Morning Briefing: Amazon Overhauls Alexa with AI Enhancements

March 1, 2025

Morning Updates: Amazon Revitalizes Alexa

Check out today's market movements:

| Market Indices | Last Close | Change || --- | --- | --- || S&P 500 | 5,862 | -1.59% || Nasdaq | 18,544 | -2.78% || Dow | 43,240 | -0.45% || Bitcoin | $84,051 | -0.56% |

1. Alexa+: Amazon's New Cash Cow?

S&P 500

5,862

Amazon CEO, Andy Jassy, has confirmed an upcoming major update for the company's voice assistant, Alexa. The update will see AI enhancements that could potentially help Amazon gain an edge in the AI chatbot market.

- "Opening doors to new revenue streams": Jassy believes the upgrades will rekindle user excitement, leading to increased revenue from subscriptions and online shopping. The new service, named Alexa+, will cost $19.99 per month, but Prime members will receive the update for free.

- Delivering on AI potential: Alexa's overhaul, which will offer increased functionality for handling more complex tasks, was delayed due to the uncompatibility of the original software with AI enhancements.

Nasdaq

18,544

2. Thursday's Market Recap

Rocket Lab's Sell-Off

Dow

43,240

Despite recording record revenues, Rocket Lab dropped over 12% following the market close, due to investor concerns surrounding the Q1 outlook and high operating costs.

Marqeta's Rocketing Stock

Bitcoin

$84,051

Marqeta, a Rule Breakers recommendation, saw a 21% surge and reached fresh heights following an optimistic 2025 forecast. Q4's processing volume saw a 29% year-over-year increase, emphasizing strong client activity.

Nebius's Post-Earnings Sell-off

AMZN

A further 11% drop in Nebius Group shares hit a new low, as the stock struggled for support after the CEO described 'the quarter' as eventful. Revenue also declined, and the annual recurring revenue showed a decrease.

RKLB

3. Friday's Market Expectations

MQ

Core PCE Release

NBIS

The Fed's preferred inflation gauge, the Core PCE, is due to be released today. January's data is forecasted to show a 2.6% year-over-year increase, marking the lowest level since June 2022.

NYSE:FUBO) is slated to release quarterly earnings before the market opens. Watch for the growth in subscribers and churn rate, plus any comments on the progress of its recent provisional deal with

CME FedWatch's Rate Cut Probability

NYSE:DIS) Hulu + Live TV business.

According to CME FedWatch, February has a 54.3% chance of seeing a potential interest rate cut. Lower inflation is a key mandate for the Fed, so a decrease in January's Core PCE could support the likelihood of an interest rate cut.

FuboTV Q4 Earnings

FuboTV will release its quarterly earnings before the market opens. Investors will be tracking the growth in subscribers, churn rate, and any updates on the recent provisional deal with Disney's Hulu + Live TV business.

4. Buffett's Market Prediction Roadmap

Rewriting History

At the height of the 1999 internet boom, the S&P 500's annualized real returns were 20%. Current AI-driven markets have seen 20%+ real returns in the last three years, with trailings operating earnings at 25-26x. Will history repeat itself?

A Second Look

Warren Buffett's 1999 prediction of 4% real returns, after factoring in 2% inflation, seems strikingly accurate. The 'Foolish Five' attributes the inflated returns from 1981-1998 to two factors: interest rate movement and profit margin improvement. If both remain constant, market trends could follow a similar path.

Alexa+ Enrichment Insights

Amazon's Alexa+ is set to incorporate cutting-edge AI technology, with a focus on utilising Large Language Models (LLMs) and agentic capabilities to handle tasks like scheduling appointments and hiring service providers autonomously. By integrating with services like Thumbtack, Alexa+ can better organize complex tasks and consciously manage your home through natural language commands.

The agentic capabilities can also automate daily activities, reducing the need for user intervention. This new technology has the potential to revolutionize the way users interact with Alexa, leading to a more personalized and convenient user experience.

