Merging Forces without Concessions: The Importance of Perspective in the Insurance Industry's Upcoming Era

In the 1990s, a significant shift occurred in the insurance sector with the rise of individualized insurance plans, marking a turning point in the industry's evolution [1]. Today, customers expect a digital-first experience, yet one that retains a personal touch, complete with seamless interfaces, instant responses, and round-the-clock access [2]. To maintain their competitive edge, insurers must cultivate a culture that prioritizes a customer-centric approach.

However, scaling up poses challenges for smaller providers, who often struggle to preserve personalized service while expanding [3]. On the other hand, large incumbents have built their reliability over decades through scale, capital strength, and regulatory experience [4]. In a hard market, captive insurance could be a creative solution for brokers and clients [5].

To maintain a personal touch while scaling, large acquirers adopt strategies such as geographic and product expansion, smart acquisitions, digital innovation, and advanced data analytics [1][2][4][5]. For instance, insurers like Centene and UnitedHealthcare have expanded into new states ahead of market changes [1]. Companies like Compass Group in the food-service industry demonstrate how scale can coexist with personalized customer relationships, as they combine smart acquisitions with maintaining customer loyalty, resulting in high contract renewal rates [2].

Advanced data analytics and AI enable granular insights into risks and personalized customer needs, enabling tailored products and risk mitigation advice that preserve a personal connection despite scale [5]. Embracing digital ecosystems and data-driven innovation fosters unified yet highly personalized experiences across multiple jurisdictions or markets [4][5]. Strategic acquisition of smaller providers not just for scale but also to integrate their niche expertise and customer relationships, smoothes the transition and preserves the personal touch to customers [2].

In the current economic climate, consumers are scrutinizing every expense, and are more likely to cancel insurance policies to save money [6]. To avoid this, insurers must actively learn from customers and translate that learning into meaningful change to avoid superficial personalization [7]. For large incumbents, integrating smaller players isn't just about technology or product design, but also about absorbing their customer-focused mindset [7].

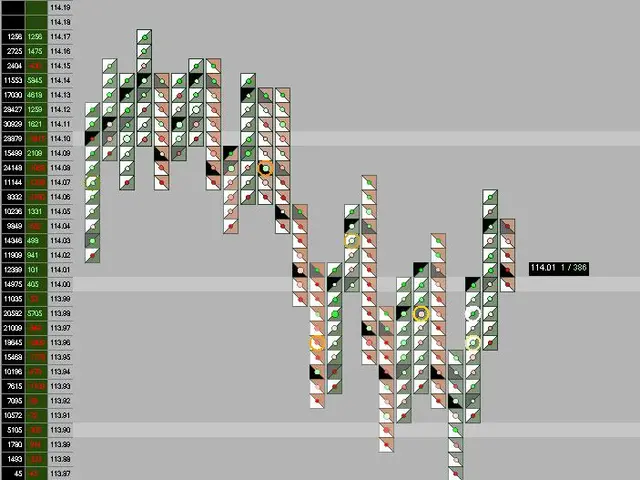

The insurance industry faces fragmentation, which negatively impacts smaller providers by increasing challenges in maintaining competitive risk pools, managing claims forecasting, and sustaining benefit design amid uncertain subsidy levels and rising consumer enrollment churn [1]. Fragmentation also leads to more complex consumer access and adherence issues, especially for vulnerable populations, further straining smaller insurers who lack scale and diversification [1].

In essence, large acquirers balance scaling efficiencies with personalized customer service by combining geographic and product expansion, smart acquisitions, digital innovation, and advanced data analytics to sustain a high-touch experience even at scale [1][2][4][5]. Smaller providers face an increasingly difficult environment in highly fragmented markets without such resources, often leading to market exit or consolidation [1].

The insurance industry in the UK has seen a measured pace of consolidation [8]. With over 3,800 domestic insurers across Europe [9], the need for personalization is paramount. To maintain personalization, insurers must prioritize real-time feedback, empower cross-functional teams, and design with empathy from the outset. In a trust-driven market, if the customer focus is diluted, insurers may gain size but lose strength.