Mexico's economy sees slow growth but stubborn inflation through 2027

Mexico's economic outlook for the next few years shows modest growth but persistent inflation concerns. Analysts now expect GDP to expand by 1.30% in 2026, a slight improvement from earlier projections. However, inflation remains a key challenge, with the central bank's 3% target unlikely to be met in 2026 or 2027.

The latest forecasts suggest Mexico's GDP growth will reach 1.30% in 2026, a small upward revision. Yet, expectations for 2027 and 2028 have been lowered to 1.80% each year. Analysts also raised their inflation estimates, predicting headline inflation of 3.95% in 2026 and 3.73% in 2027—both above Banco de México's (Banxico) 3% target.

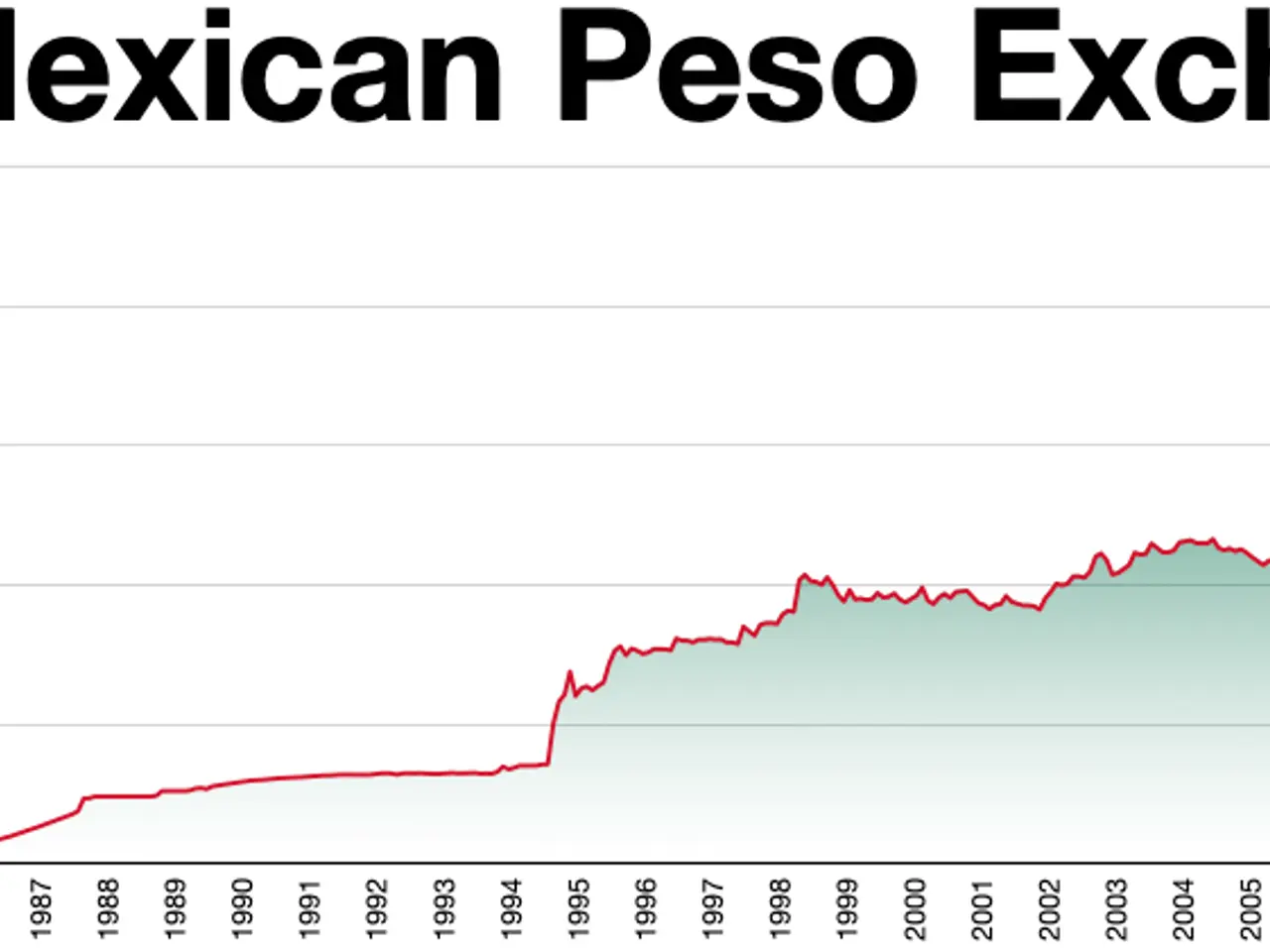

Banxico aims to bring inflation back within its target range by the third quarter of 2026 and keep it there for the following year. Core inflation, which excludes volatile items, is now forecast at 4.11% for 2026 and 3.75% for 2027. Despite these pressures, analysts do not expect the peso's exchange rate to push consumer prices higher, projecting it to end 2026 at 18.50 per US dollar.

On monetary policy, two interest rate cuts are anticipated by the end of 2026, leaving the benchmark rate at 6.50%. However, economic uncertainty lingers. Half of the surveyed analysts question whether now is a good time to invest in Mexico, while 20% believe the business climate will deteriorate in the next six months due to governance issues and external risks.

Mexico's economy faces a mixed picture ahead. Growth is set to improve slightly in 2026, but inflation will stay above target for at least two more years. With interest rates expected to ease and concerns over investment conditions persisting, businesses and policymakers will need to navigate ongoing challenges.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Life Expectancy Soars, But Youth Suicide and Substance Abuse Pose Concern

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting