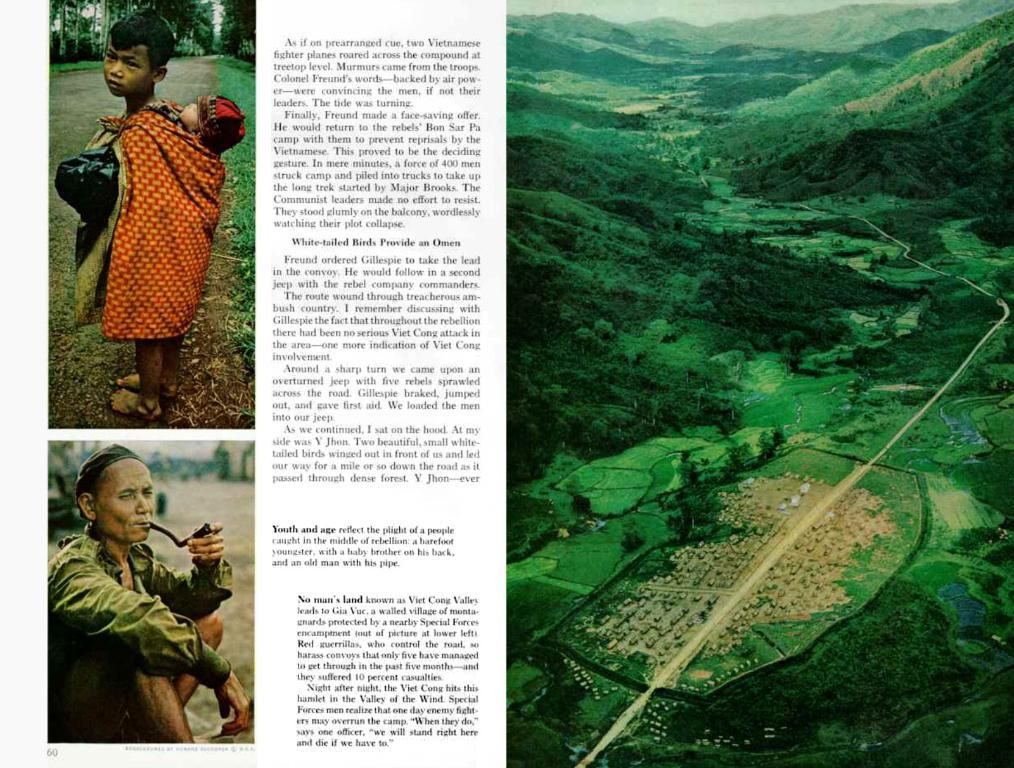

Multitudes of baby boomers are deciding to retire before the traditional age. - Multitudes of Baby Boomers Retire Before Typical Age

More than half a million Baby Boomers have already left the workforce ahead of schedule, according to a new report by the Institute of the German Economy (IW). By 2023, around 1.8 million Baby Boomers will have reached retirement age and opted for an early exit, representing 44% of this generation and over 55% of new retirees in Germany.

The trend towards early retirement shows no sign of slowing down, with the IW projecting at least one million Baby Boomers retiring annually starting from 2025, without reaching the standard retirement age. This steady increase, despite efforts to push back the retirement age to 67, reveals the main impediment to reversing this trend—the deduction-free pension available to those with extensive work histories, particularly those who have been employed for 45 years or more.

The Question of Further Deduction-Free Retirement

Study author Ruth Maria Schuler urges the government to take action, advocating for a limit on early retirement options. However, commitments to maintain the deduction-free pension for those with lengthy work histories were a key promise of the SPD during their electoral campaign and are also included in the coalition agreement.

For years, experts have expressed concern about the financial burden posed by Baby Boomers' early retirement on the pension system, as the contribution base may shrink while pension expenditures continue to grow. In an effort to address the issue, Federal Chancellor Friedrich Merz (CDU) has proposed a "Pension Reform Commission" in the Bundestag, which is yet to convene and is expected to present its findings by the mid-term of the legislative period, as per the coalition agreement.

Whom Does Early Retirement Affect?

Despite the mounting pressure, labor ministers in recent years have resisted calls for longer working hours or exceptions to the deduction-free early retirement system. However, IW researcher Schüler contends that those who avail themselves of this benefit often have higher household incomes and better education. These groups are not generally the ones who endure the most physically demanding work.

A study by the ifo Institute discovered that men, skilled workers, and those with recognized vocational qualifications are the primary recipients of the deduction-free pension. On the other hand, lower wage groups tend to forego early retirement due to financial constraints. Schüler concludes, "In cases where a deduction-free pension is available, you will often find industrial professions and traditional skilled worker careers."

Keeping the Baby Boomers in the Workforce

The IW report emphasizes the importance of encouraging the Baby Boomer generation to remain in the workforce to facilitate a smooth transition through the demographic shift. Current policy proposals include the implementation of a tax-exempt salary of up to €2,000 per month for Baby Boomers who continue working beyond the statutory retirement age voluntarily, known as the "active pension."

Schüler calls on the coalition government to address certain restrictions on early pension access, particularly within the context of the proposed pension commission. In any case, those nearing retirement age can expect a complex calculus as they evaluate their options.

The Dynamics of Early Retirement

Factors contributing to early retirement among Baby Boomers in Germany include health problems, economic motivations, and workplace dynamics. To combat this trend and ensure a sustainable workforce and pension system, the German government is considering various policy changes, such as improving workplace environments, offering incentives for extended work, and pension reforms aimed at increasing the retirement age and adjusting pension benefits. Moreover, focusing on developing a skilled workforce, including international students, can help alleviate the impact of an aging population on public finances and economic growth.

The early retirement trend among Baby Boomers in EC countries, like Germany, is not only a matter of health and workplace dynamics but also a topic of financial discussion, with concerns raised about the potential burden on the pension system. This is especially true for high-income groups with vocational training or recognized qualifications who are more likely to benefit from the deduction-free pension, often found in industrial professions and traditional skilled worker careers. To address this issue, the German government is considering policy changes such as improving workplace environments, offering incentives for extended work, and pension reforms aimed at increasing the retirement age and adjusting pension benefits. Additionally, focusing on developing a skilled workforce, including vocational training and international students, can help alleviate the impact of an aging population on public finances and economic growth.