However, concerns about user privacy, security, and the integration of personal data will need to be addressed for Alexa+ to gain widespread adoption.

- If you're interested in investing in the AI chatbot market, you might want to consider Amazon's upcoming update to Alexa, which will come with AI enhancements and is set to be included in their new service, Alexa+. You can find more information about the S&P 500's movements in the table above.

- For those looking to stay updated on the AI-driven markets, you might find the 'Alexa+ Enrichment Insights' section useful. It provides information about Amazon's plans to incorporate LLMs and agentic capabilities into Alexa+, allowing users to handle tasks like scheduling appointments and autonomously managing their homes through natural language commands.

- To highlight the potential impact of AI-driven markets, take a look at Warren Buffett's 1999 prediction of 4% real returns after factoring in 2% inflation. In light of current market trends, with trailings operating earnings at 25-26x and 20%+ real returns in the last three years, it's interesting to consider the possibility of history repeating itself.

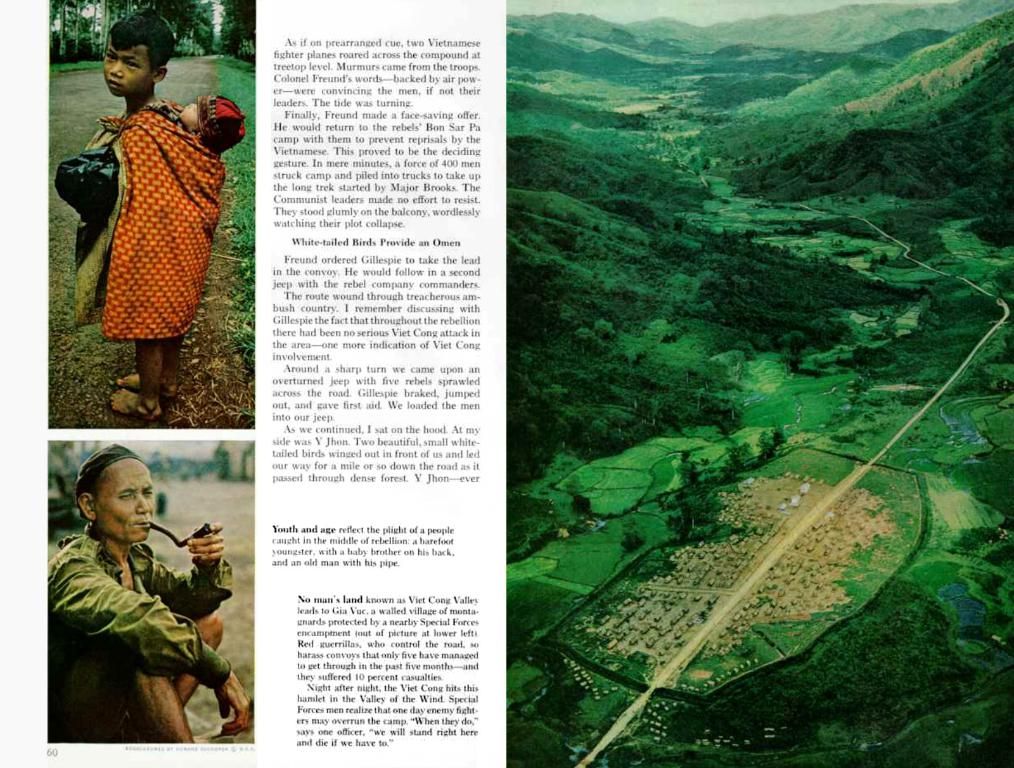

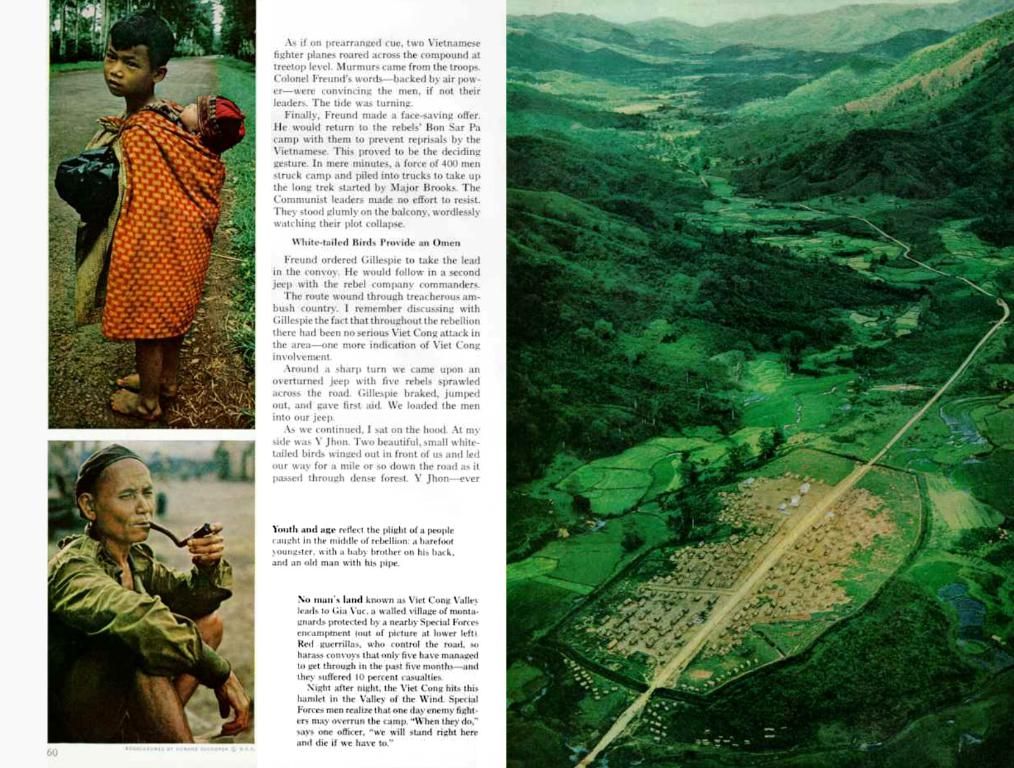

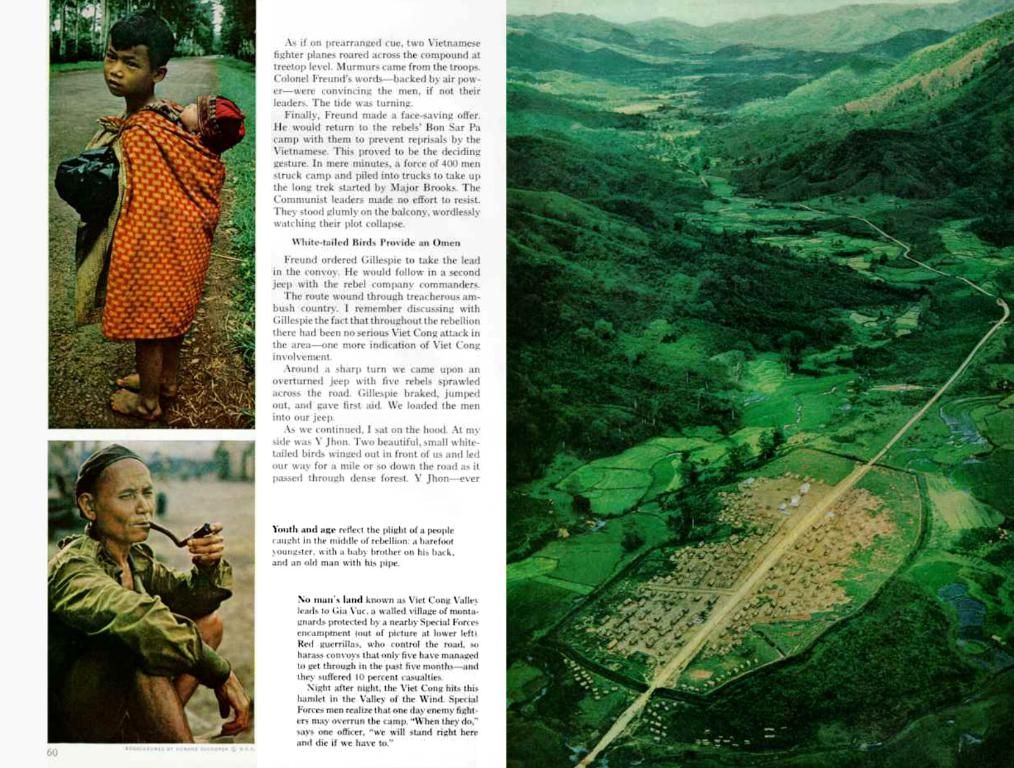

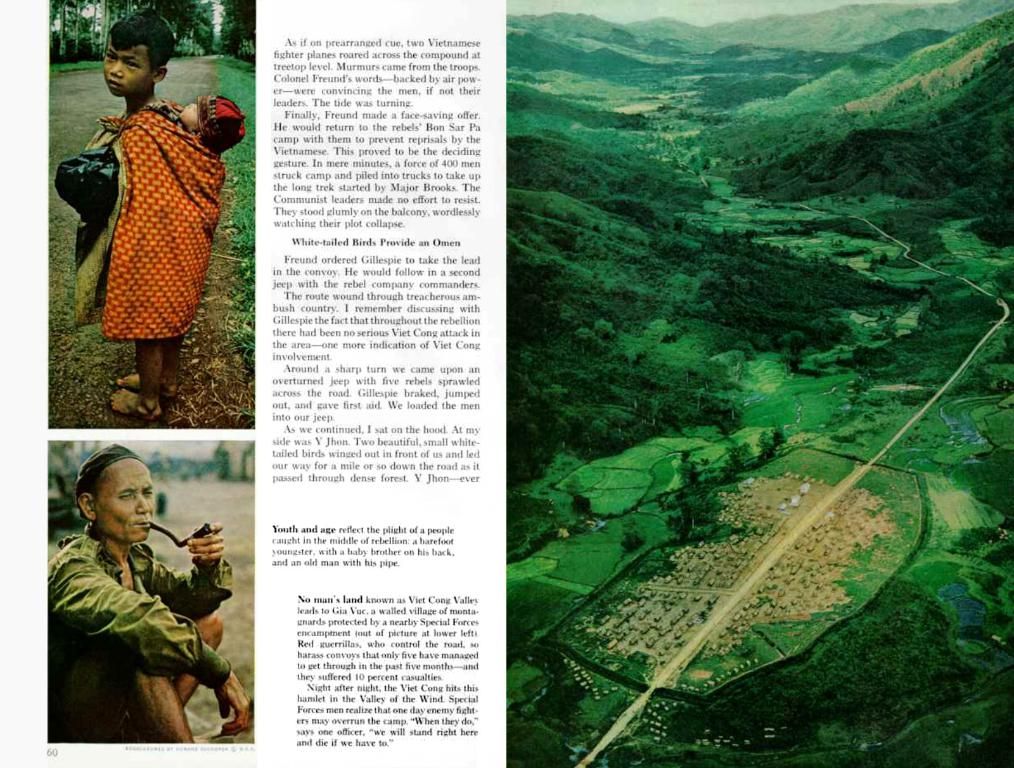

- If you're curious about how to access more information or to further explore the market movements, you can click the 'href' links provided in the text for specific companies or market indicators, such as Dow, Nasdaq, and Bitcoin. There's also the image of Amazon's logo in the 'img' section, which you may find informative.