Monthly Utility Expenses Across Cities: Unveiling the Cities with the Highest and Lowest Budgets

Daily Life Squeeze: Households Spending Over Two-Thirds on Essentials

Get ready to tighten your purse strings even more! Recent findings show that the average UK household spends a staggering £50.81 per day, or £1,524.37 a month, on essential bills and daily expenses—nearly 70% of their take-home pay!

According to comparison website Money Supermarket's latest Household Money Index, which covers the period between January and March 2025, this figure amounts to 69% of the average monthly salary of £26,480 after tax. Keep in mind that this figure doesn't account for pension contributions, student loan repayments, and other potential deductions—meaning you might be left scrambling for the rest.

As if that wasn't enough, essential spending is projected to climb after "Awful April," when water, energy, broadband, and council tax rates saw hefty hikes. Get ready to feel the pinch!

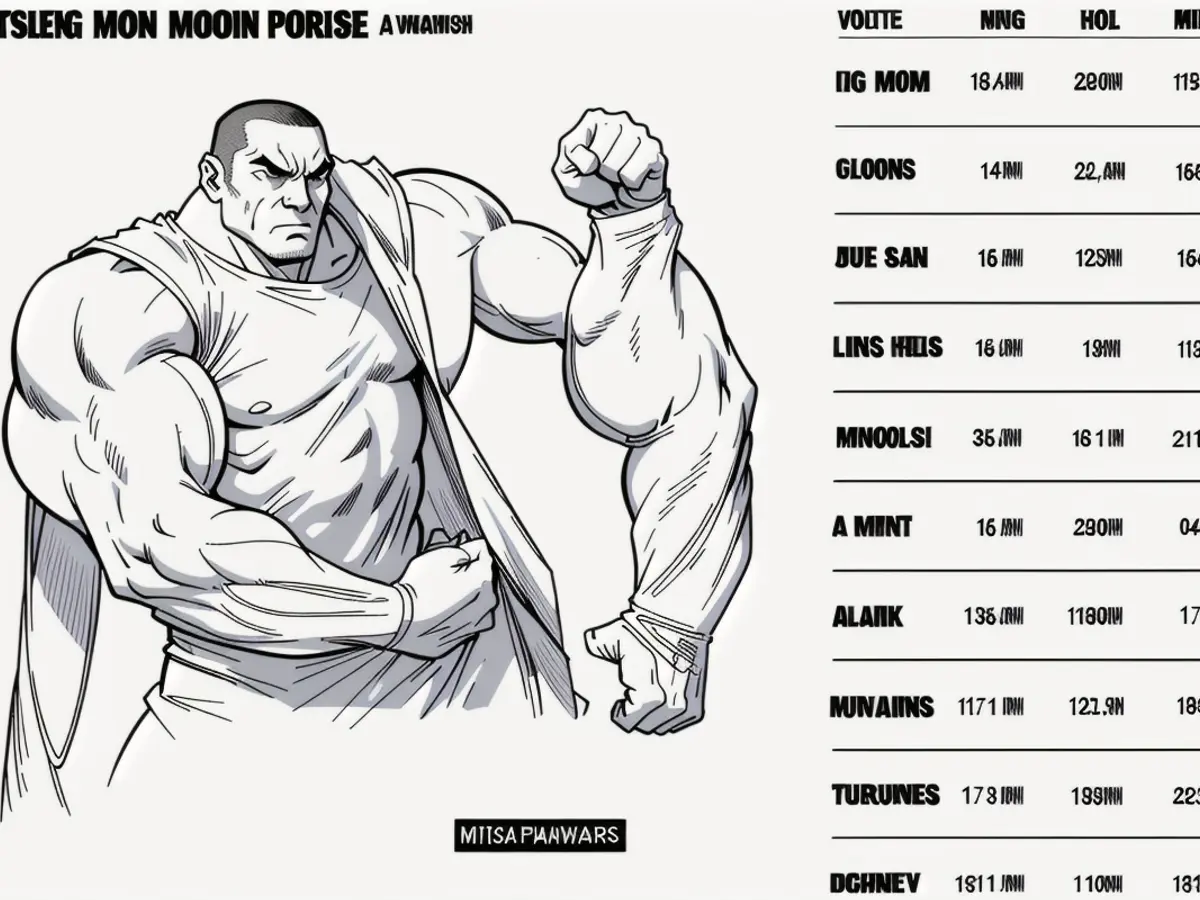

Interestingly, the place you call home can significantly impact the size of your wallet after essential spending. For instance, households in Manchester spend around 84% of their income on essentials, compared to London residents who only dish out 71%. Edinburgh residents fare better, with just 63% of their income going towards bills, followed closely by Nottingham dwellers at 63%.

So, what's causing these escalating costs? An increase in gas and electricity bills plays a significant role, as Money Supermarket reported that bills jumped from £102 to £110 per month between the last quarter of 2024 and the first of 2025. The unpredictable wholesale energy market, exacerbated by geopolitical tensions, is behind this surge. The January price cap soared to £1,738, and though it dipped again in April to £1,849, it's expected to decrease further in July when demand on the grid dwindles.

Similar stories unfold for rent, which increased from £223 to £235 a month, and mortgages, which leaped from £236 to £248. However, a drop in grocery spend (from £175 to £164) and petrol costs (from £50 to £45) helps offset these increasing costs somewhat.

But fear not! As Kara Gammell, personal finance expert at Money Supermarket, advises, "[i]t's never been more important to understand where your money is going—and how it compares to the rest of the UK." Regularly reviewing your bills and maximizing savings can help bridge this seemingly insurmountable gap.

>>> Related Articles- Previous- 1- Next- Best energy deals April 2025: Fixed tariffs that BEAT the market- Households face higher bills due to row over gas storage hub

>>> Stay Informed- water- energy- broadband- council tax- inflation- mortgage rates- grocery spend- petrol costs- CPI inflation reading- bank of England rate cuts- fossil fuel costs- infrastructure maintenance- geopolitical tensions- local authority funding shortfalls- price transparency rules

>>> Key Factors Driving Bill Increases1. Rising energy bills driven by volatile wholesale energy markets and global fuel costs.2. Water charges increasing due to infrastructure upgrades and operational cost pressures.3. Council tax hikes caused by local authority funding shortfalls.4. Broadband and mobile providers applying annual increases linked to Consumer Price Index (CPI) plus 3.9%.

#[ OTHER SOURCES ]1. The Guardian: Household budgets are being hit by nine key cost increases2. The Telegraph: Household bills hit a record high 3. Money Supermarket: Household Money Index 4. Ofgem: Price cap 5. Water UK: Water bills

- Households in the UK are spending a significant portion of their income on essential bills and daily expenses, accounting for an average of 69% of their take-home pay each month.

- Not only are households struggling with current rates, but essential spending is projected to increase after the "Awful April" hikes in water, energy, broadband, and council tax rates.

- The cost of living crisis is affecting different regions unevenly, with households in Manchester spending around 84% of their income on essentials, while Edinburgh residents spend only 63%.

- The increase in gas and electricity bills, petrol costs, rent, and mortgage payments are the primary drivers behind the rising essential expenditures in the UK.

- Industry experts advise regular review of bills and maximizing savings to help address this seemingly insurmountable gap in personal finances.

- In the realm of personal-finance and business, understanding the current energy market trends, geopolitical tensions, and various costs (such as mortgage rates, grocery spend, and council tax) is crucial to navigating the current financial uncertainty.