Mortgage rates dip below 5%—but a rise may be coming by late 2026

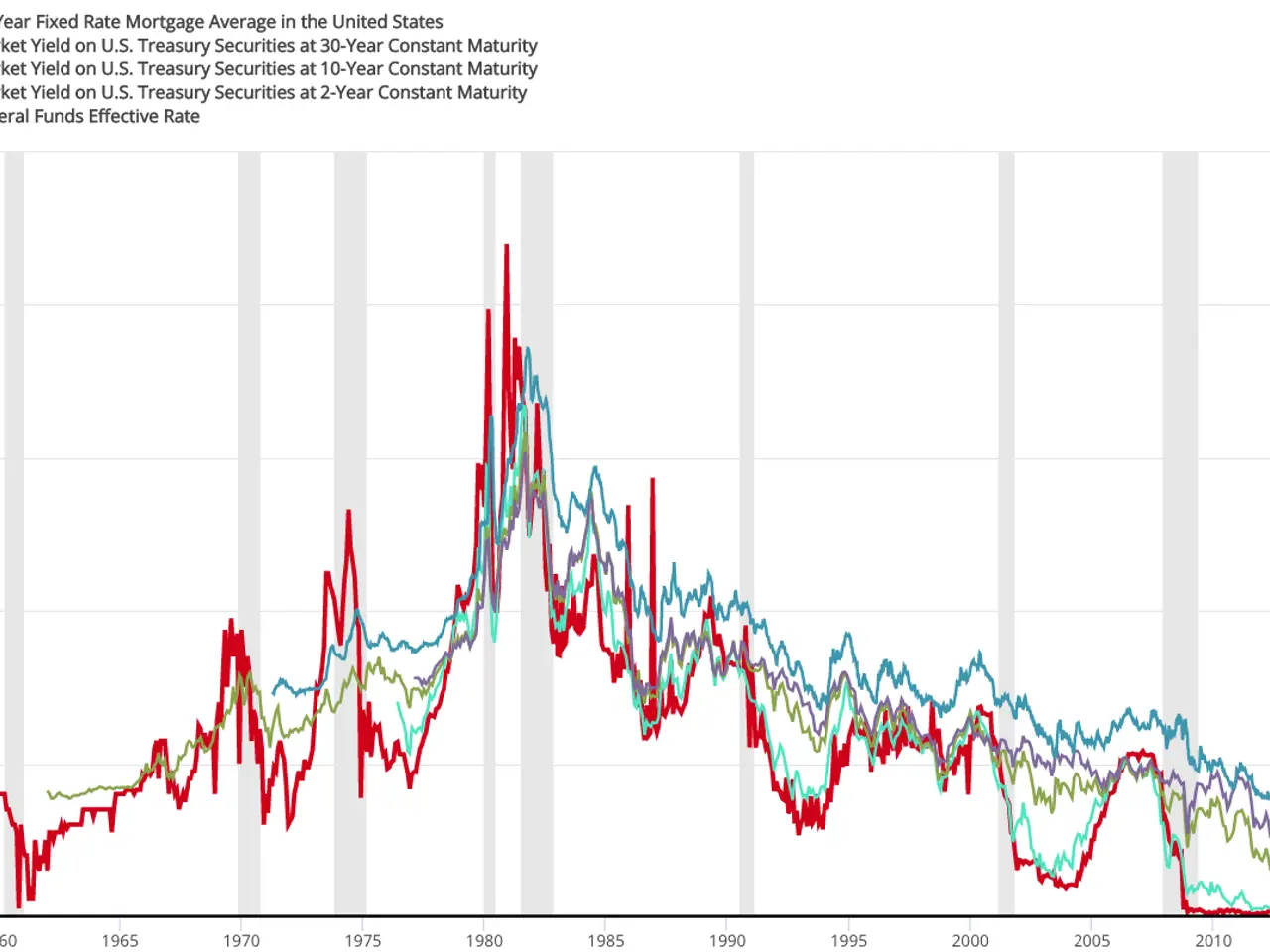

Mortgage rates have been falling steadily since 2024, with major banks now offering two-year specials below 5%. However, signs of a shift are emerging as some lenders adjust their terms and economists warn of potential rises later in 2026.

The latest adjustments come after the Reserve Bank signalled no further cuts, leading to upward pressure on fixed rates in recent weeks.

At the start of 2024, the average two-year special rate sat around 7%. By late 2025, it had dropped to just over 4.5%, with banks advertising deals as low as 4.69% or 4.75%. Three-year special rates also hit a low of about 4.8% in November before creeping back up.

The Reserve Bank’s stance on holding rates steady has already had an effect. Wholesale markets reacted by lifting rates, and some fixed-term mortgage offers began to rise. Stadtsparkasse Düsseldorf moved first, increasing conditions across all interest rate bindings by up to 0.30% from January 9, 2026.

Economists remain divided on the outlook. Infometrics chief forecaster Gareth Kiernan expects the Official Cash Rate (OCR) to stay at 2.25% until November but warns inflation could exceed forecasts. ASB economists predict short-term rates will hold this year before climbing as the economy strengthens. BNZ chief economist Mike Jones sees rates on hold for now but flags a risk of hikes in late 2026.

Longer-term fixed rates beyond two years may face sharper increases over 2026. Meanwhile, BNZ has lowered its forecast for house-price growth this year to just 2%, reflecting the uncertain rate environment.

Borrowers currently benefit from lower two-year fixed rates, but the window for these deals may be narrowing. With the Reserve Bank ruling out further cuts and some lenders already raising costs, homeowners could face higher repayments by late 2026. The housing market’s response will depend on how inflation and economic growth unfold in the coming months.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Sleep Maxxing Trends and Tips: New Zealanders Seek Better Rest

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting