Mortgage rates climb as Treasury yields hit 2025 highs amid geopolitical tensions

Geopolitical tensions have risen after President Trump’s recent comments about acquiring Greenland and raising tariffs on European nations. At the same time, financial markets reacted sharply to strong US economic data and remarks from Federal Reserve Chair Jerome Powell. The combination of political uncertainty and economic signals has pushed mortgage rates higher.

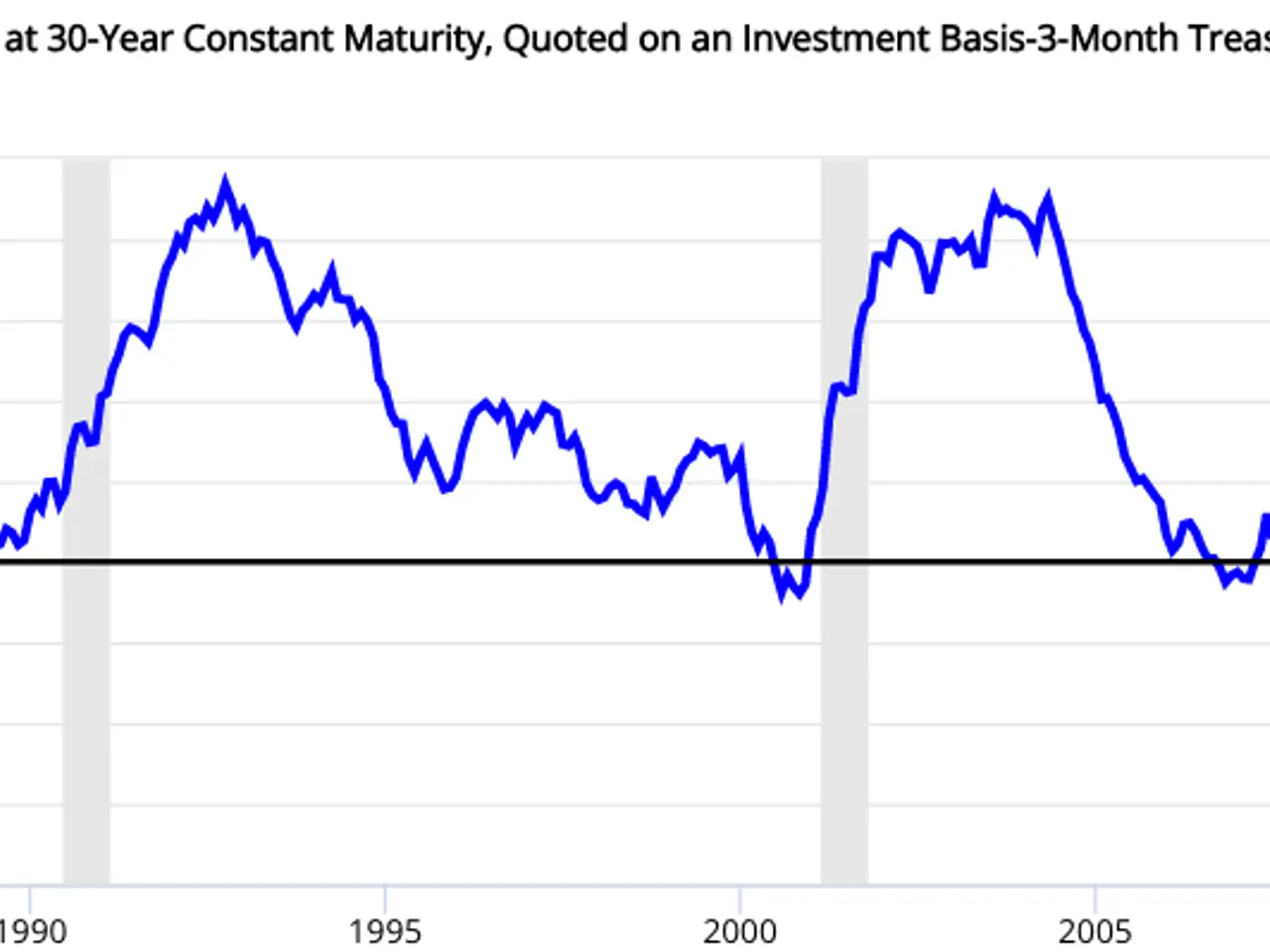

The 10-year US Treasury yield surged this past week, climbing from around 4.15% to a peak of 4.31%. This marked the highest level since August 2025. The jump followed Powell’s hawkish statements on January 24, 2026, which reinforced expectations of tighter monetary policy.

For weeks, longer-term Treasury yields had remained stuck in a narrow band between 4.1% and 4.2%. The sudden breakout reflected both robust economic figures and growing concerns over inflation. Higher tariffs, if implemented, could push prices up further, forcing the Federal Reserve to keep interest rates elevated. The bond market now faces increased volatility due to multiple shifting factors. If foreign governments respond to the geopolitical strain by selling US assets like Treasuries, yields could climb even higher. Previous tariff disputes have often de-escalated quickly, but the current situation adds pressure to an already sensitive market. Analysts suggest that US Treasuries might become an attractive short-term investment if tensions ease. However, the immediate outlook remains uncertain as traders weigh political risks against economic fundamentals.

The recent spike in Treasury yields highlights how geopolitical moves and economic policies are intertwined. With interest rates rising in response to both inflation fears and political developments, investors are bracing for further fluctuations. The coming weeks will show whether the situation stabilises or if volatility persists.