MicroStrategy's Bitcoin Bet Turns $2.5B Into $100B in Just Four Years

MicroStrategy's aggressive BTC strategy has driven its market value to extraordinary heights in recent years. The company's stock, once tied closely to the value of its BTC holdings, now trades at a massive premium—despite occasional setbacks when cryptocurrency prices fall. This shift has reshaped how the firm funds its ongoing BTC purchases.

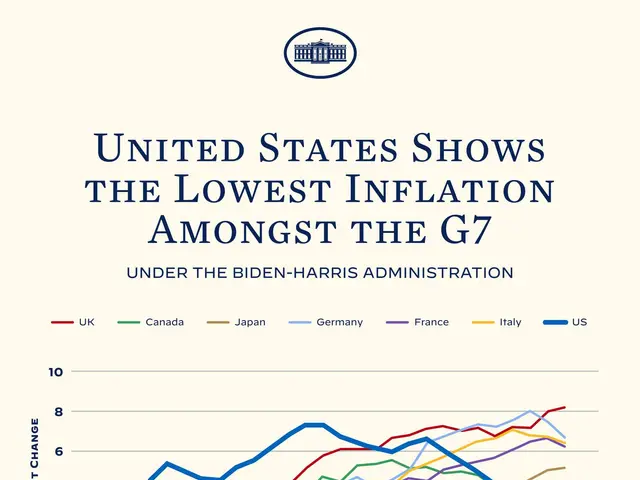

In early 2022, MicroStrategy's market capitalisation stood at around $2.5 billion, with BTC priced near $46,000. By February 2026, as BTC surged to roughly $110,000, the company's valuation exploded to over $100 billion. Investors pushed its stock to trade at three to four times the net asset value (NAV) of its BTC reserves, drawn to its high-risk, leveraged approach.

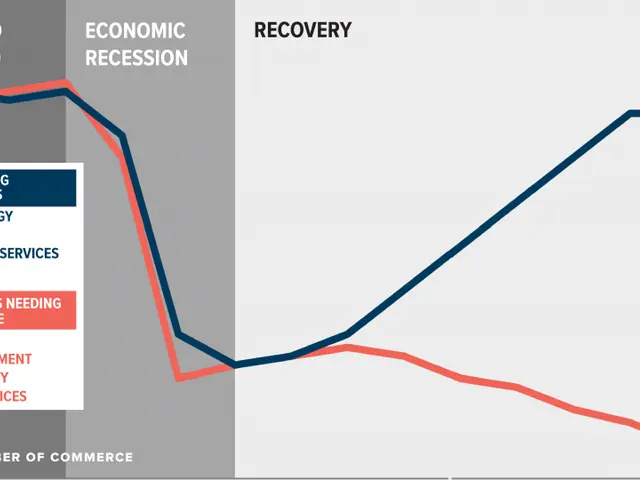

Fundraising becomes tougher when BTC's price drops. The stock often trades below its BTC NAV, meaning new shares issued to buy more BTC dilute existing investors more heavily. Yet even in weaker stock market conditions, the company continues acquiring BTC—adding around 10,000 coins throughout 2022 despite unfavourable conditions.

The firm's debt, totaling about $8.3 billion in convertible notes, does not immediately threaten its BTC stash. Most of these obligations can be refinanced or converted into equity, with the earliest major maturity not due until late 2027. This flexibility allows MicroStrategy to avoid forced sales of its BTC holdings for now.

MicroStrategy's stock now commands a premium far beyond its BTC reserves, reflecting investor confidence in its long-term bet. While falling cryptocurrency prices complicate fundraising, the company's debt structure provides breathing room. For the time being, its BTC accumulation strategy remains intact.