Mortgage Crisis in Russia: 21 Regions Struggle with High Housing Costs

A recent study by the analytical center 'Dvizhenie.ru' and Devision reveals that residents in 21 Russian regions are struggling with mortgage payments, with low- to middle-income families spending more than half of their income on housing costs. The primary market offers affordable mortgage rates, while the secondary market sees higher costs and varying repayment terms.

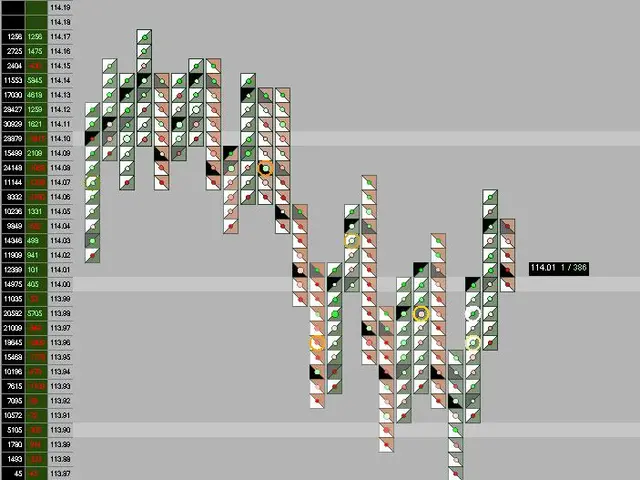

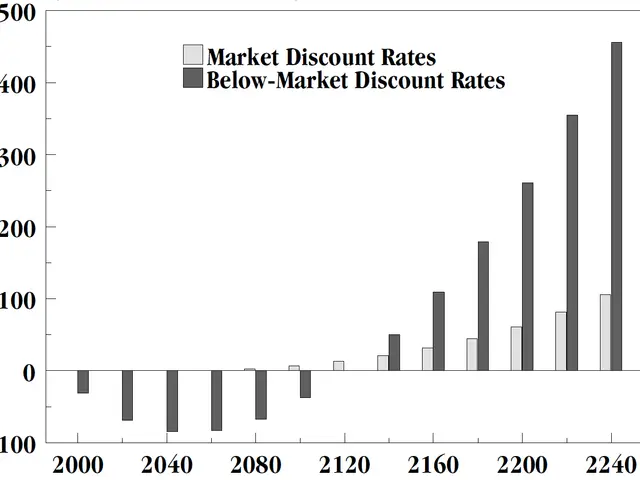

The primary market offers attractive mortgage rates starting at 7.74%, with an average of 22.5% per annum for secondary residence mortgages, a decrease of 4 percentage points since June. Repayment amounts and terms differ significantly across regions and housing types.

In primary residence mortgages, residents of the Ural Federal District face the lowest repayment of 1.6 million rubles over 8.1 years, while those in the Central Federal District have the highest at 3.1 million rubles. For secondary housing, a loan term of 30 years or more is required for approval. Residents in regions like Kalmykia, North Caucasus republics, Ivanovo region, and North Ossetia are spending the largest share of their salary on mortgages. In Moscow and St. Petersburg, residents face the highest repayment amounts, reaching 8.5 million rubles and 6.9 million rubles respectively. Meanwhile, on the secondary market, Moscow residents need 7.2 years to repay, with Pyatigorsk residents requiring over 30 years and amounts up to 22 million rubles.

The study highlights the financial strain faced by many Russian families due to high housing costs. While primary market mortgage rates are affordable, secondary market rates and repayment terms vary significantly, with some residents struggling to keep up with payments. Addressing these disparities could help alleviate the financial burden on low- to middle-income families.